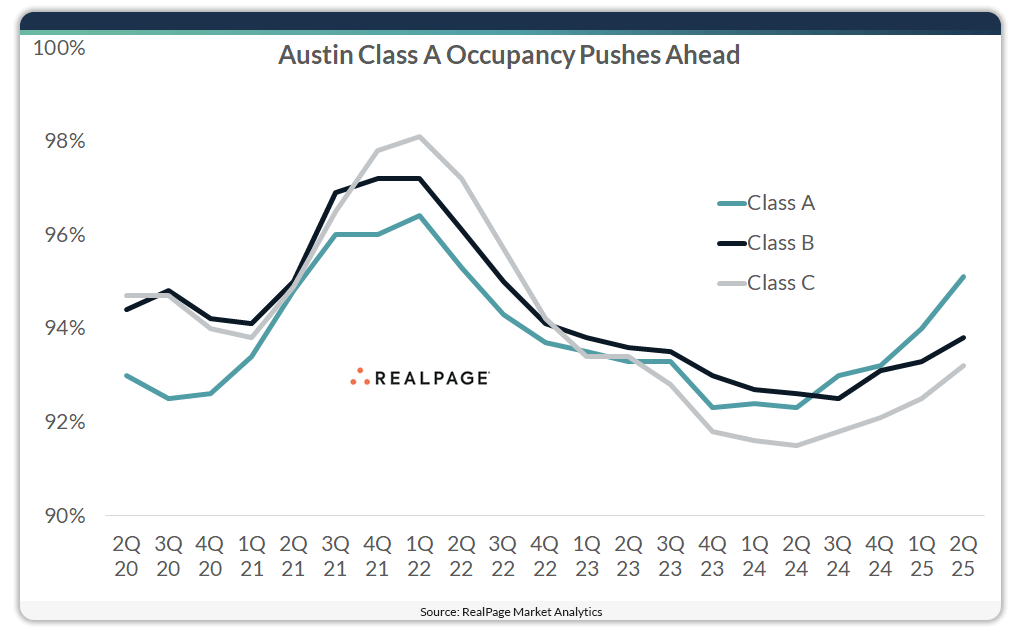

- Austin added 26,800 new multifamily units over the past year—an 8.5% increase in inventory—yet Class A apartments are effectively full with 95.1% occupancy in Q2 2025.

- Class A product saw a 270 bps year-over-year occupancy gain and remains the only tier above the 95% effectively full threshold.

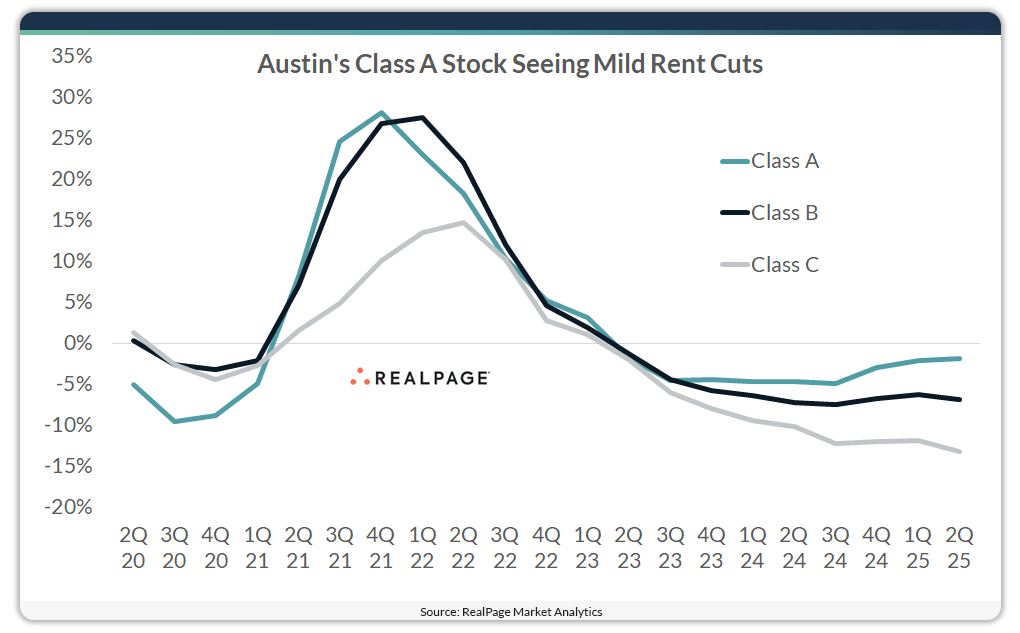

- While all asset classes saw rent declines, Class A rents dipped just 1.8%, compared to deeper cuts in Class B (-6.8%) and Class C (-13.2%). Concession usage was also lowest in Class A.

Austin’s Luxury Apartment Sector Defies Oversupply Fears

Despite an influx of new apartment deliveries, Austin’s Class A rental market remains tight, reports RealPage. The metro added nearly 27K units over the past 12 months, approaching the record set earlier in 2025. Yet, occupancy in the city’s most expensive, stabilized units rose to 95.1% in Q2—marking a return to “effectively full” levels for the first time since mid-2022.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Premium Units Lead The Market

While overall market occupancy came in at 93.9%, Class A apartments were the standout, outpacing both Class B (93.8%) and Class C (93.2%) units. Just a few years ago, top-tier properties were trailing their mid-tier counterparts. Now, strong renter demand—driven by population growth and high incomes—is pulling tenants up the quality ladder.

This demand hasn’t come at the expense of pricing power. Though rents are falling across all segments, Class A units saw the smallest cuts. Concessions followed a similar trend: only 30.5% of Class A units offered concessions, compared to 56.7% of Class C properties.

Affordability Pressure Drives Renters Upmarket

Austin’s economic fundamentals continue to support its apartment market. The metro’s population grew nearly 11% between 2020 and 2024, the strongest growth among major US markets. Combined with constrained single-family home inventory and elevated for-sale housing costs, more would-be buyers are remaining renters—and opting for newer, amenity-rich Class A buildings.

While home prices have cooled slightly since the pandemic peak, they remain high. The average home price rose more than 40% between 2019 and 2021, per Texas A&M’s Real Estate Center. Today’s prices still far outpace pre-pandemic levels, limiting affordability and boosting multifamily demand.

What’s Next

Austin’s fundamentals suggest continued strength in the top-end rental market. Population growth, high personal incomes, and for-sale housing constraints are expected to sustain demand for premium multifamily. While market-wide rent growth may remain soft in the short term, occupancy trends point to potential pricing recovery by mid-2026—particularly in Class A.