- Blackstone buys $2B in loans from Atlantic Union Bankshares at a 7% discount, extending its aggressive push into discounted commercial real estate (CRE) debt.

- Total CRE loan acquisitions hit $20B over 24 months, making Blackstone one of the most active buyers in this space.

- Regional banks under pressure from high interest rates and balance sheet strain are selling off pre-2022 CRE loans to free up capital.

- Loan sale follows a merger between Atlantic Union and Sandy Spring Bank, enabling the combined bank to offload marked-to-market loans without recording losses.

A Buying Spree Continues

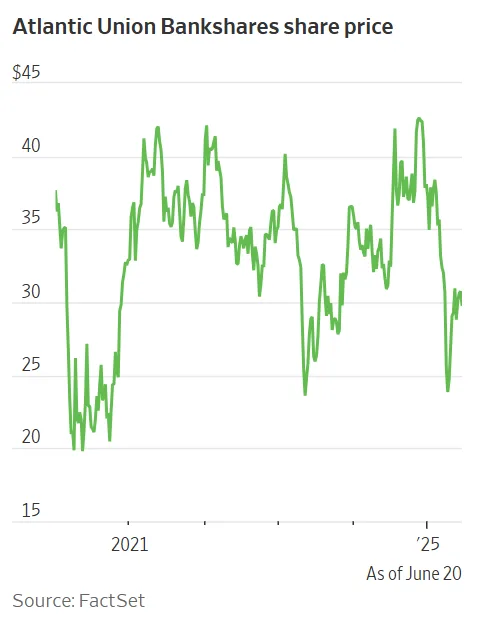

According to The WSJ, Blackstone is again scooping up discounted commercial property real estate debt, this time acquiring a $2B portfolio from Richmond-based Atlantic Union Bankshares. The loans, which are backed by apartments and neighborhood retail, remain current but were originated during the low-rate era—making them less valuable in today’s high-rate environment.

The purchase comes at a roughly 7% discount, consistent with Blackstone’s broader strategy of acquiring distressed but performing CRE debt at markdowns.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A $20B Bet

This latest purchase brings Blackstone’s total investment in commercial property loans to $20B over the past 24 months. The firm has been one of the largest and most consistent buyers, capitalizing on the liquidity constraints faced by small and regional banks across the US and abroad.

Bank Pain, Blackstone’s Gain

Regional and community banks—traditionally the lifeblood of local real estate development—are feeling the heat from interest rate hikes that have devalued older loans. Many of these banks are sitting on large volumes of low-rate CRE loans but are reluctant to sell and book losses.

However, Atlantic Union was in a unique position. Following its April merger with Maryland-based Sandy Spring Bank, it marked Sandy’s CRE loans to market. This allowed the merged bank to sell to Blackstone without taking a loss, and reinvest in new originations.

The Bigger Picture

This transaction underscores two converging trends: continued pressure on smaller banks with commercial property exposure and increased consolidation in the sector. Analysts expect more deals like Atlantic Union’s as mergers accelerate under the Trump administration’s looser stance on bank M&A.

Higher interest rates and weak office demand remain significant headwinds, but for opportunistic investors like Blackstone, this dislocation offers continued entry points into discounted assets with long-term upside.

Why It Matters

With Blackstone betting big and banks offloading loans to manage risk, the commercial real estate debt market is undergoing a major transition. Deals like this may signal a thaw in a frozen market and offer a pathway for banks to regain lending capacity—potentially easing a capital crunch that’s hit regional developers the hardest.