- Bulk move-ins (100K+ SF) reached 177M SF in H1 2025, a 17.5% increase from H1 2024, but net absorption dropped 33% year-over-year to 55M SF due to rising move-outs.

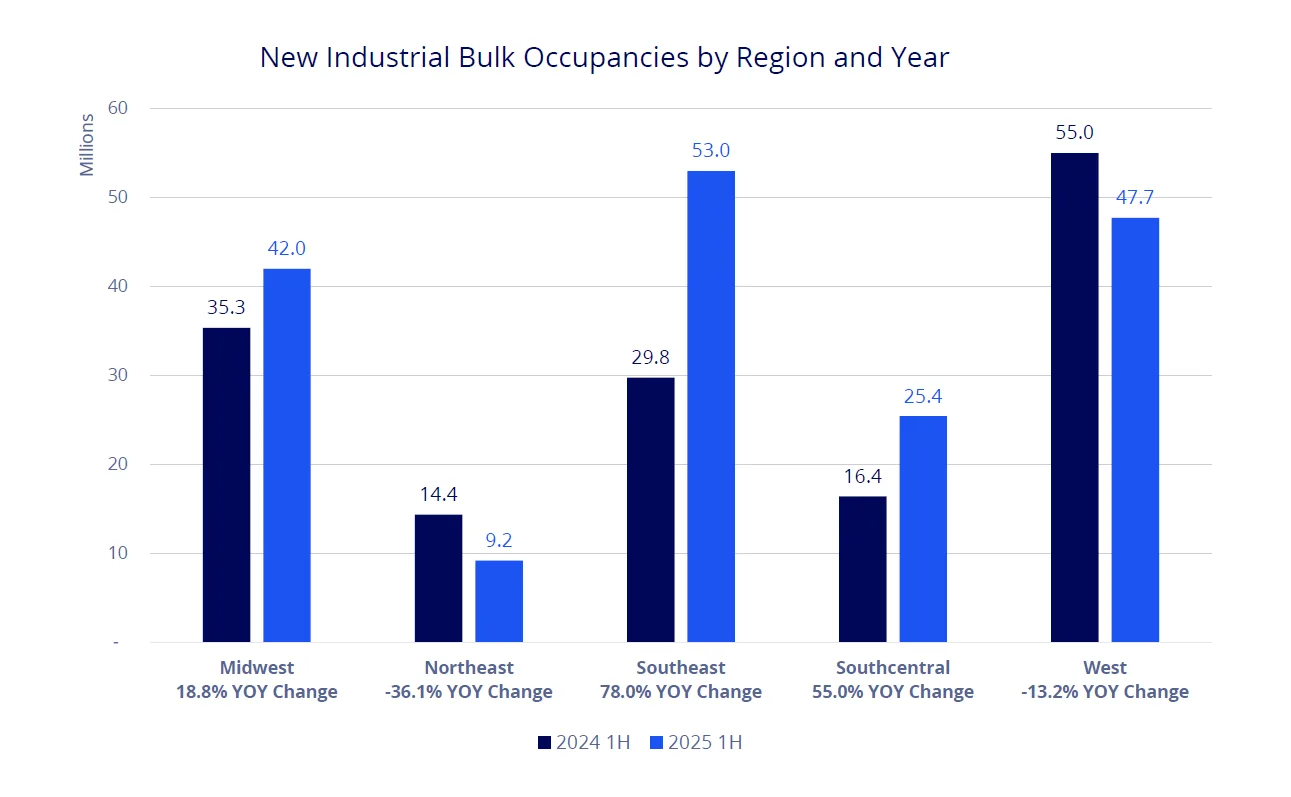

- The Southeast region led all US markets with 53M SF of new bulk leasing, up 78% YoY, while the West and Northeast saw declines.

- Logistics, trucking, and transportation companies made up 31% of all new bulk occupancies, with Asian-based 3PLs accounting for 21% of that share.

- Tesla and TSMC led new occupancies, with Tesla taking 3.5M SF across four states and TSMC occupying 1.6M SF in Phoenix.

