- C-PACE financing enables long-term, fixed-rate funding for CRE energy and resilience upgrades.

- Record deal volume includes a $465M transaction for DC’s Geneva project, the largest C-PACE deal to date.

- 40 states have enacted C-PACE policies, up from just 6 active programs in 2015.

- Lenders and investors are attracted by C-PACE’s security, flexibility, and recapitalization benefits.

Loan Volume Surges

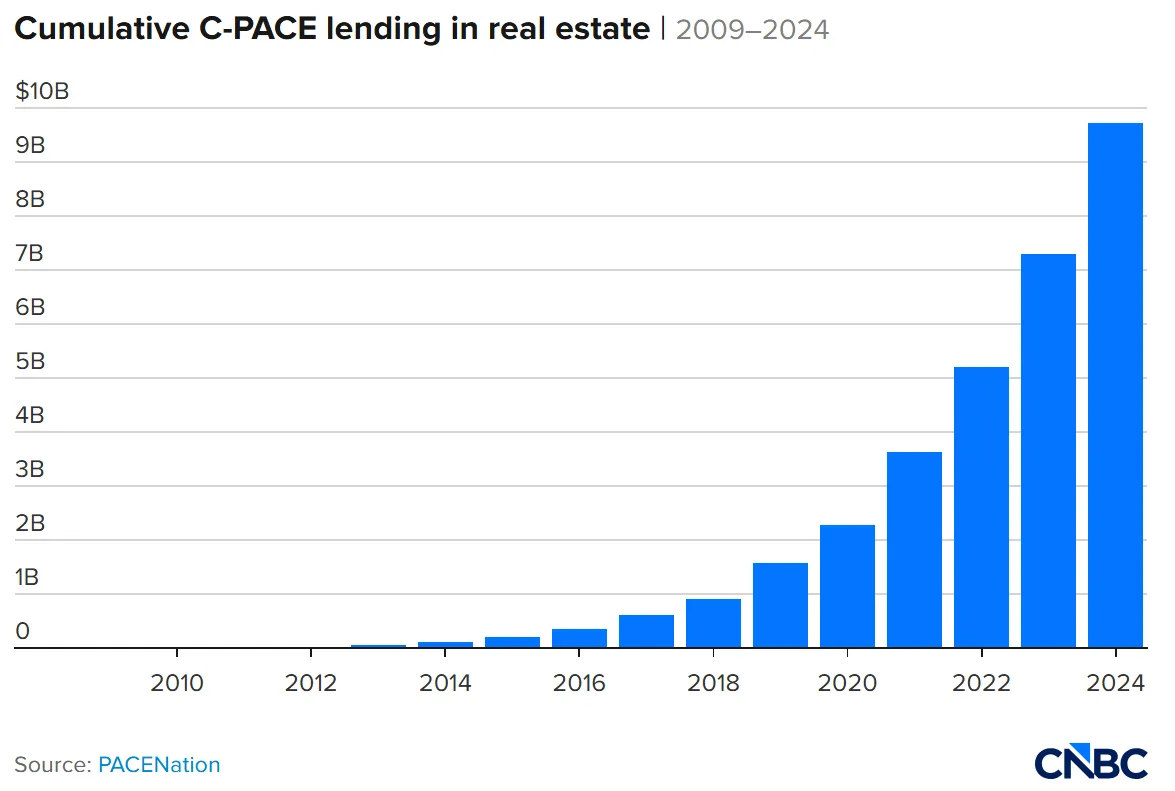

C-PACE financing—commercial property assessed clean energy—is experiencing record growth across the US CRE market, reports CNBC. Nuveen closed the largest C-PACE deal in history at $465M for The Geneva, a Washington, DC office-to-residential conversion. Over the last five years, double-digit gains in C-PACE lending have propelled cumulative investment near $10B by the end of 2024, according to PACENation.

What is C-PACE?

C-PACE financing differs from traditional bank loans, attaching repayment to a property’s tax bill over decades. This structure helps property owners fund energy efficiency, water conservation, renewable energy, or resilience upgrades. With fixed, long-term payments and the potential for reduced operating costs, C-PACE has become increasingly attractive amid tighter credit conditions in CRE lending.

Why Borrowers and Investors Prefer C-PACE

C-PACE offers more than just environmental benefits. Nearly 97% of upgrades, according to Nuveen, focus on cost-saving improvements. These include energy efficiency and building resilience, rather than only renewable energy installations.

Lenders and investors favor C-PACE for its secure, fixed-rate structure. Loans tie to property tax bills and remain in place through ownership changes. This stability provides long-term value and reduces risk, especially during volatile market cycles.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Flexibility and Market Expansion

Retroactive C-PACE loans give property owners tools to recapitalize and reduce senior debt. Many use the capital to fund new construction or complete stalled renovations. Companies like Peachtree have securitized C-PACE loans, which now attract insurance firms and institutional investors. In Washington, D.C., one such conversion project recently secured record financing using C-PACE, showing how the tool can unlock value even in tight capital markets. As a result, more capital is flowing into this segment.

Today, 40 states have enacted C-PACE policies, with 32 running active programs. This growth stems from better market education, rising investor interest, and flexible deal structures.