- Former President Donald Trump floated the idea of eliminating capital gains tax on home sales.

- Rep. Marjorie Taylor Greene’s bill would end the tax for primary residences, benefiting high-gain markets like California.

- Critics say the plan favors the wealthy and won’t improve housing affordability.

According to Bloomberg, former President Donald Trump recently said his team is “thinking about” ending capital gains tax on home sales. The idea echoes a bill by Rep. Marjorie Taylor Greene, which would eliminate the tax on primary residences. While real estate groups support it, economists warn it could mainly help wealthy homeowners.

Big Gains, Bigger Benefits

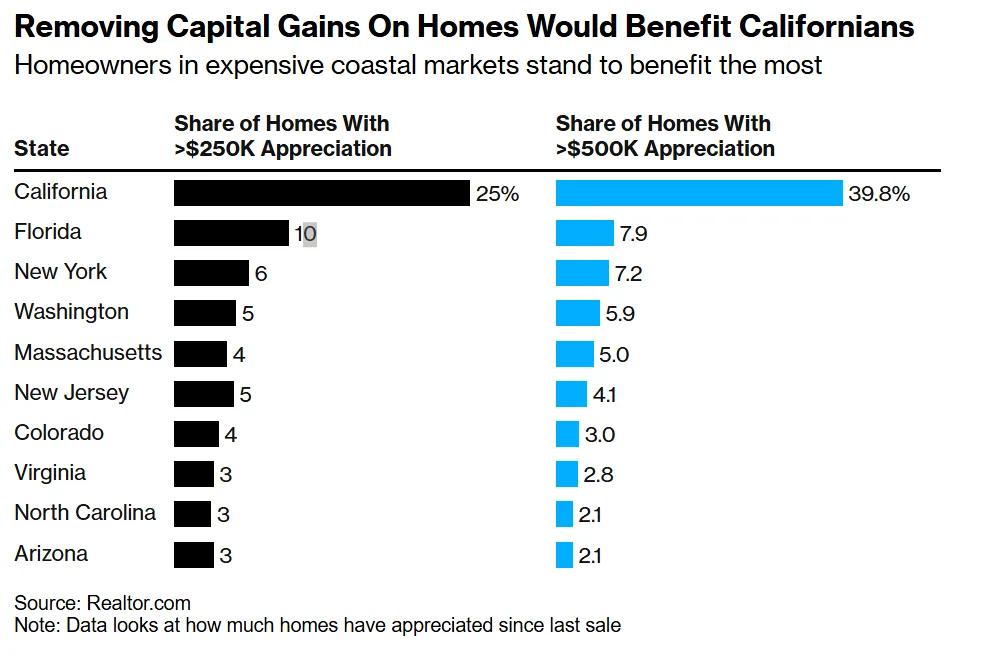

Current tax law allows homeowners to exclude up to $250,000 in gains ($500,000 for couples) when selling a primary home. But many homes in California have appreciated far beyond that. Realtor.com data shows 40% of US homes with over $500,000 in gains are in the state.

Who Wins and Who Doesn’t

Greene’s bill would eliminate the cap entirely. Supporters say this would encourage older homeowners to sell, freeing up inventory. Nearly 29M homeowners may already exceed the current tax cap. That number could rise to 70% by 2035, according to the National Association of Realtors.

Still, most of the benefits would go to the wealthy. In 2022, homeowners above the cap had a median net worth of $2M. That compares to $330,000 for those below it, based on Yale Budget Lab data.

The Affordability Disconnect

Critics argue the bill won’t help with housing costs. Sellers still need to buy new homes, often at today’s high prices. Redfin’s Chief Economist, Daryl Fairweather, says that could increase competition in the market. First-time buyers may end up facing more cash-rich buyers.

“This doesn’t really move the needle for affordability,” said Fairweather.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What’s Next

The bill hasn’t moved forward in Congress yet. The real estate industry backs it, seeing it as a way to unlock inventory. But experts say it could deepen inequality and leave housing prices high.

Why It Matters

Eliminating capital gains tax on home sales may motivate some homeowners to sell. But most of the financial benefits would go to those already well-off. In markets like California, that could make it even harder for new buyers to get in.