- Class B industrial assets are outperforming in both primary and secondary markets, driven by value-add potential and rising investor demand.

- US industrial rents have surged nearly 70% since 2020, fueling returns through “mark to market” lease strategies.

- Annual rent escalations have reset to 3.0–4.5%, creating stronger long-term income growth for landlords.

- Limited new supply and tenant renewal pressures are strengthening landlord pricing power across all asset classes.

Yield In Unlikely Places

Amid historically low interest rates in 2020-2021, industrial property investors turned their attention from fully leased class A assets toward class B and value-add properties with higher yield potential. These deals—often with near-term lease expirations and below-market rents—presented opportunities for rent repositioning through “mark to market” strategies. The bet paid off: US industrial rents have climbed nearly 70% since 2020, with Q1 2025 rates averaging $10.36 PSF, up from $6.11, reports Avison Young.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Class B Momentum Builds

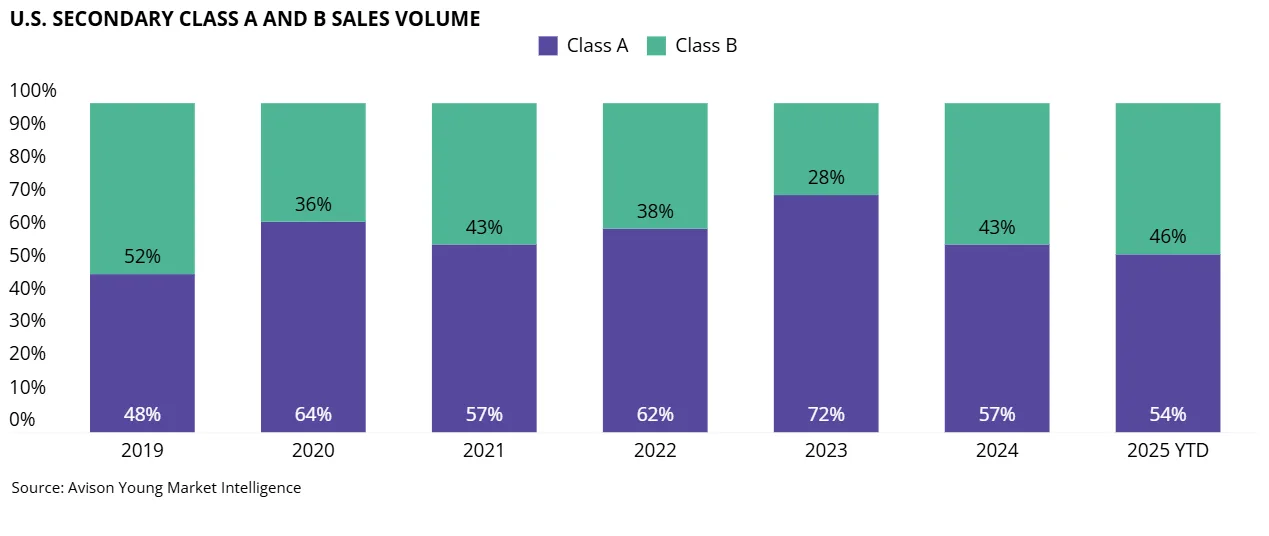

In major markets like Chicago, Northern New Jersey, and Philadelphia, class B industrial sales have, at times, outpaced class A volumes. In 2024, class B accounted for approximately 31% of industrial sales in functionally modern buildings (built post-1980), and in select secondary markets—including Austin, Charlotte, and Phoenix—that share jumped to 46% by early Q2 2025.

Class B activity may level off, but investor demand stays strong for value-add deals with short WALTs and rising escalations.

Escalations Recalibrated

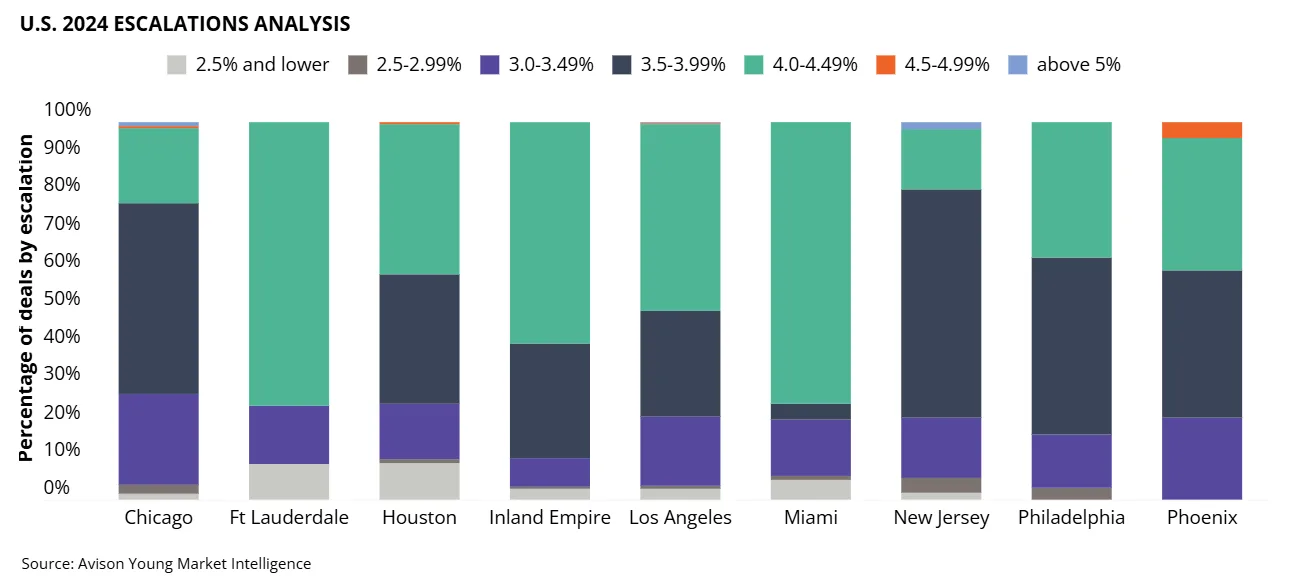

Rent growth isn’t just about market demand anymore—contract structures have evolved too. The once-standard 2–2.5% annual escalation has largely disappeared, replaced by 3.0–4.5% bumps across most markets. In markets like Atlanta and Nashville, lease escalations over 4% are common, especially on short-term deals.

In 2024, the most common escalation range is 3.5–3.99%, with newly built speculative product often commanding 4% increases. This shift is driven by a combination of construction cost inflation, rising interest rates, and fewer tenant concessions.

Secondary Markets, Primary Returns

Analysis of seven high-growth secondary markets—Phoenix, Indianapolis, Denver, Charlotte, Orlando, Las Vegas, and Austin—revealed class B assets averaging 37% of industrial sales since 2020. Many of these markets are benefiting from strong demographic trends, limited new supply, and tenant demand for affordable space under 50K sf.

For investors, this means solid returns without chasing trophy assets.Cap rates may start low, but rent growth and better lease terms drive strong long-term value creation.

The Tenant Equation

Not all tenants are equally positioned in this new leasing environment. Large occupiers absorb costs or pass them on; smaller tenants face higher renewals and fewer relocation options. Rising taxes and insurance strain budgets, but tenants aren’t leaving core submarkets or downgrading property classes.

Instead, tenants are leaning into space efficiency and lease renewals—giving landlords further negotiating leverage.

Bottom Line: Yield Through Creativity

Industrial real estate remains a favored asset class, but today’s investor success story increasingly hinges on creative strategy. Yield is no longer tied exclusively to class A buildings or gateway markets. Class B assets in rising secondary metros—when paired with smart lease structuring and timing—are proving to be a recipe for outperformance.