- Commercial multifamily mortgage debt outstanding increased by $53.4B (1.1%) in Q3 2025.

- Multifamily mortgage debt reached $2.24T, up 1.8% from the previous quarter.

- Agency and GSE portfolios led dollar gains, rising $27.8B (2.6%).

- Commercial banks remain the largest holders, accounting for 37% of debt.

Steady Growth for Commercial Multifamily Mortgage Debt

The Commercial Property Executive reports that total outstanding balance of commercial multifamily mortgage debt expanded by $53.4B in the third quarter of 2025, as per data from the Mortgage Bankers Association. The figure marks a 1.1% increase from Q2, bringing overall commercial multifamily mortgage debt to $4.93T.

Multifamily debt continued to drive the sector, rising by $40.3B (1.8%) to reach $2.24T. This segment’s year-over-year growth was notable at 5.9%, and it now comprises 22.5% of all commercial debt outstanding.

Agency and GSE Portfolios Lead Market Gains

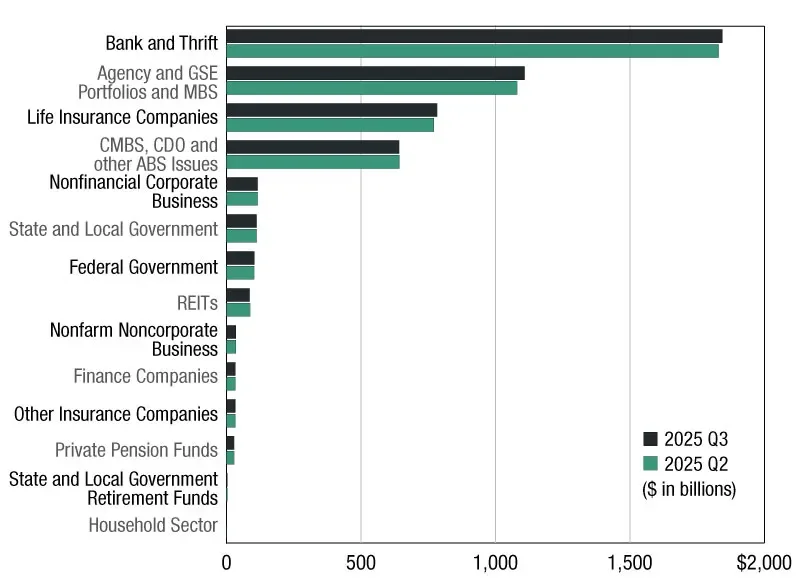

Agency and GSE portfolios, including mortgage-backed securities (MBS), saw the largest dollar increase in Q3 2025. Their holdings grew by $27.8B, a 2.6% rise from the previous quarter. Commercial banks added $13.8B (0.8%) and life insurance companies increased holdings by $12.1B (1.6%). Federal government portfolios grew by $1.2B (1.2%). The gains in agency and GSE activity come as recent policy shifts expanded lending capacity for multifamily financing, further fueling market momentum.

The largest share of commercial multifamily mortgage debt is held by commercial banks at $1.8T (37%). Agency and GSE portfolios, including MBS, account for $1.11T (23%), while life insurers hold $783B (16%) and CMBS/CDO/ABS issues constitute $642B (13%).

Why the Multifamily Segment Is Key

Commercial multifamily mortgage debt continues to be a main driver for overall sector growth amid ongoing economic uncertainty. The increase in agency and GSE lending, supported by strong participation from commercial banks and life insurers, underscores persistent investor appetite for multifamily assets. Notably, REITs were the only major holder segment to decrease in exposure, dropping 2.5% in the quarter.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes