- 34% of CMBS loans failed to pay off at maturity between 2020 and early 2025, totaling $45.4B in unresolved debt.

- Office and retail properties were hit hardest, with office loans showing the highest rate of failed payoffs (40%).

- Stronger credit metrics helped loans pay off, especially those with debt yields above 10% and DSCRs above 1.5x.

- Resolution timelines varied, but modified loans typically took 5–6 months to resolve, while loans with losses took up to 14 months.

The Maturity Wall: A Growing Concern

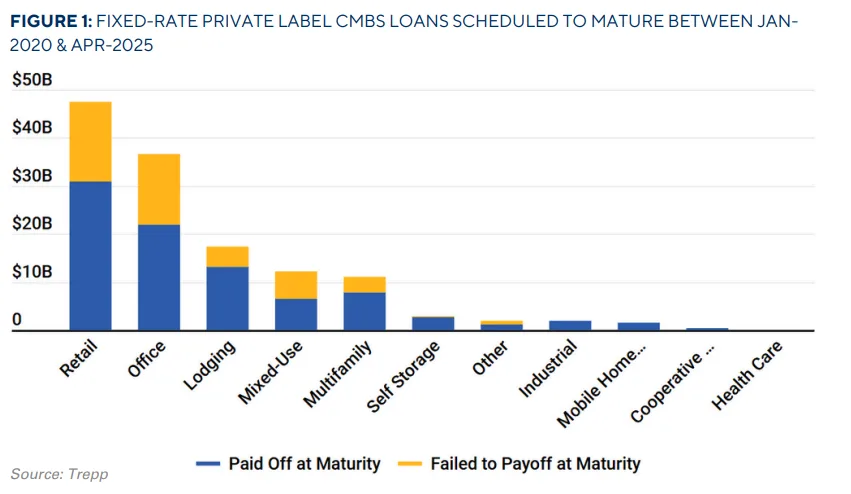

Trepp reviewed more than $133B in commercial mortgage-backed securities (CMBS) loans that were due between January 2020 and April 2025. While 66% were paid off on time, a full one-third failed to meet their deadlines, a sharp drop from pre-pandemic averages that exceeded 80%.

This rising default rate shows how much tougher it has become for borrowers to refinance, especially as interest rates climb and property values decline.

Sector by Sector: Who Struggled, Who Didn’t

Some property types weathered the storm better than others. Here’s how they performed:

- Office: Out of $36.7B in loans, 40% failed to pay off — the highest share among major sectors.

- Retail: Had the most maturing volume overall ($47.4B), with a 35% non-payoff rate.

- Mixed-Use: Was the weakest performer, with 46% of loans failing to pay off on time.

- Lodging: Surprised to the upside. Despite early pandemic setbacks, 76% of loans were repaid on time.

- Multifamily, Industrial, and Self-Storage: Each saw payoff rates over 70% (and up to 95%), thanks to strong demand and rent growth.

Why Some Loans Paid Off — and Others Didn’t

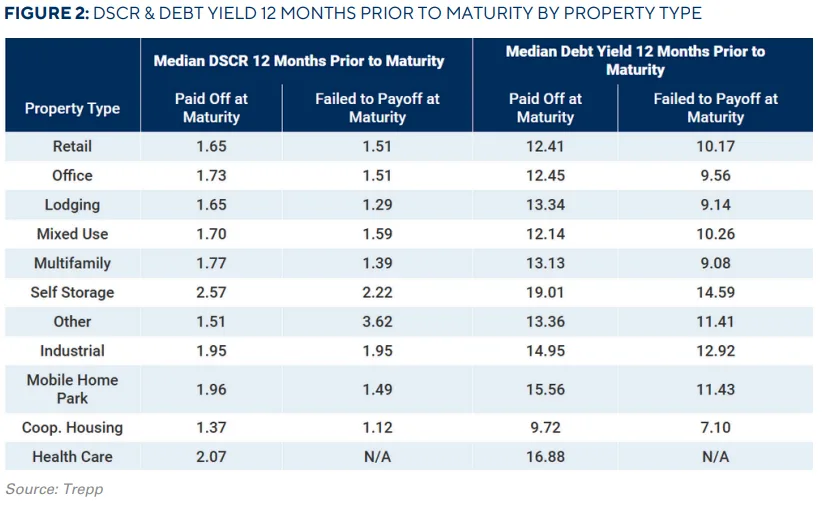

The biggest difference between loans that paid off and those that didn’t? Credit performance.

Loans with higher debt service coverage ratios (DSCRs) and debt yields had a much better shot at refinancing.

For example:

- Office loans that paid off had a DSCR of 1.73, compared to 1.51 for those that didn’t.

- Their debt yields were also stronger: 12% vs. 9.56%.

- Retail loans followed a similar pattern.

This shows that even small differences in credit metrics made a big difference — especially as lenders tightened standards.

What Happens When a Loan Doesn’t Pay Off

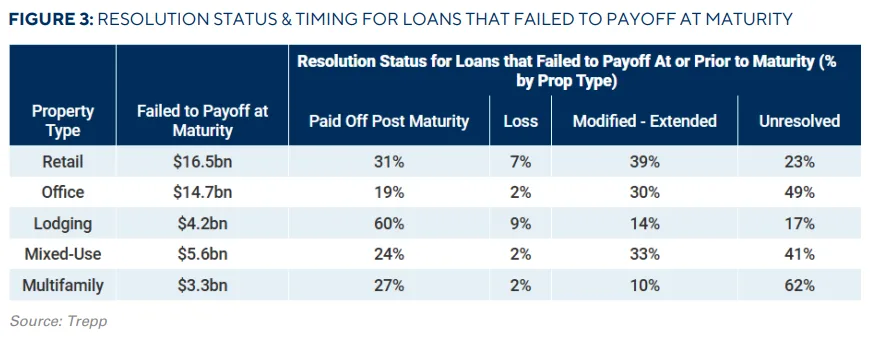

When loans missed their maturity, they took several paths:

- Lodging loans performed best post-maturity — 60% were eventually paid off, often within just four months.

- Retail and Office loans were more troubled. Only 31% of retail loans and 19% of office loans were paid off after maturity.

- Instead, many were modified or extended as lenders delayed bigger losses.

- Mixed-Use and Multifamily loans saw the most delays. In fact, 41% of mixed-use and 62% of multifamily loans remained unresolved as of mid-2025.

Resolution Timelines: What to Expect

Resolution times varied based on the outcome:

- Quick payoffs usually took 2–4 months. These often involved borrowers lining up new loans just after maturity.

- Modified or extended loans took 5–6 months to work through.

- Loans resolved with a loss took the longest — often 9 to 14 months, as they involved foreclosures or complex negotiations.

Why It Matters

The numbers tell a clear story: Loan performance and refinancing options are closely tied. When metrics fall short — especially debt yields under 10% — refinancing becomes much harder.

At the same time, some sectors are still stuck. Half of office loans and more than 60% of multifamily loans that failed to pay off remain unresolved.

This is a sign that many problems haven’t been solved — just postponed.

What’s Next

Looking ahead, CMBS maturities will remain a challenge, especially for office, mixed-use, and lower-performing multifamily properties.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes