- Over $100B in CMBS loans are maturing in 2026, with more than half expected to default at maturity.

- Market experts view the CMBS maturity wave as a recalibration, not a systemic shock, with increased modifications and workouts.

- Office sector outlook remains negative due to major appraisal declines, while retail shows surprising resilience.

- Robust refinancing and private debt fund formation offer new options for challenged assets.

CMBS Loans Hit Major Maturity Wall

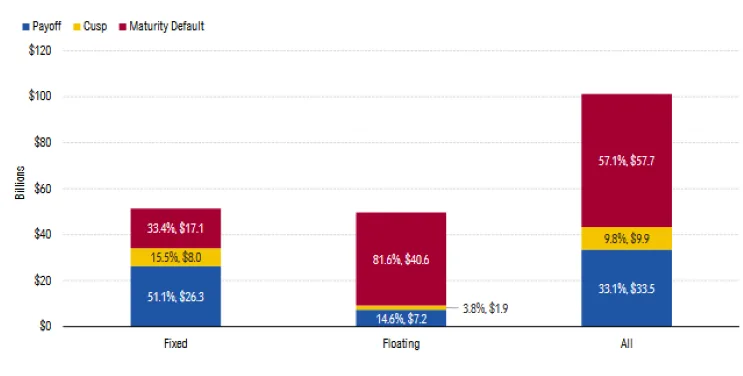

Over $100B in fixed- and floating-rate CMBS loans will mature in 2026, Morningstar reports. More than half—roughly $57.7B—are likely to default at maturity. Another $9.9B faces high risk, says the Commercial Property Executive. These figures highlight serious pressure points across the commercial real estate sector.

Market Recalibration, Not Breakdown

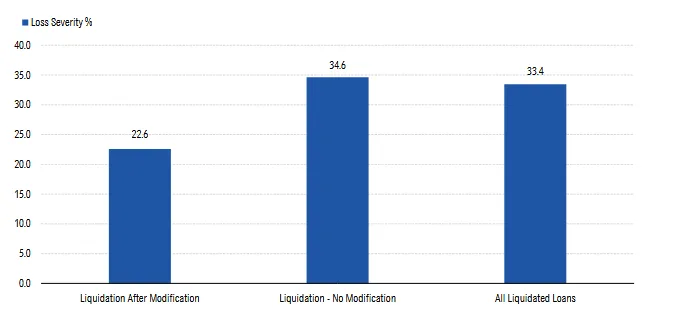

Industry leaders argue the CMBS loans maturity wave signals structural repricing, not sudden distress. Many maturing loans originated at peak valuations and cannot be refinanced in today’s recalibrated market. Analysts expect an increase in loan modifications, which have historically resulted in lower loss severities than foreclosures or straight liquidations. This process is viewed as a market-clearing mechanism rather than a financial crisis event.

Refinancing Activity and Debt Funds on the Rise

Refinance activity is surging, with US origination volume up 42% year-over-year. Meanwhile, private real estate debt fund formation has increased by over 50%. More investors are entering the market, seeking opportunities in the CMBS loan sector. A sharp increase in private-label issuance also reflects rising investor confidence in securitized real estate debt. These trends expand refinancing and recapitalization options for distressed or transitional assets.

Office Retrenches, Retail Recovers

Recent appraisals show office property values have dropped 55.8% since issuance. This marks the office sector as the weakest in the CMBS loans universe. The office market remains bifurcated: high-quality assets attract tenants while obsolete buildings face conversion or demolition. The retail sector remains stable, driven by declining supply and historically low vacancy rates. Institutional investors continue to show growing interest in retail assets. Analysts expect retail CMBS loans to generate some of the strongest returns among major property sectors in the coming years.

What’s Next

The 2026 maturity wave signals a long workout period, not a sudden market collapse. The sector is adjusting to new valuations and tighter credit. Investors face both challenges and openings as lenders, borrowers, and capital providers navigate a shifting financial landscape.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes