- CMBS issuance surged to over $150B in 2025, a 140% jump from 2024.

- Refinancing activity is set to rise as $900B in loan maturities approach in 2026.

- Delinquency rates have crept higher but remain below historical peaks.

- Sector performance varies; office and multifamily show signs of improvement.

Renewed CMBS Momentum

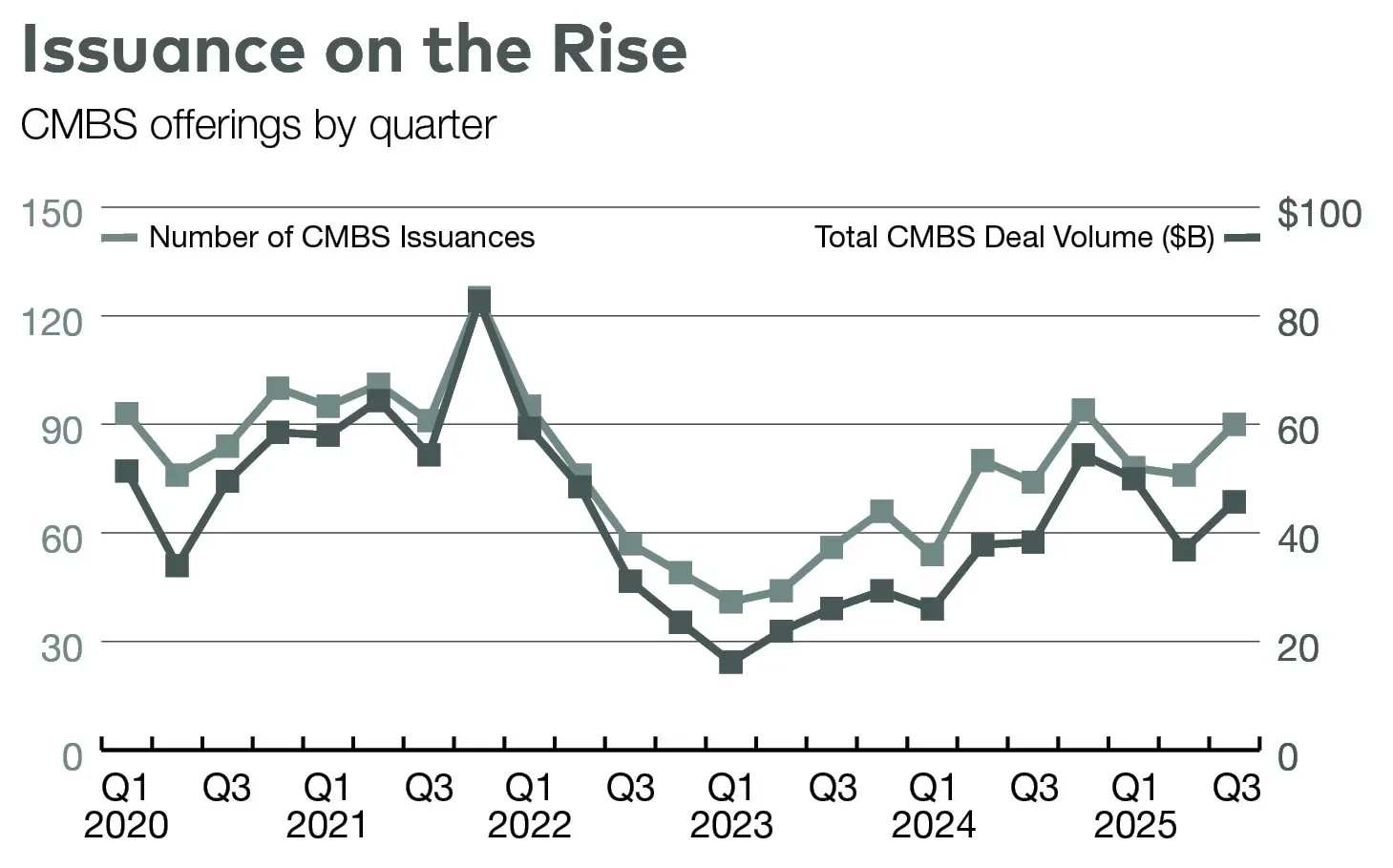

According to the Commercial Property Executive, capital is flowing back into commercial real estate and the CMBS market, continuing the rebound seen in 2025. Issuance in 2025 surpassed $150B, fueled by pent-up demand and investors seeking yield. Experts anticipate another robust year as CMBS provides vital liquidity for borrowers needing to refinance approaching maturities.

Drivers Behind the Growth

Several trends support increased CMBS market activity. The potential for interest rate cuts, a looming wave of loan maturities, improving property fundamentals, and recovering investment sales all set the stage for stronger CMBS volume in 2026. Earlier forecasts had already pointed to this upward trajectory, and 2025’s issuance performance has largely validated those expectations. Multifamily, industrial, and high-quality office assets are expected to see significant capital inflows, bolstering the sector’s refinancing and acquisition needs.

