- Deloitte’s annual CRE survey of 850 executives shows overall optimism remains but has dipped slightly, with the firm’s sentiment index falling from 68% last year to 65%.

- Capital availability replaced interest rates as the top concern, with more than half of respondents facing loan maturities in the coming year.

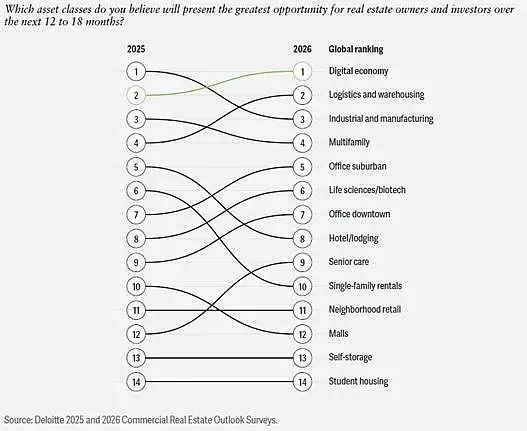

- Office is regaining investor attention, with suburban and downtown office climbing in the rankings of asset classes seen as opportunity plays.

Optimism Slips, But Not Gone

Deloitte’s 2025 CRE executive survey found that while 65% of respondents expect improvements in rents, vacancies, leasing, and cost of capital through next year, the figure is down from 68% in 2024, as reported by Bisnow.

Partner Sally Ann Flood summarized the sentiment: “The recovery has paused but is not canceled.”

The survey, which polled CEOs, CFOs, COOs, and senior leaders from firms managing $250M+ in assets, revealed executives remain generally positive on revenues—83% expect increases this year, down from 88% in 2024.

Capital Concerns Take Center Stage

For the first time, the availability of capital topped the list of macroeconomic risks for CRE executives, surpassing elevated interest rates and cost of capital. This concern reflects a divide between new lending opportunities and looming loan maturities.

- Loan Maturities: Over half of respondents reported having a property loan due within a year. Just 21% expected to pay off in full, while 34% anticipated extensions or modifications, 29% sought refinancing, and 15% expected foreclosure.

- Market Dynamics: Despite worries, new loan volume rose 90% year-over-year in Q1, CMBS originations more than doubled, and dry powder for CRE reached $585B, according to JLL.

Flood noted the split: “There’s really two tales to the debt markets. Legacy loans remain stressed, but newer capital is opening up for CRE.”

Office Finds New Momentum

Long considered the sector in distress, office properties are regaining investor interest as valuations reset. Deloitte’s survey ranked suburban office as the fifth most promising asset class (up from seventh), and downtown office jumped to seventh (from ninth).

Driving factors include:

- Return-to-office trends in major cities.

- Steep price corrections, with some assets down 50% from peak values.

- Transaction activity: JLL reported $25.9B in office sales in H1 2025, a 42% increase YoY.

Flood suggested the worst may be over: “I think we’ve seen the bottom of office valuations. That reset has contributed to office being a positive sector.”

Still, the top opportunity cited in the survey was digital economy properties—particularly data centers—fueled by tech investment in AI infrastructure.

AI Adoption: Targeted Gains, Broader Challenges

The survey also revealed tempered expectations for artificial intelligence.

- Challenges: 27% of executives reported difficulties with AI implementation, up from 16% last year, citing technical hurdles and organizational resistance.

- Success Stories: CRE leaders reported the most value in tenant relationship management, construction oversight, and lease drafting.

Flood cautioned against overreliance: “Leasing-specific use cases are showing success. But AI isn’t a blanket solution—it works best when targeted to improve specific processes.”

Why It Matters

The survey underscores a CRE market in transition: capital is returning, but legacy debt challenges remain; office is reemerging as an opportunity play; and AI promises benefits but requires careful integration.

The consensus? Recovery isn’t over—it’s just on pause.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes