- Hines expects real estate income to outperform as inflation and rising cap rates echo 1970s conditions, despite headwinds in valuations.rn

- Tariffs and deglobalization are fueling inflation and pressuring growth, reshaping global investment strategies.rn

- Supply constraints across sectors set the stage for long-term rent growth, especially in modern, sustainable assets.rn

- Hines is focused on living, grocery-anchored retail, and US office credit, while monitoring selective industrial and alternative sector opportunities.

“The Bell Can’t Be Unrung”

Hines’ mid-year 2025 outlook frames a market environment defined by persistent inflation, geopolitical realignment, and policy volatility. What seemed like a recovery at the start of the year has turned more uncertain amid abrupt US tariff shifts. Yet, Hines argues this is a moment for strategic action—not retreat—as real estate fundamentals and cap rates begin to diverge from traditional models shaped by four decades of falling interest rates.

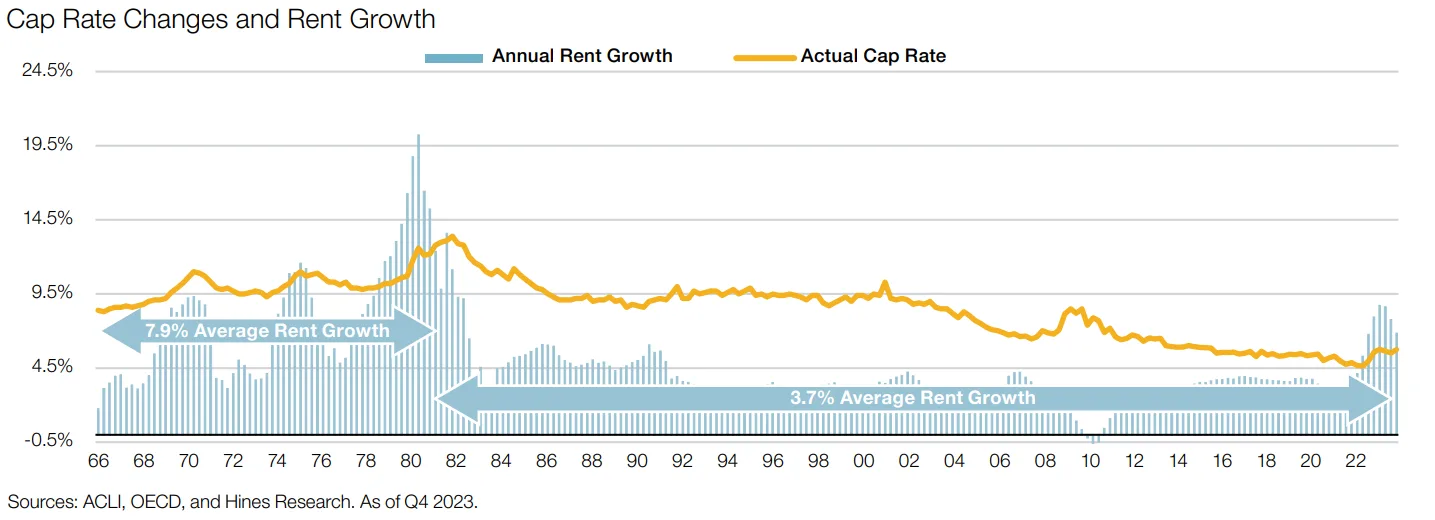

Rising Cap Rates, Resilient Rents

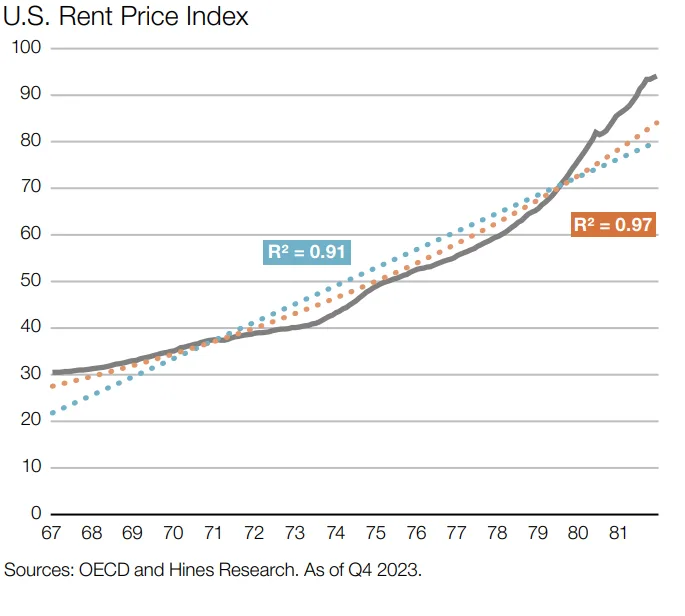

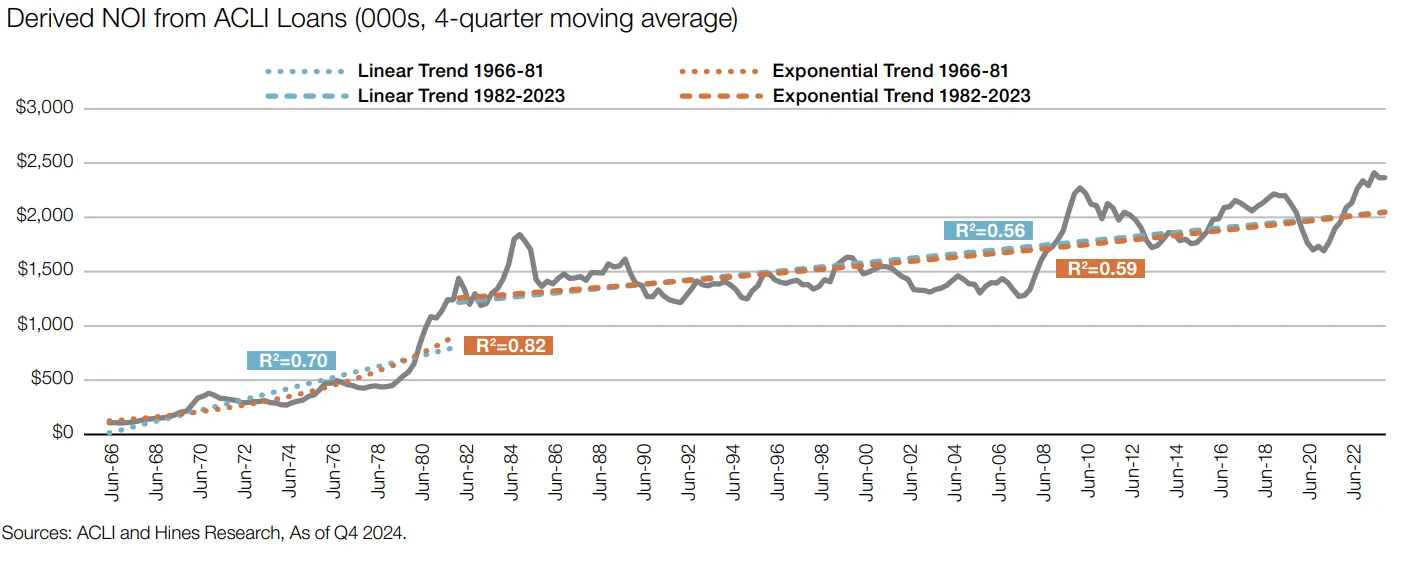

Looking back at the 1966–1982 cycle, Hines research shows that rising cap rates didn’t stifle real estate income—they strengthened it. Rents grew at an average of 7.9% during that inflationary period, nearly doubling the growth rate of the cap rate compression era. With construction activity at historic lows globally, similar conditions could be forming, positioning real estate for robust income growth—even as valuations adjust.

Living Sector

Global housing undersupply is driving demand across regions. The US rental market is adjusting post-Sunbelt oversupply, while cities like Chicago and San Francisco are already seeing strong rent growth. Europe and Asia show promise in institutionalizing sectors like student housing and single-family rentals.