Market Risks and Diverging Performance

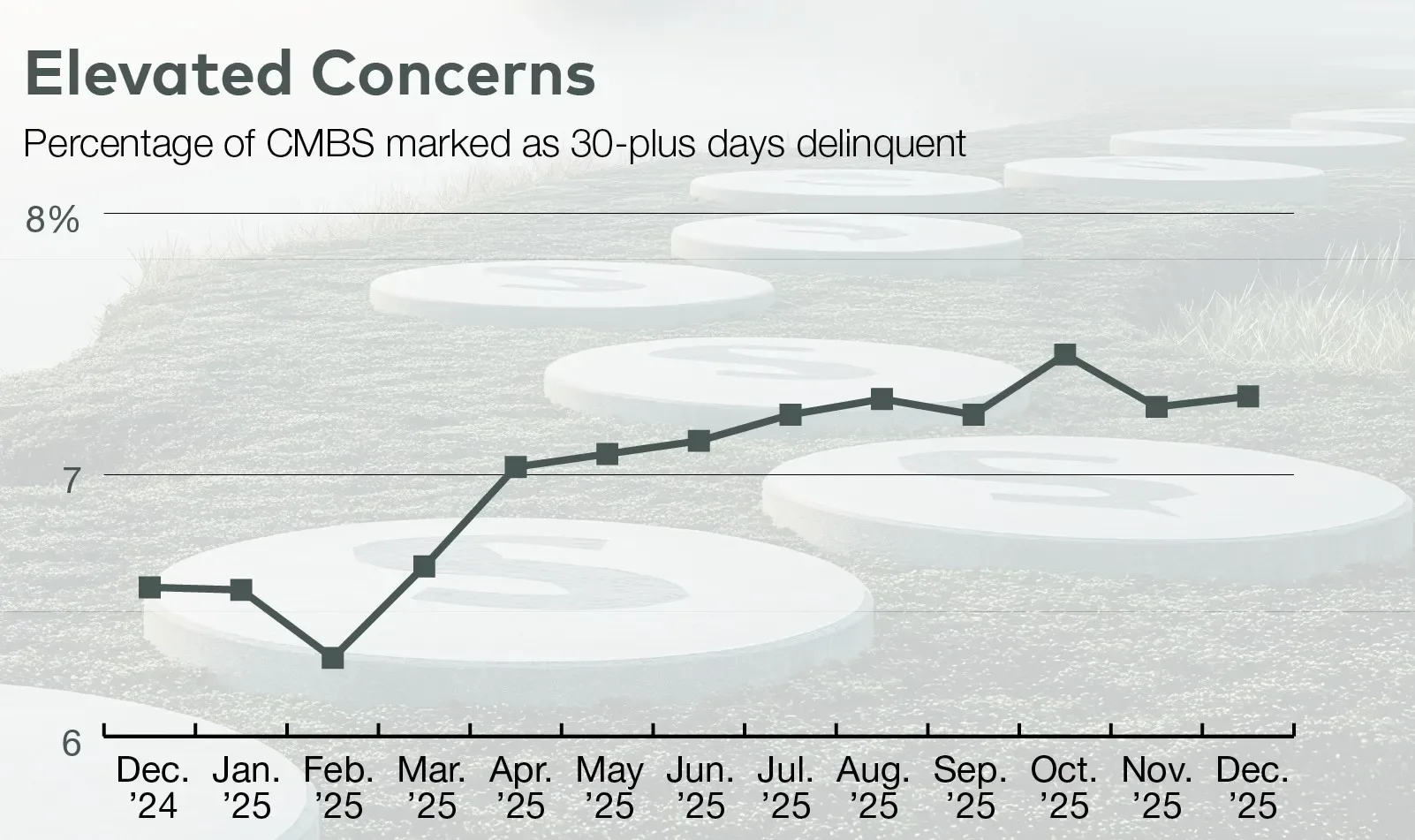

Despite positive momentum, risk factors persist. Delinquency rates rose to 7.3% by December 2025, though still below post-GFC highs. Industrial and retail segments showed modest delinquency increases, while office delinquency rates recently declined. Lenders remain flexible for top-tier assets but are tightening conditions and requiring more equity from typical properties facing refinancing challenges.

What to Expect as 2026 Unfolds

CMBS market performance will depend on careful underwriting and property fundamentals. While refinancing remains viable, investors and sponsors must navigate higher loan costs and a more selective lending environment. Sectors with improving fundamentals, such as office and multifamily, are poised for the most significant rebound, keeping the CMBS market a crucial, if cautious, source of real estate financing in the year ahead.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes