- Natural disasters often lead to wealthier, more exclusive communities. As towns rebuild, housing prices rise and lower-income residents move out.

- Federal aid and insurance money help drive recovery, but often benefit property owners more than renters.

- This trend, known as “climate gentrification,” is happening across the US as extreme weather becomes more common.

When Rebuilding Means Starting Over—Somewhere Else

Towns hit by disasters often come back richer—but not for everyone, per The WSJ. In Panama City, Florida, and Paradise, California, recovery after storms and wildfires has transformed these communities. But in the process, a pattern of climate gentrification has taken hold, forcing many longtime, lower-income residents out.

Panama City: A Storm of Change

Hurricane Michael struck Panama City in 2018. The storm damaged or destroyed tens of thousands of homes, especially in poorer neighborhoods. Many families did not have insurance or the legal documents needed to claim disaster aid.

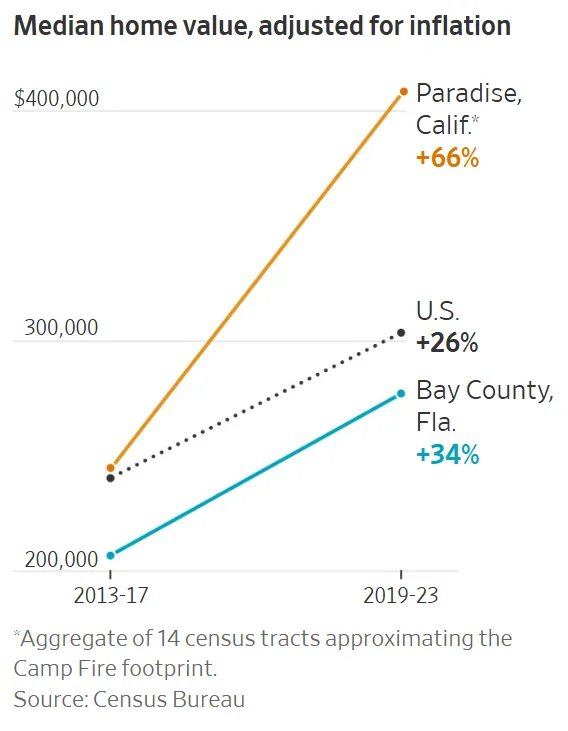

As they left, wealthier buyers and investors moved in. New homes, shops, and restaurants followed. Prices surged. In some areas, homes once rented for $1,200 a month now go for over $2,000. Some residents gave up trying to return.

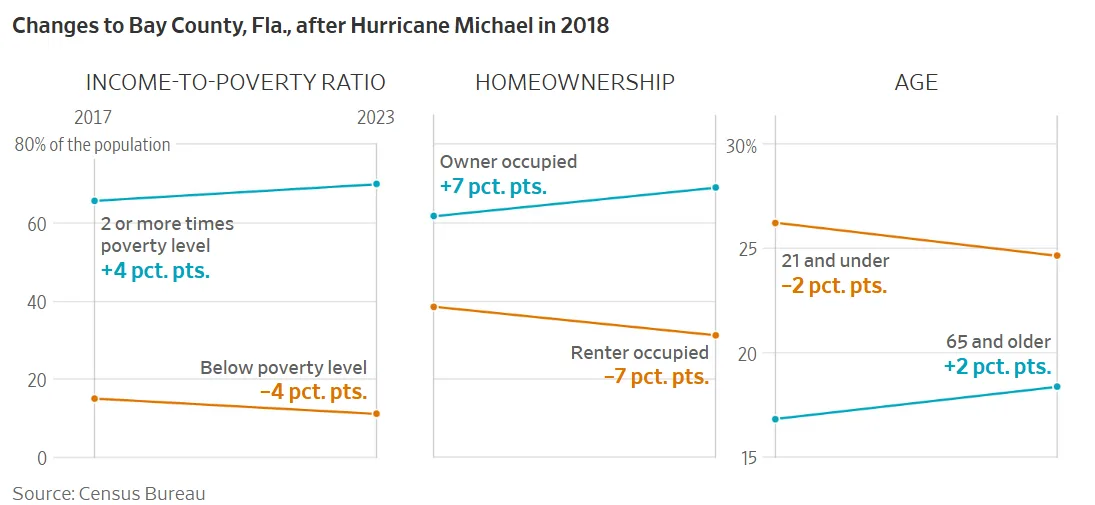

The median income in Bay County, where Panama City is located, rose 9% between 2017 and 2023. Poverty dropped from 15% to 11%. But that shift happened in part because many poorer people left.

Downtown Panama City also changed. Once quiet and run-down, it now features brick-paved streets, new stores, and upscale housing. Over $50M in private investment has flowed in.

Paradise: Rising From the Ashes—at a Price

The 2018 Camp Fire destroyed nearly all of Paradise, California. It was the deadliest wildfire in state history. Over 80 people died. Almost 19,000 buildings burned.

Many residents had little insurance. Some sold their land and left for good. Others couldn’t afford the rising cost of rebuilding or insurance.

Today, Paradise is growing again. New homes are bigger, more fire-resistant, and much more expensive. The median home value rose 66% after the fire. The share of mobile homes fell, while larger homes became more common.

The population is still far below what it was before the fire. But wealthier residents are moving in. Real estate is booming, and some say the fire helped “upgrade” the town.

A Pattern Emerges Across the US

This is part of a growing trend called “climate gentrification.” It happens when natural disasters push out poorer people and make room for richer ones. Recovery efforts often focus on rebuilding property, not helping displaced residents.

Studies show that neighborhoods hit by tornadoes, hurricanes, and fires often end up wealthier and whiter. Aid and investment tend to favor those who already have more.

Why It Matters

With more extreme weather events expected, more communities will face this challenge. Rebuilding brings better homes and higher values—but also raises costs and barriers.

What’s Next

As this year’s wildfire and hurricane seasons begin, the US may see more of this pattern. Policymakers will need to ask: How can recovery be made fairer, so everyone has a chance to return and rebuild?

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes