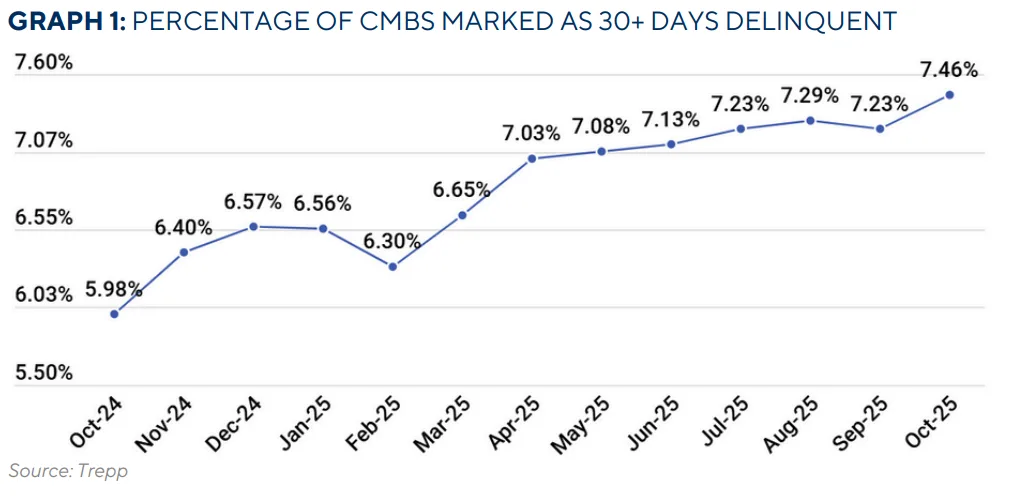

- The overall US CMBS delinquency rate increased to 7.46%, up 23 basis points from September.

- Office delinquencies reached a record 11.76%, surpassing previous highs set earlier this year.

- Multifamily delinquencies rose 53 basis points to 7.12%, the highest since 2015.

- Over $4.0B in new delinquencies were recorded in October, pushing the total delinquent balance to $44.6B.

Delinquencies Rise for Second Month in a Row

In October 2025, the US CMBS delinquency rate moved higher for the second straight month, per Trepp. It rose 23 basis points from September, reaching 7.46%. Compared to the same time last year, the rate is up 148 basis points, highlighting ongoing stress in the commercial real estate market.

This jump was due to a $1.1B increase in delinquent loans and a $3.2B drop in the total loan pool, which fell to $598.1B. As a result, a larger share of the remaining loans is now delinquent.

Office Sector Continues to Struggle

Once again, the office sector was the biggest driver of distress. Its delinquency rate soared to a record 11.76%, up 63 basis points from September. This beat the previous highs of 11.08% in June and 11.66% in August.

More than $1.7B in office loans became newly delinquent in October, while just $760M returned to current status. This growing gap continues to widen as demand for office space remains weak.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Multifamily Delinquencies Reach a 10-Year High

The multifamily sector also worsened. Its delinquency rate rose 53 basis points to 7.12%, crossing the 7% mark for the first time since December 2015. The sector saw a net increase of over $300M in delinquent loans.

This increase may reflect rising costs, tighter lending, and pressures from expiring short-term loans that are hard to refinance in today’s market.

Other Property Sectors See Smaller Changes

Although the office and multifamily sectors saw the largest increases, other sectors also moved higher:

- Lodging rose 26 basis points to 6.07%

- Retail increased 13 basis points to 6.89%

- Industrial inched up 8 basis points to 0.64%, but continues to outperform other sectors

While these increases were more modest, they still point to broader pressure in the market.

