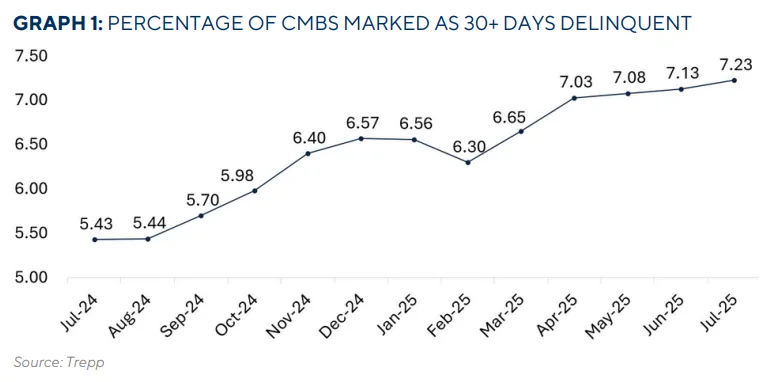

- The US CMBS delinquency rate rose to 7.23% in July, up 10 basis points from June.rn

- Multifamily delinquencies jumped to 6.15%, the only major property type to see an increase.rn

- Office delinquencies edged down slightly to 11.04%, following a record high in June.rn

- New delinquencies totaled over $4.4B, outpacing $3.0B in loan cures.rnrnrn

Multifamily Drives Overall Increase

trepp reports that the US CMBS delinquency rate climbed to 7.23% in July, up from 7.13% in June. This marks the fifth consecutive monthly increase and a 180 basis point rise year-over-year.

Multifamily was the primary driver. The delinquency rate rose 24 basis points to 6.15%, reflecting continued weakness in the sector. In contrast, retail, office, and lodging all posted slight month-over-month declines.

Office Eases Slightly After Record High

The office delinquency rate ticked down to 11.04% in July, after hitting 11.08% in June. While a small change, it’s a welcome shift following consistent increases throughout 2025.

Lodging dropped to 6.59%, down 22 basis points, while retail decreased 16 basis points to 6.90%.

Distress Outpaces Recovery

In July, 129 loans became newly delinquent, totaling over $4.4B. That’s $1.4B more than the volume of loans that cured during the same period.

The top 10 newly delinquent loans accounted for nearly half of the total, at $2.1B. Mixed-use, retail, and office each saw more than $800M in new distress.

CMBS 2.0+ Trends

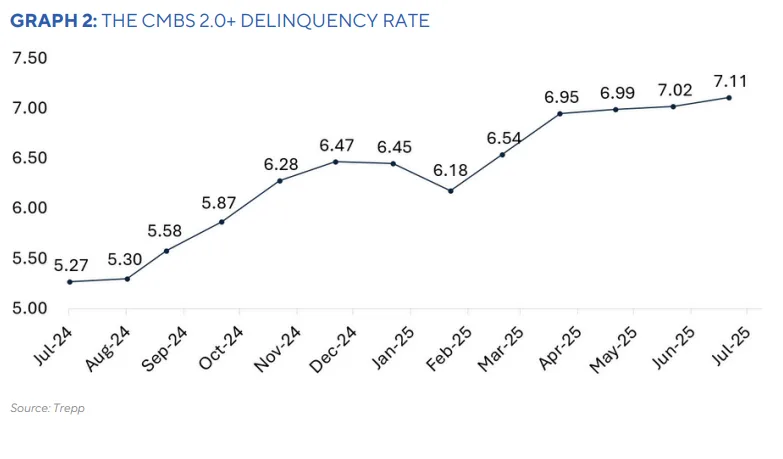

The CMBS 2.0+ delinquency rate rose to 7.11%, up 9 basis points. The serious delinquency rate reached 6.81%, up 7 basis points.

Multifamily loans in this category jumped to 6.14%, while office ticked down to 10.91%. Lodging and retail also saw moderate declines.

Outlook

With new delinquencies outpacing cures and multifamily performance worsening, distress in CMBS is likely to remain elevated. Office loans continue to carry the highest risk, despite a brief pause in their upward trend.

Expect delinquencies to stay volatile through year-end, especially as more loans hit maturity without clear refinance options.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes