- Commercial real estate values are down 17% on average from 2022 highs, with some sectors like office seeing discounts of up to 36%.

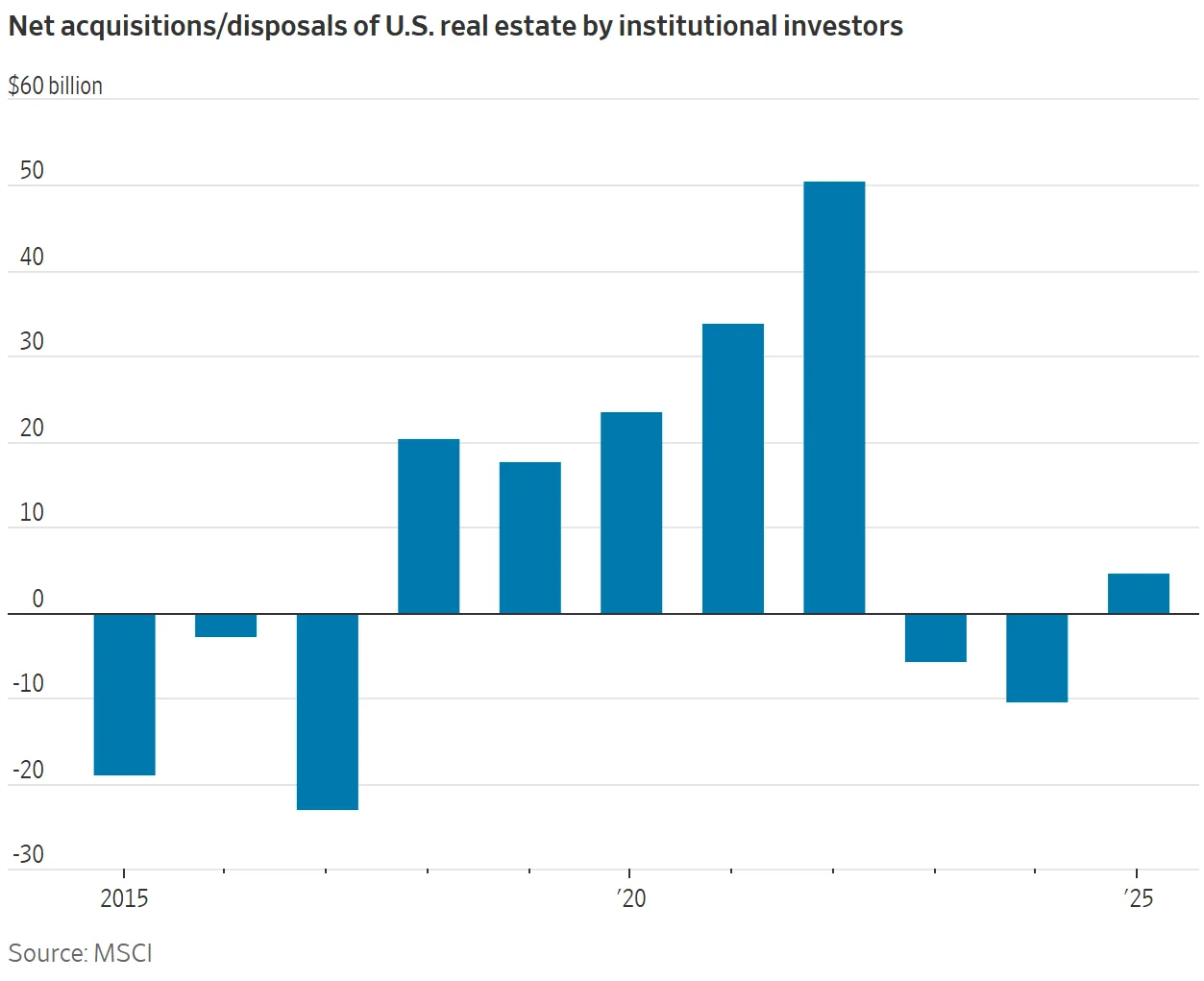

- Institutional investors have turned net buyers in 2025 for the first time in three years, although overall activity remains muted.

- A combination of fair valuations, rising construction costs, and limited new supply is making existing assets—especially in retail and senior housing—more attractive.