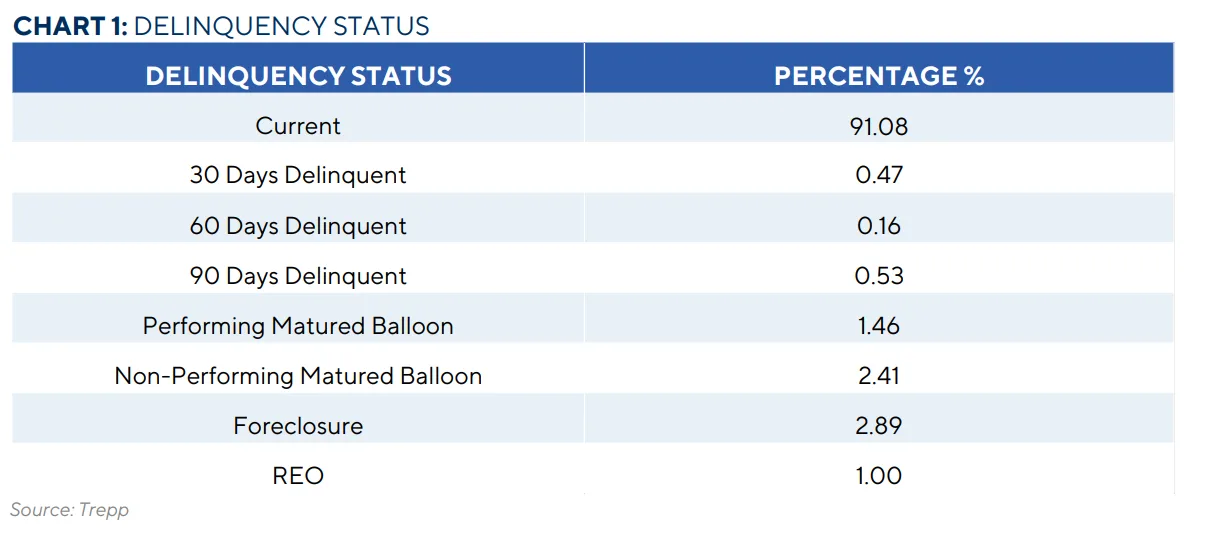

Serious Delinquencies Are Also Rising

Not only are more loans becoming delinquent, but many are also moving deeper into trouble. The share of seriously delinquent loans (60+ days late, in foreclosure, REO, or non-performing balloon) rose to 6.99%, up 24 basis points from the previous month.

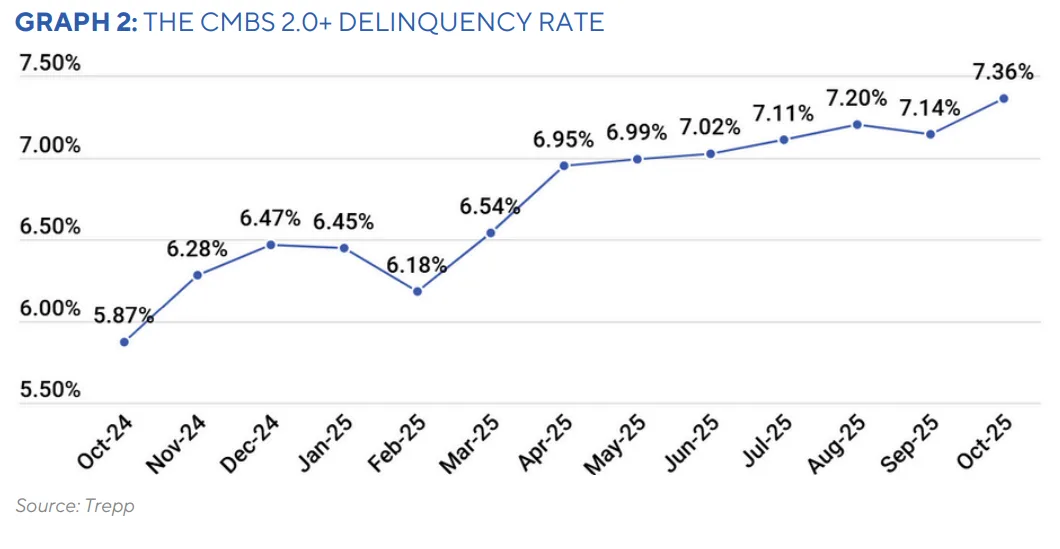

CMBS 2.0+: Similar Pattern Emerges

Loans issued after the 2008 financial crisis—referred to as CMBS 2.0+—also showed weakness:

- The CMBS 2.0+ delinquency rate increased 22 basis points to 7.36%

- Serious delinquencies in this group rose to 6.89%

- Excluding defeased loans, the rate would be 7.54%

These figures suggest that even loans with stronger underwriting are feeling the strain.

Why This Matters

Rising delinquencies—especially in office and multifamily—are a sign of ongoing trouble in the real estate market. As more loans mature, many borrowers are struggling to refinance or sell properties. This adds pressure on lenders, investors, and servicers.

For developers and property owners, this environment is forcing hard decisions, including possible restructurings, sales, or even handing back the keys.

Looking Ahead

As the market moves into 2026, delinquencies are likely to stay elevated. The volume of newly delinquent loans—over $4.0B in October alone—suggests that distress may continue to build.

With interest rates high and demand uncertain, especially for office properties, stakeholders should expect more challenges in the months ahead.