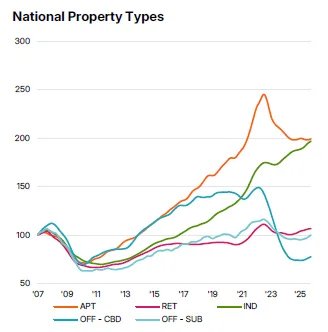

- The RCA CPPI National All-Property Index rose 4.2% year-over-year in October 2025, the largest annual increase since 2022.

- Industrial, office, and retail sectors led the gains, while apartment prices continued a modest recovery after nearly three years of declines.

- Despite a 22% drop in deal volume from the prior year, investor appetite for quality assets remains strong.

Property Prices Rebound Across the Board

Commercial property prices in the U.S. saw a significant uptick in October, with the RCA CPPI National All-Property Index up 4.2% from a year earlier—the most substantial annual increase in three years. On a monthly basis, the index climbed 0.8%, signaling a potential annualized growth rate of 10.7%.

This comes amid a market defined by cautious optimism. Financing conditions have improved, but recent macroeconomic uncertainty—including a government shutdown—has left investors navigating a murky outlook. Still, they appear willing to pay premiums for high-quality assets despite a year-over-year decline in transaction volumes.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Sector Snapshots

- Industrial: Prices increased 4.9% YoY and 0.4% MoM, extending a monthly winning streak since May 2023. However, growth has cooled from the 6.0% YoY pace a year earlier.

- Office: CBD and suburban office sectors rose 4.6% and 4.2% YoY, respectively. Annualized MoM gains suggest even faster momentum, at 7.9% for CBD and 10.0% for suburban offices.

- Retail: The index grew 4.7% YoY and posted its 17th straight monthly gain, though the 0.1% MoM uptick suggests slowing growth ahead.

- Apartments: The apartment sector recorded a 0.5% annual gain, marking three consecutive months of recovery after nearly three years of losses. MoM growth suggests an annualized rate of 3.6%.

Metro Market Breakdown

- Non-Major Metros outperformed with a 5.3% YoY gain.

- Major Metros saw a -0.8% YoY decline, reflecting broader weakness in primary markets such as New York and San Francisco.

Why It Matters

Despite transaction volumes falling, rising prices across most sectors reflect a resilient market. Investors are adjusting to tighter capital markets by prioritizing quality over quantity. The divergence between primary and secondary market performance also highlights a shift in investor focus.

Looking Ahead

The momentum in pricing suggests cautious confidence heading into 2026, but continued volatility in economic data could still temper growth. The return of consistent gains in the apartment sector and the strength of suburban office and industrial assets may shape investment strategies in the months ahead.