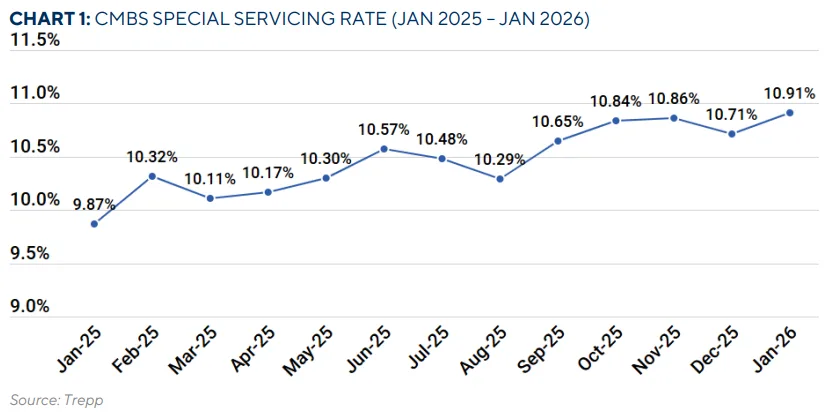

- CMBS special servicing rate climbed 20 basis points to 10.91% in January 2026, driven by new office transfers.

- Office loans accounted for nearly 59% of January’s new CMBS special servicing volume.

- Retail and mixed-use segments saw declines in special servicing rates, while office and multifamily increased.

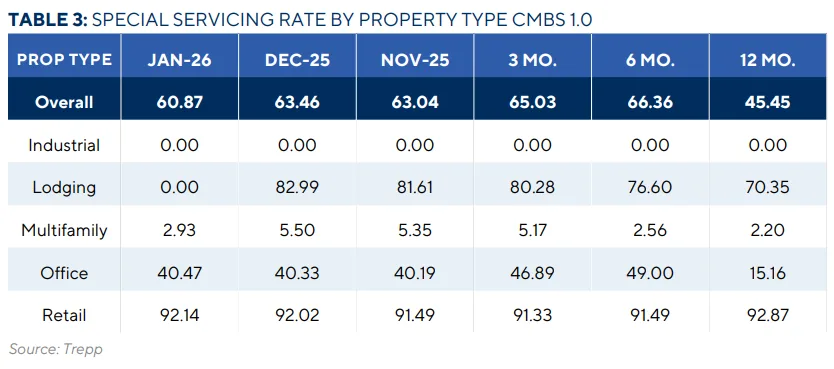

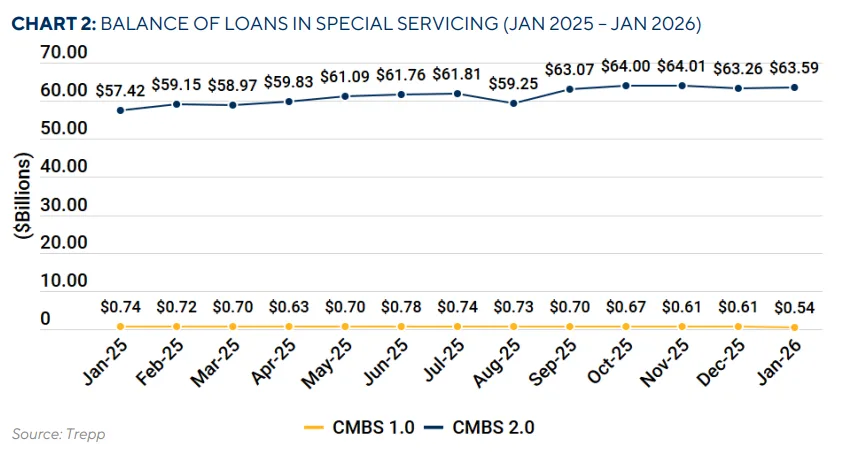

- CMBS 2.0+ loans had a significantly lower special servicing rate (10.84%) compared to CMBS 1.0 (60.87%).

CMBS Special Servicing Rate Climbs in January

The Trepp CMBS special servicing rate ticked up 20 basis points to 10.91% in January 2026, reflecting a renewed wave of distress across US commercial real estate. Office properties drove the monthly increase, recording the largest rate jump among property types.

New transfers to CMBS special servicing reached roughly $2.3B in January, spanning 38 loans. Office assets made up $1.33B of this total, across nine loans, representing nearly 59% of new servicing activity for the month. Retail followed with $513M across nine loans, or 23% of January transfers.

Sector Performance Highlights

Office special servicing rate soared 47 basis points to 17.11% in January, reflecting ongoing challenges in that sector. Multifamily edged up 6 basis points to 8.14%, while industrial was steady at 0.85%.

Conversely, mixed-use special servicing rates decreased 30 basis points to 13.67%, and retail dropped 23 basis points to 11.76%. Lodging retreated 11 basis points, finishing January at 9.37%.

Notable Loan Transfers and Loan Details

The $835M One New York Plaza loan marked January’s largest transfer to special servicing. The loan transferred due to an imminent balloon and maturity default. The 2.6M KSF Lower Manhattan office tower secured a 24-month extension to January 2028. The borrower negotiated the extension during discussions with the servicer.

Retail also posted notable activity in January. The $312.6M Lakewood Center mall loan transferred for imminent maturity default ahead of its June 2026 due date. The property recently reported a 1.33x DSCR and 93% occupancy. However, the borrower did not present refinancing plans before the transfer.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Distinction Between CMBS 1.0 and 2.0+ Performance

CMBS 2.0+ loans continued to outperform legacy deals. Post-2008 issuance recorded a 10.84% special servicing rate in January 2026. In contrast, CMBS 1.0 loans posted a 60.87% rate. Stronger underwriting and tighter regulations continue to support newer vintages.

Outlook for CMBS Special Servicing

The increase in the CMBS special servicing rate—mostly from office distress—signals persistent liquidity and maturity risk in the sector. While some property types are seeing relief, office assets remain vulnerable as refinancing hurdles continue to drive new loans into special servicing through 2026. The latest uptick follows several volatile months for CMBS performance, after late-2025 data showed temporary rate pullbacks before distress resumed its upward trend.