Retail Sector

Grocery-anchored retail in the US is thriving amid minimal new development and rising tenant demand. In Asia, retail completions are down significantly, creating favorable fundamentals. European markets are stabilizing, offering value as retail sorts into winners and losers.

Office Sector

While global office performance varies, US markets are showing early signs of recovery. Manhattan and San Francisco are seeing stronger leasing, with demand moving beyond trophy assets. With cap rates adjusting upward, Hines sees attractive opportunities in US office credit as lenders re-engage and pricing begins to recalibrate.

Industrial Sector

Leasing has softened in the US due to recent supply waves, but smaller, infill warehouses remain resilient. Europe and Asia face similar slowdowns, though tighter supply constraints offer support. Future tariff-driven supply chain shifts may unlock new development nodes.

Alternative Sectors

Sectors like medical office, self-storage, student housing, and data centers are supported by solid demand trends and limited new supply. Despite hyperscaler caution, data center demand remains strong, driven by AI and long-term digital infrastructure needs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What’s Next

With inflation still a risk and interest rates potentially staying higher for longer, Hines believes real estate may again prove resilient. Rising cap rates are reshaping underwriting and return expectations, but they may also support stronger income growth over time. Combined with supply scarcity and increased investor selectivity, these dynamics suggest a new phase is emerging. While the next cycle won’t mirror the last, history suggests real estate can thrive in this evolving environment.

“We can’t unring the bell,” writes CIO David Steinbach. “But we can redefine the echo.”