Bulk Leasing On The Rise—But Absorption Falters

New industrial leasing activity rebounded strongly in early 2025, reports Colliers. Tenants occupied 177M SF of bulk space—defined as 100K SF or larger—during the first two quarters. That marks a 17.5% increase from the 151M SF leased in the same period in 2024. However, despite the strong leasing activity, net absorption dropped to just 55M SF. That’s 33% lower than the same period last year. The decline was driven by an increase in move-outs, especially in smaller assets under 200K SF.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

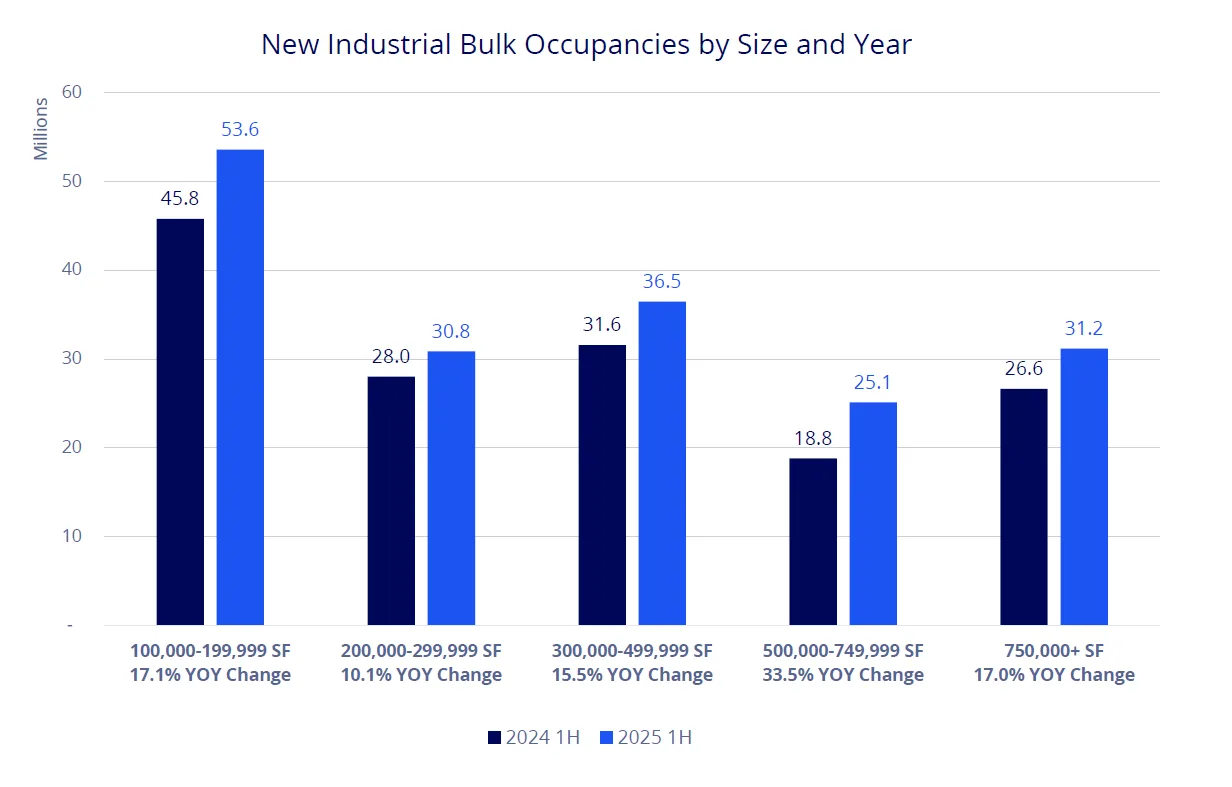

Shift Toward Smaller Deal Sizes

The number of bulk transactions increased, but average lease size continued to decline, dropping to 258K SF in H1 2025 from 264K SF in 2024 and 289K SF in 2023. The trend points to more tenants taking smaller bites of space—despite 15 mega-leases over 1M SF being signed in the period.

Where the Growth Happened

According to Colliers, the Southeast was the standout region, with 204 occupiers leasing 53M SF—up 78% year-over-year. Other regions like the Midwest and Southcentral also grew, while the West and Northeast posted declines.

Every size segment of bulk space recorded YoY growth in new occupancies, but the 500K–749,999 SF range led with 34% growth. Still, net absorption turned negative in the 100K–199,999 SF segment, where move-outs surged.

