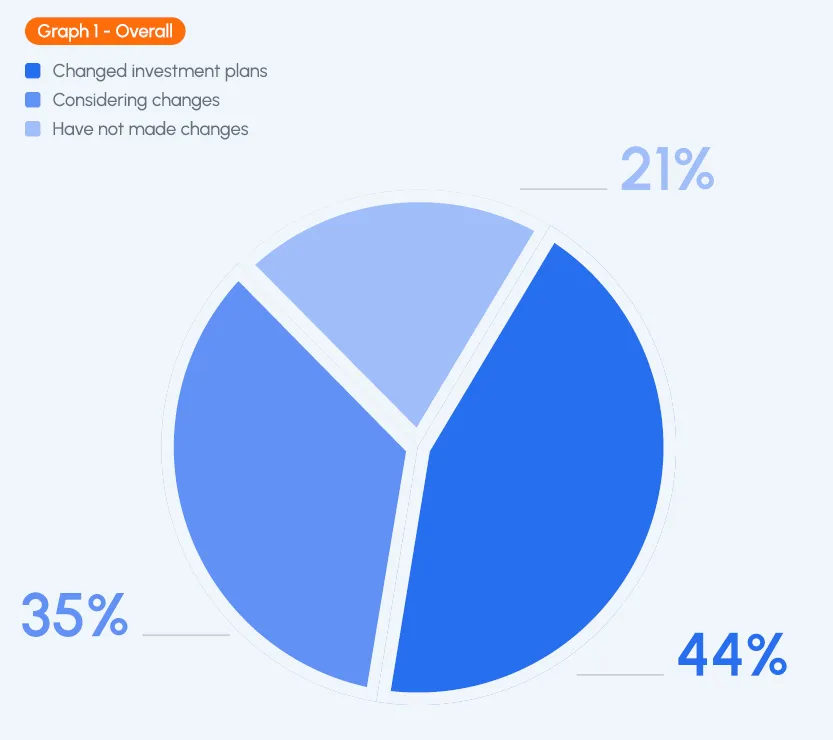

- 44% of firms have changed investment plans, favoring new asset classes and geographic regions in response to volatility.

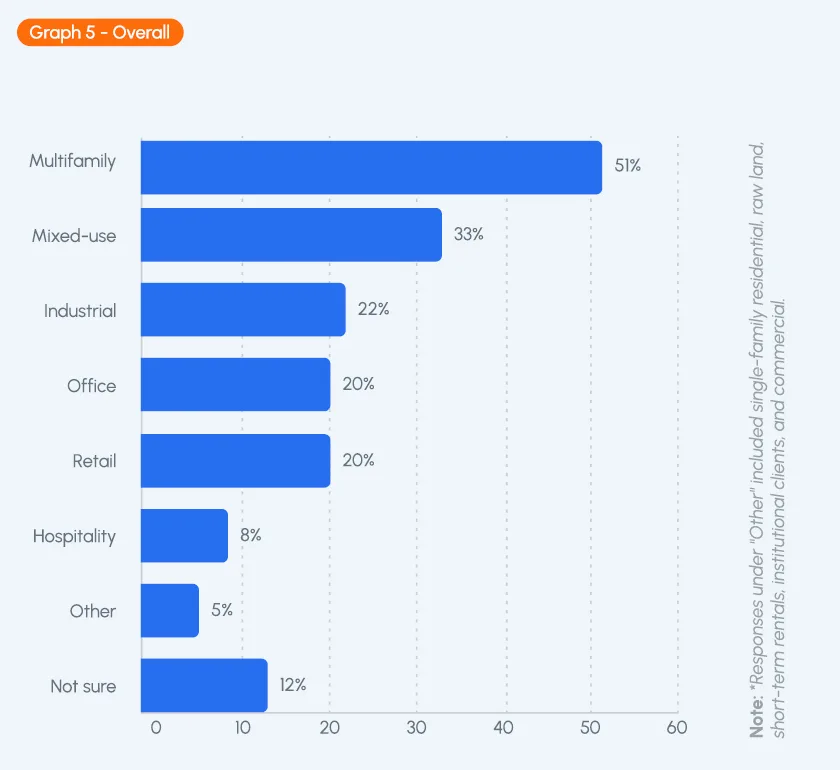

- Income-stable assets like multifamily and mixed-use dominate 2025 priorities, with 84% of respondents focusing on these categories.

- Capital raising is challenging for 58% of firms, with increased investor concerns and a demand for transparency driving more frequent updates.

- Opportunistic strategies lead, with 48% targeting undervalued or distressed assets amid ongoing market uncertainty.

A turbulent start to 2025

The 2025 commercial real estate market opened on a cautious note, shaped by high interest rates, persistent inflation, and volatile investor confidence. According to a new sentiment report from Agora and Talker Research, 44% of surveyed U.S. firms have already adjusted their strategies to navigate this shifting landscape.

Realignment in strategy

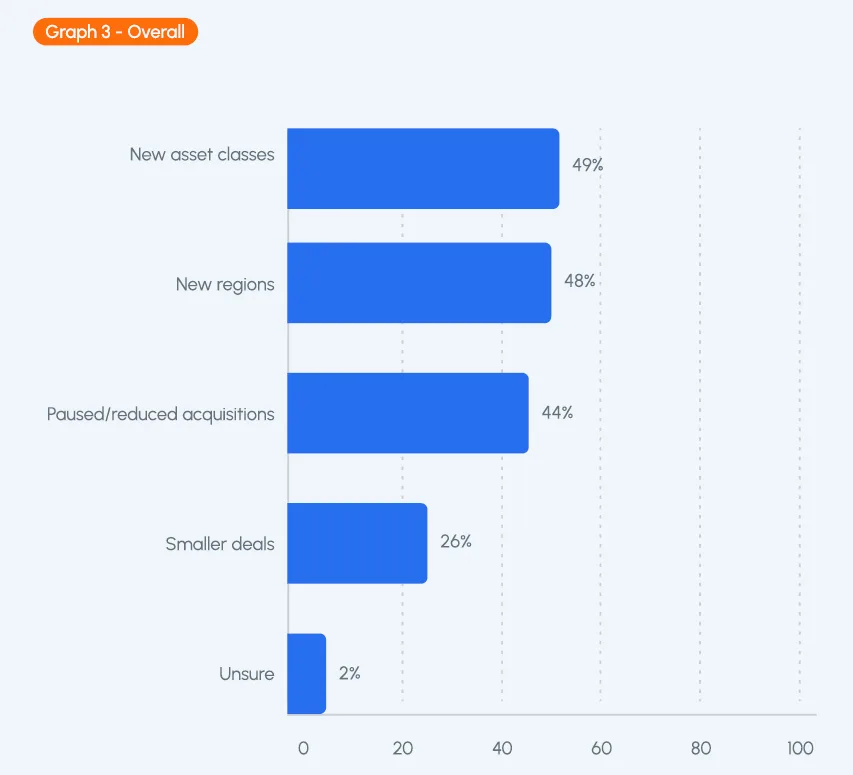

Among those firms making changes, nearly half are exploring new asset classes (49%) and expanding into new regions (48%). Meanwhile, 44% have slowed acquisitions, and 26% are pursuing smaller deals. The Southwest stands out, with 82% of firms there pivoting to new asset types—far more than the 18% doing so in the West.

Multifamily remains king

Stable, income-generating assets are taking center stage. 51% of firms are prioritizing multifamily, while 33% are targeting mixed-use properties. Only 8% are pursuing hospitality. Regional differences are stark: in the Southwest, 65% are focused on multifamily, and 50% on mixed-use—well above other areas.

Where the money’s going

The Southeast and Southwest are hot investment targets, drawing 28% and 26% of firms respectively. Millennials lead this charge, with strong preferences for these regions. Nationwide investment strategies also appeal to Gen Z, with 44% indicating a broad approach.

Investors demand more data, more often

Capital remains difficult to raise—58% say it’s gotten harder—and investors are increasingly vigilant. 76% are concerned about volatility, while 31% are specifically asking for transparent performance metrics. Weekly updates are now the norm for 38% of firms, a sign of increased communication pressure.

Opportunism with a dose of realism

48% of firms describe their current investment posture as opportunistic, looking for undervalued or distressed assets. Only 25% are aggressive, while 17% have adopted a defensive stance and 10% are on hold entirely.

Recession fears and readiness

While 45% do not expect a U.S. recession in 2025, 38% think one is likely. If it occurs, 41% of firms will target distressed buying, and another 40% will double down on asset management. Just 14% said they would pause acquisitions altogether.

Looking ahead

The industry doesn’t expect uncertainty to fade soon. Most anticipate at least another 6 to 12 months of volatility, with only a few betting on shorter recovery timelines. As one firm put it, staying nimble and informed may be the best strategy in this high-stakes market.