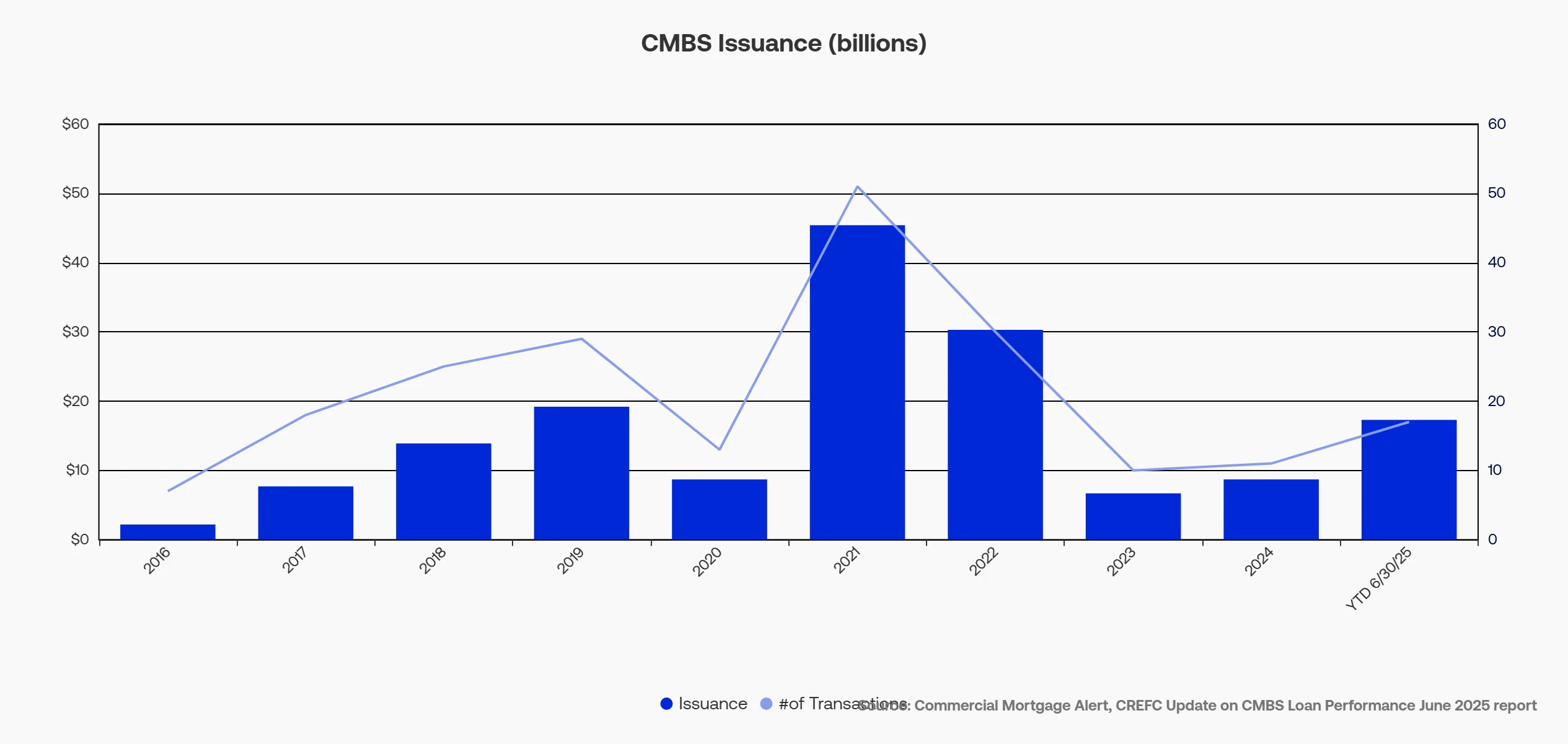

- CMBS issuance reached $59.55B in H1 2025, the highest first-half total since 2007. SASB deals made up nearly 75% of the total.

- Investors favor SASB and CRE-CLO deals, while conduit deals are shrinking. Some investors are warming up to office loans again.

- Loan distress is rising. In July, 7.5% of KBRA-rated private-label CMBS loans were delinquent.

- Non-bank lenders are gaining market share, and more lenders are working together to fill funding gaps.

CMBS Market Holds Up in a Tough Environment

According to Altus Group, despite higher distress and limited bank lending, CMBS has helped keep capital flowing into commercial real estate.

On the CRE Exchange podcast, Andrew Foster, Senior Director at KBRA, shared his view of the current market. He noted that CMBS remains a valuable tool for property owners.

“It’s helping many of the largest owners in the country,” said Foster.

SASB and CRE-CLO Lead the Way

CMBS issuance in early 2025 was strong. Trepp reported $59.55B in issuance through June. This marks the best first half since before the 2008 financial crisis.

Single-asset, single-borrower (SASB) deals made up most of that total. They accounted for nearly 75% of the market. CRE-CLO deals also surged, with Q1 volumes hitting a 2.5-year high.

Conduit issuance has shrunk but still sees investor interest.

Office Exposure Returns to the Table

There’s a shift in investor behavior. More are now open to loans backed by office properties, despite ongoing uncertainty.

That said, loan performance remains a concern.

In July, 7.5% of KBRA-rated CMBS loans were delinquent. Including specially serviced loans, the rate hit 10.6%.

Foster added that downgrades are still outpacing upgrades. Many borrowers are feeling the pressure of higher interest rates.

Non-Bank Lenders Take a Bigger Role

The CMBS market is seeing more activity from non-bank lenders, such as private equity funds, mortgage REITs, and debt funds.

Many of these lenders are now working together. For example, a private lender may bundle bridge loans into a CRE-CLO deal. If securitization isn’t an option, they might use a warehouse line from a bank or insurer instead.

This flexibility has helped keep the market moving.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Adjusting to Higher Interest Rates

Borrowers and lenders are still adjusting to today’s rate environment. Many now believe rates may stay at current levels for some time.

Foster expects that this mindset shift will influence how market players deal with troubled loans.

Even with rising distress, he remains hopeful. “Most of the major property types have been very resilient,” he said.

Why It Matters

CMBS is still a key capital source for commercial real estate. Even with loan challenges, demand for deals is strong, and the market is adapting.

What’s Next

Expect more growth in SASB and CRE-CLO issuance in the second half of 2025. Non-bank lenders will keep gaining ground.

As the market settles into higher rates, more loan workouts and pricing clarity are likely to follow.

Foster summed it up: “It’s a diverse market that is still performing well. That gives me a lot of optimism.”