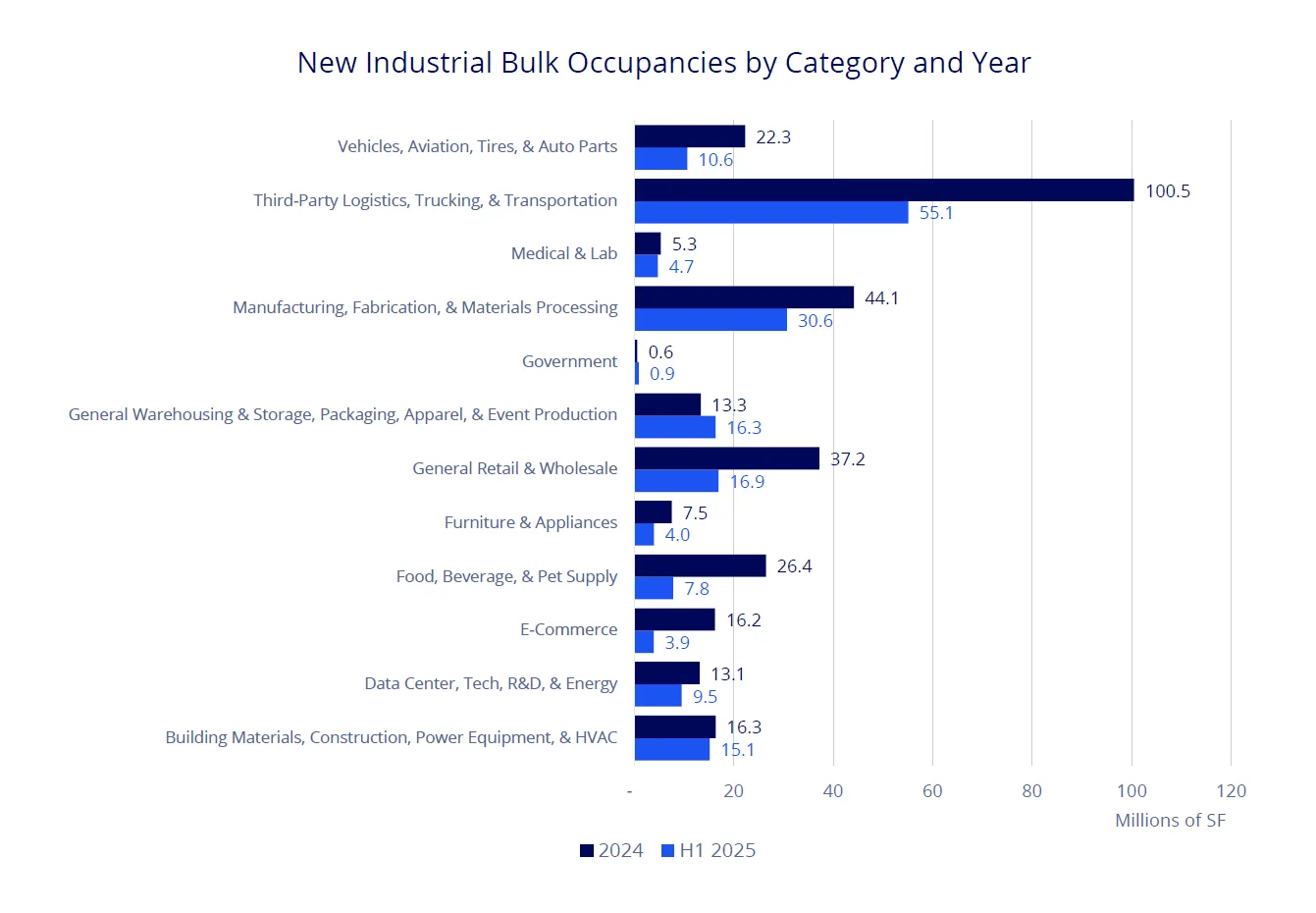

Leading Industries & Occupiers

- Third-party logistics (3PL), trucking, and transportation companies dominated activity with 31% of new bulk leasing.

- Asian-based 3PLs now account for 21% of total bulk space taken by logistics companies, a growing share.

- Manufacturing, materials, and processing firms followed with 17% of activity, down slightly from 19% a year ago, but poised for a rebound as CHIPS Act-related facilities begin to deliver.

Notable Deals:

- Tesla: 3.5M SF across 7 facilities in NV, TX, CA, and IL, including a 1.5M SF facility in Sparks, NV.

- TSMC: 1.6M SF in Phoenix for semiconductor operations.

- DrinkPAK: 1.4M SF in Fort Worth, TX.

- CJ Logistics: 1.4M SF in Stockton, CA.

Outlook: Vacancy Rising Unevenly, Demand Recovery Underway

Tenant demand is expected to pick up in H2 2025, led by logistics and manufacturing. As new construction slows, vacancy rates are expected to peak, balancing supply and demand. However, market segmentation will widen, with some regions facing more vacancy pressure due to local oversupply and shifting tenant dynamics.

Despite short-term softness in net absorption, the industrial sector continues to show resilience, with new leasing across all space sizes and a return of large-scale occupancies signaling improving tenant confidence.