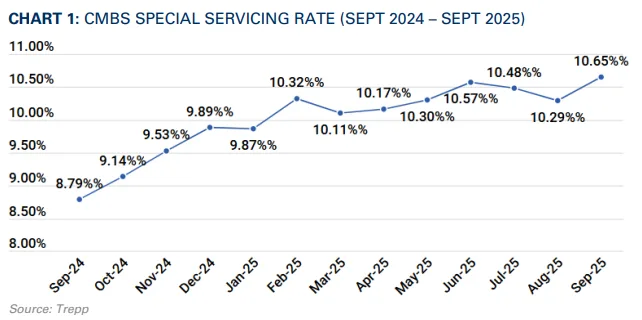

- The CMBS special servicing rate rose to 10.65%, the highest in 12 years, after two consecutive months of decline.

- Office loans dominated new special servicing transfers, led by two large loans totaling $730M, including a $425M loan secured by 32 Avenue of the Americas in NYC.

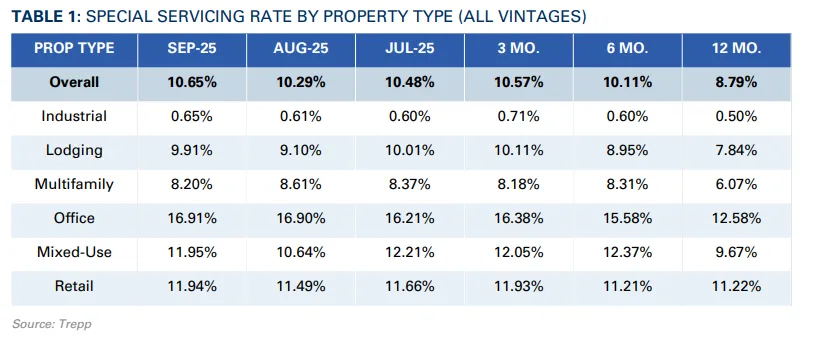

- Mixed-use properties saw the sharpest increase in distress, jumping 130 basis points to 11.95%.

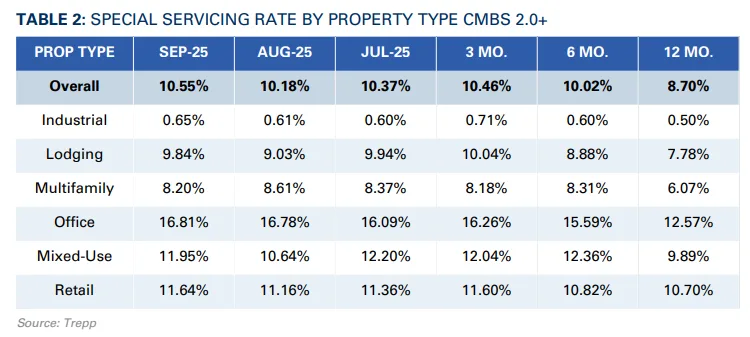

- CMBS 1.0 loans now show a staggering 66.53% special servicing rate—up from 24.35% a year ago—compared to 10.55% for CMBS 2.0+

A New Peak in Distress

September’s 36-basis-point jump in the CMBS special servicing rate brought it to 10.65%, the highest level since May 2013, per Trepp.

The total balance of loans in special servicing now stands at $63.8B, up more than $3B month-over-month.

This uptick follows two months of improvement, signaling that rising maturities and tenant exits are fueling renewed pressure—particularly across office, retail, and mixed-use assets.

Office Takes Center Stage

Office loans once again led the charge in new special servicing transfers. Of the $2.4B in newly transferred loans in September, $1.5B (63%) came from the office sector.

Two Notable Transfers:

- 32 Avenue of the Americas (NYC):

A $425M loan backed by a 1.2M SF Lower Manhattan office asset moved to special servicing due to an imminent maturity default. The property remains 57% occupied, with a DSCR of 1.15x in 1H 2025. - Bravern Office Commons (Bellevue, WA):

A $304M loan transferred after Microsoft exited as the sole tenant. The loan, currently through August, moved to special servicing for imminent monetary default ahead of its 2027 maturity.

Mixed-Use and Retail Also Climb

- Mixed-use special servicing rate rose the most—130 bps to 11.95%—after a dip in August.

- Retail saw a 45 bps jump to 11.94%, matching a nearly three-year high.

- Lodging ticked up 81 bps to 9.91%, while multifamily was the lone decliner, falling 41 bps to 8.20%.

Breaking Down CMBS Generations

The data highlights a growing divergence between older and newer CMBS structures:

- CMBS 2.0+ (post-2008):

Special servicing rate at 10.55%, up from 8.70% a year ago. - CMBS 1.0 (pre-2008):

Special servicing rate exploded to 66.53%, nearly tripling from 24.35% in September 2024, largely due to legacy office and retail assets.

Why It Matters

The sustained rise in the special servicing rate underscores the challenges commercial real estate continues to face, especially in the office sector, where maturity risk, tenant turnover, and capital market uncertainty persist.

The jump in CMBS 1.0 distress also reflects how older, lower-quality assets with limited tenant or capital support are increasingly struggling to refinance or stabilize.

What’s Next

With tens of billions in maturing loans ahead and sector fundamentals, particularly in office, still under pressure, CMBS special servicing volumes could remain elevated into 2026.

Watch for more office distress and possible extensions or modifications, as servicers attempt workouts on loans facing fast-approaching maturity cliffs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes