- Local Law 97 requires NYC buildings over 25,000 sq. ft. to report carbon emissions by June 30, with fines starting at $268 per metric ton for overages.

- About 5,000 buildings are expected to miss current compliance thresholds, despite the law being passed in 2019.

- While large institutional owners are mostly prepared, small landlords face costly retrofits, often opting to pay fines in the short term.

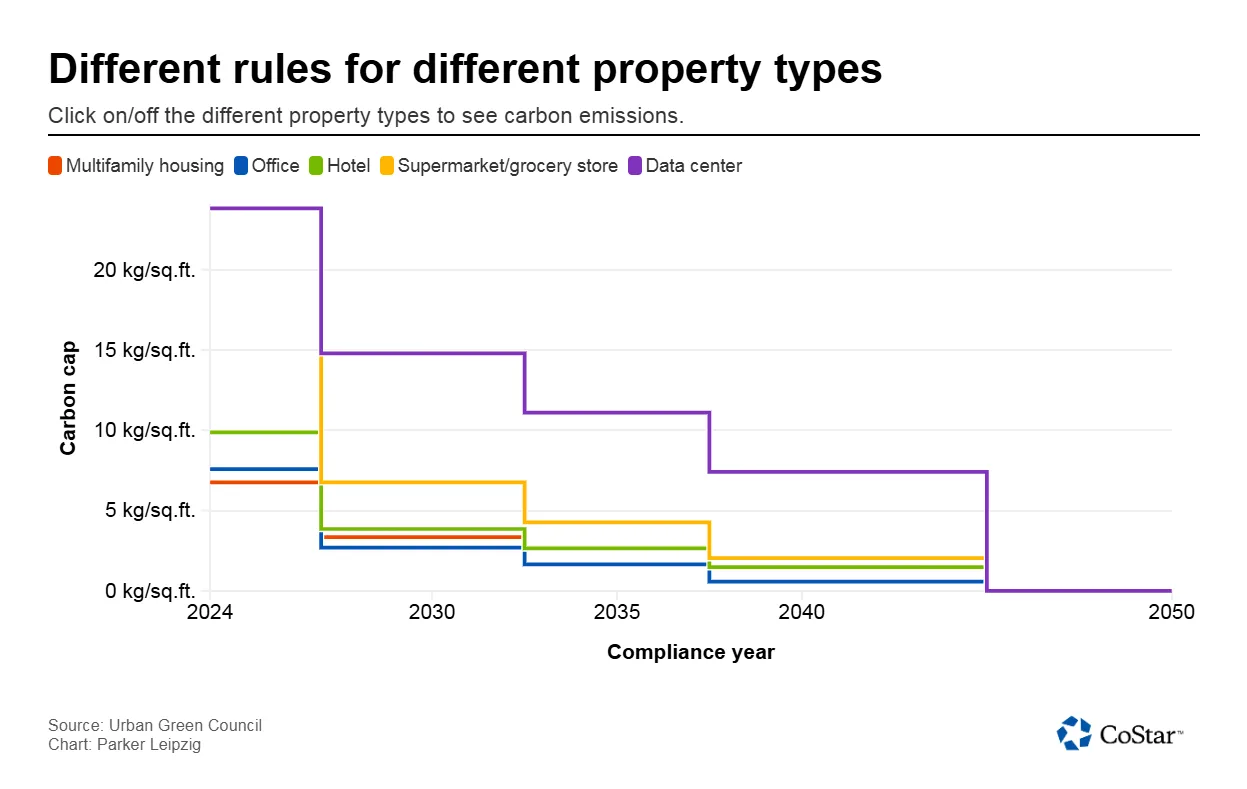

- The law aims to cut citywide building emissions by 40% by 2030 and nearly eliminate them by 2050.

Countdown to Compliance

New York City landlords are approaching a major compliance deadline under Local Law 97, a landmark climate initiative aimed at dramatically reducing carbon emissions from large buildings. By June 30, property owners must file certified reports detailing their building emissions—an initial step toward a 40% reduction goal by 2030, per CoStar.

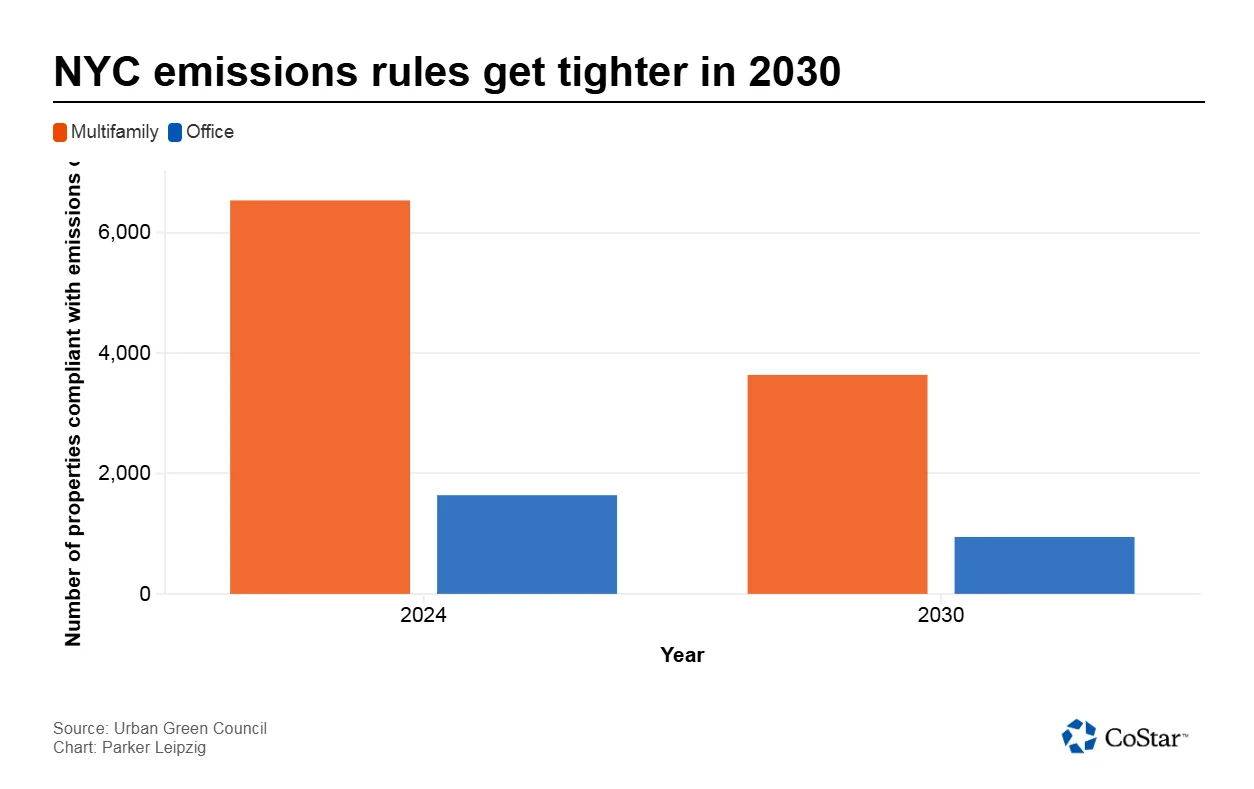

The law, enacted in 2019, applies to most buildings larger than 25,000SF, roughly 50,000 properties citywide. Those exceeding emissions caps face a fine of $268 per metric ton above the limit, with even stricter thresholds coming in 2030.

Short-Term Pain vs. Long-Term Planning

Despite the long runway, thousands of buildings—especially pre-war residential properties—aren’t ready. According to the Urban Green Council, only 49% of these multifamily buildings will meet emissions limits by 2030, down from 94% today.

The steep costs of carbon compliance have many owners weighing whether to invest in energy upgrades or simply pay the fines. One 50,000SF building emitting 400 metric tons of carbon could face fines nearing $20,000 this year.

“We’re seeing landlords choose to pay penalties now rather than disrupt tenants or replace legacy systems,” said Peter Varsalona of Rand Engineering & Architecture.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Institutional Players Lead the Way

Larger owners, including Empire State Realty Trust and SL Green, are ahead of the curve. Empire State Realty Trust has retrofitted the Empire State Building and expects full compliance across its NYC portfolio this year. Similarly, Hines and its Hudson Square joint venture partners recently completed a decarbonization project at 345 Hudson and are upgrading nearby assets.

These landlords often use flagship properties as test beds for green technologies before rolling them out portfolio-wide.

Policy Pushback and Political Uncertainty

Not all industry voices are on board. The Real Estate Board of New York (REBNY) estimates fines could top $900M by 2030. Critics argue the law unfairly burdens building owners while power grid emissions—largely out of their control—remain unaddressed.

Federal politics could add volatility. Tariffs and threats to renewable energy projects like Empire Wind from former President Trump may hinder the city’s ability to green its power supply.

Financial Incentives and Planning

Experts urge landlords to tap into programs like NYC’s Accelerator, NYSERDA incentives, PACE financing, and Con Edison rebates. Low-cost upgrades such as LED retrofits and HVAC optimizations may help some buildings meet compliance without massive overhauls.

“Landlords need to align their emissions strategy with capital planning,” said Brett Bridgeland of CBRE. “The goal is to avoid last-minute decisions under pressure.”

What’s Next

With the first deadline looming, enforcement data will start to reveal the scale of the challenge. As limits tighten in 2030, compliance may become more urgent and costly.

The broader lesson: Local Law 97 is not just a penalty structure—it’s a signal that climate-forward building strategy is no longer optional in New York’s commercial real estate market.