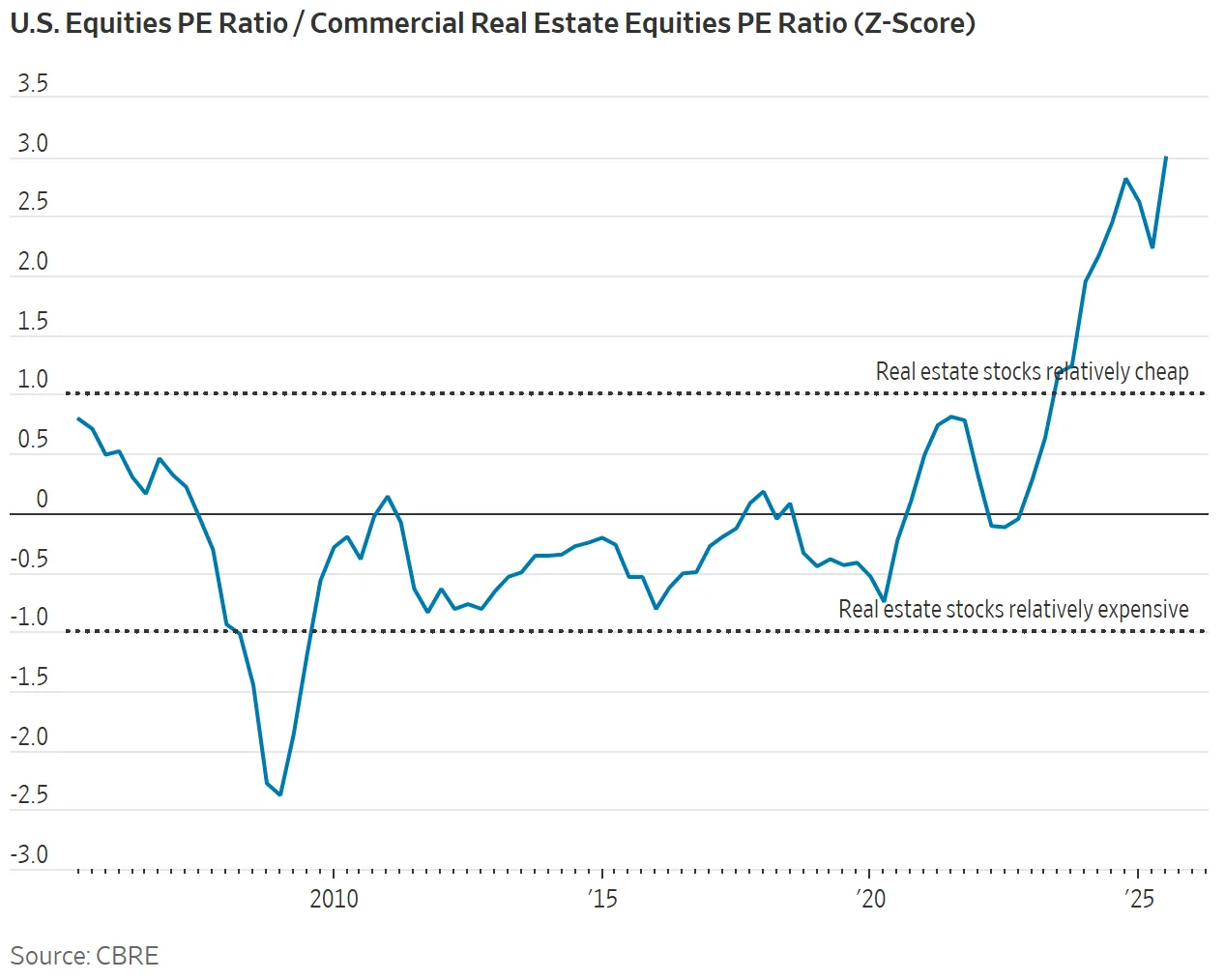

- Property stocks are trading at their biggest discount to US equities in 20 years, offering potential upside if sentiment shifts or other asset bubbles burst.

A Market Repricing Years in the Making

According to The WSJ, after several years of sharp declines and underperformance, US commercial real estate is starting to look like a bargain. Average property values are still down double digits from 2022 peaks, with office buildings and apartments particularly hard hit. But some long-term investors are beginning to take another look at the beaten-down sector.

Big Buyers Slowly Return

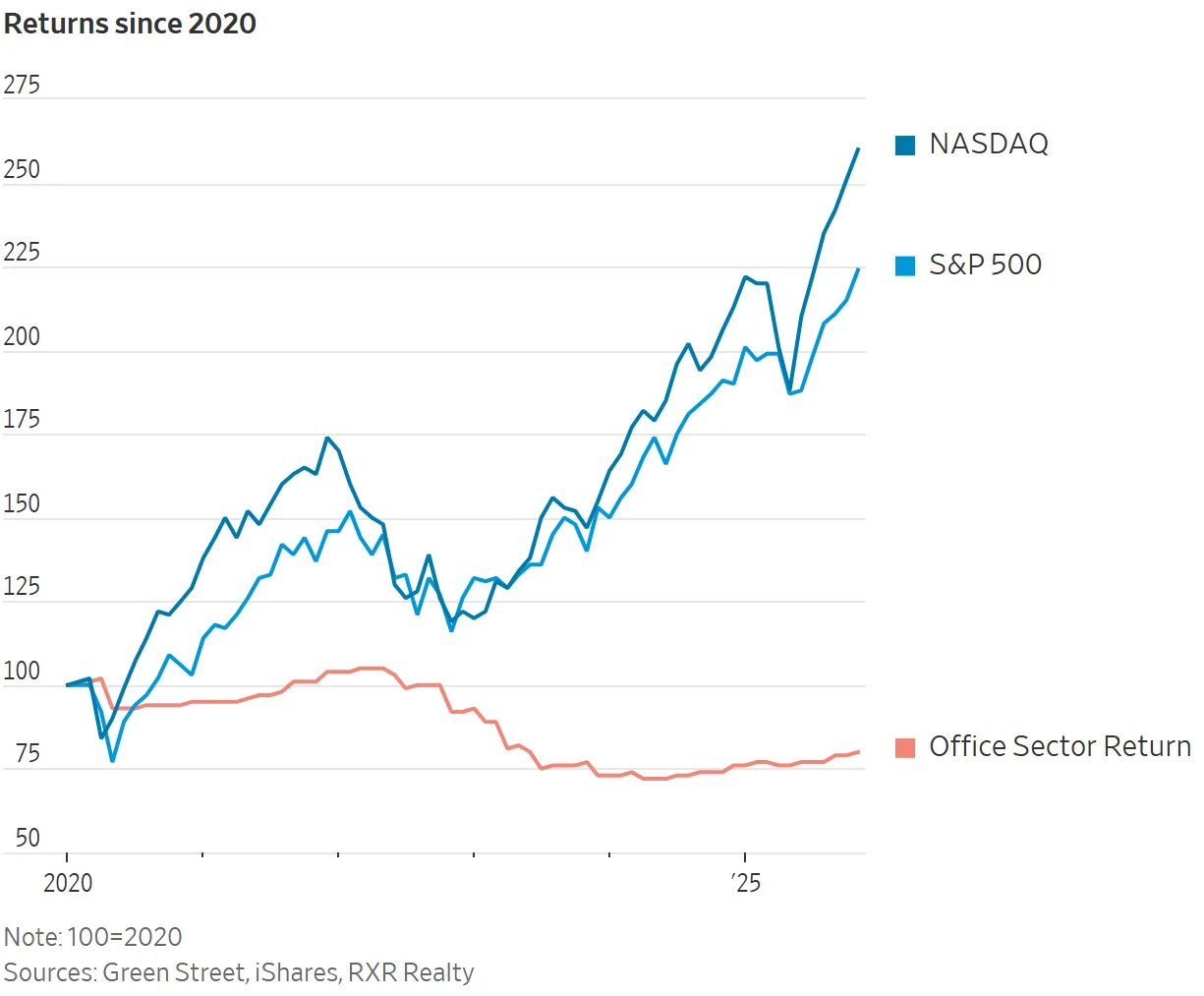

Institutional investors—pension funds, insurers, and sovereign wealth funds—have traditionally held sizable positions in commercial real estate. But they’ve pulled back in recent years amid disappointing returns. From Q3 2019 through 2025, private real estate funds returned just 20%, compared to a 150% surge in the S&P 500.

Still, data from MSCI shows a turning point: In 2025, these large investors became net buyers for the first time in three years, picking up $4.6M more in US property than they sold.

Pain, Patience, and Property

Part of the investor hesitation is rooted in lingering pain. Many own real estate assets that are now worth less than they paid. Office and multifamily assets have been particularly difficult, both in terms of valuation and the high costs of repositioning older properties.

Additionally, the sector now has to compete with higher-yielding alternatives like private credit, data centers, and infrastructure. In fact, some investors find it more attractive to lend against real estate than to own it outright.

In certain high-growth Sun Belt and Mountain West markets that saw rapid price increases during the pandemic, a growing number of homeowners are now finding themselves underwater on their mortgages—a shift that reflects broader real estate value resets beyond just institutional portfolios.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Still, the Math Is Changing

But even as other assets remain in the spotlight—especially AI-related equities—commercial real estate has quietly become one of the few fairly valued asset classes in the US Investors like RXR and Blackstone are already snapping up prime office buildings at steep discounts.

Meanwhile, property stocks are trading at their largest discount relative to US equities in two decades, per CBRE. On a risk-adjusted basis, Green Street says private real estate is now attractively priced compared to corporate bonds.

Limited Supply, Rising Costs, and Rent Growth

Another tailwind: new construction is down sharply. Inflation has driven building costs up more than 40% since 2020, limiting the financial feasibility of new projects. That’s especially true in sectors like retail and senior housing, where new supply has been minimal.

With fewer new buildings coming online, existing landlords could benefit from rising rents. In some cases, developers now need rents to rise 40% just to justify new construction—giving an edge to current owners with stabilized properties.

What Comes Next

As interest rates stabilize and new supply stays constrained, income-producing assets could regain favor. Property markets were similarly overlooked during the dot-com boom—only to rebound once tech euphoria faded.

If today’s AI rally hits a wall, commercial real estate may once again become the “safe haven” asset that institutional investors rely on for stable income and diversification.

Bottom Line

Commercial real estate may still carry baggage from recent years, but for long-term investors, the combination of discounted valuations, limited supply, and attractive income could signal a rare buying window—especially if other asset classes cool.