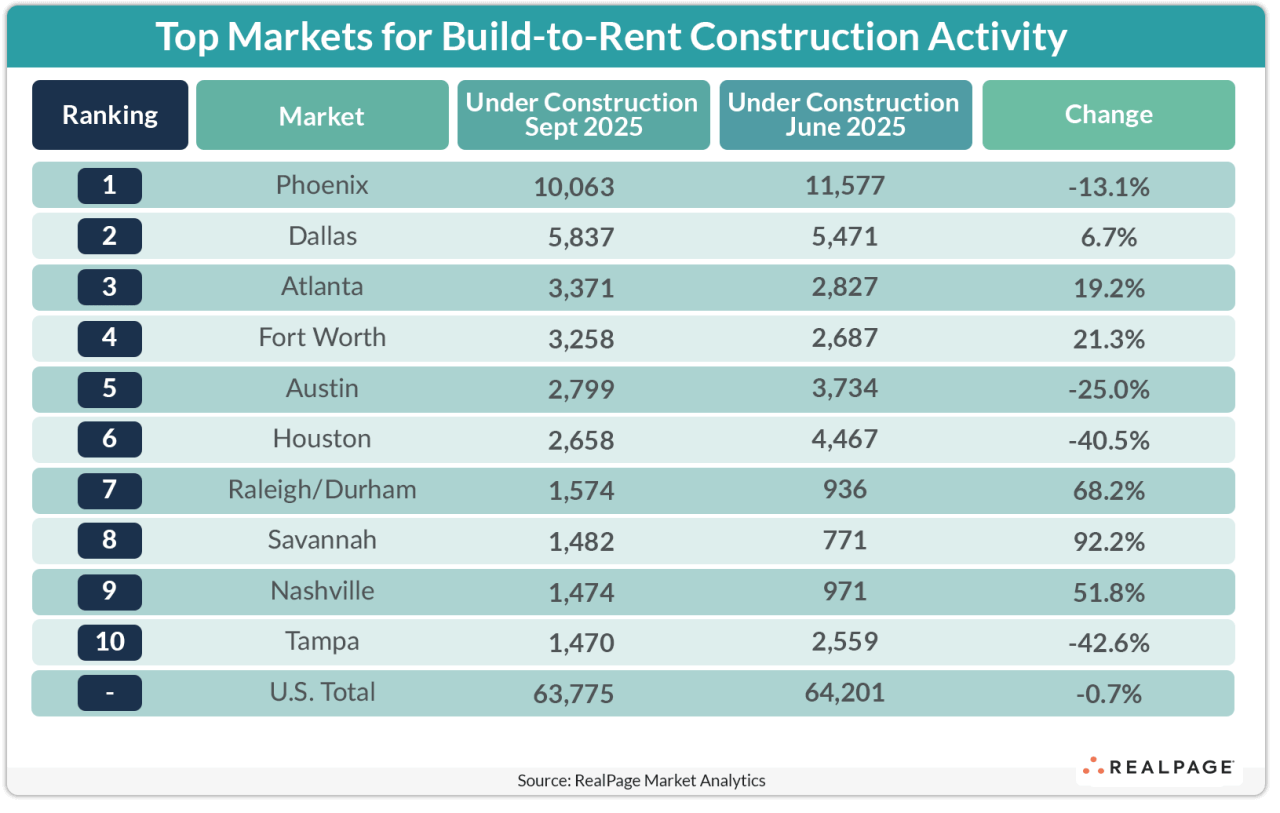

- The national BTR pipeline slipped 0.7% from June to September, totaling 63,800 units under construction.

- The South region leads the country in BTR activity, accounting for nearly 60% of all units underway.

- Western BTR construction declined by more than 10%, while the Midwest and Northeast saw moderate increases.

Pipeline Eases But Remains Active

US build-to-rent construction is showing signs of moderation.

According to RealPage, about 63,800 BTR units were under construction nationwide as of September, including those still in lease-up. That marks a slight 0.7% decrease from June — a signal that the once rapidly expanding sector is feeling the pressure of broader market slowdowns.

Regional Performance: The South Still Reigns

Despite the national dip, three of the four US regions reported upticks in BTR construction:

- South: With nearly 37,700 units underway, the South is by far the dominant BTR region. That total is more than double the next closest region and represents a 2.3% increase from June.

- West: The only region to see a downturn, the West posted a 10% drop to 17,400 units under construction.

- Midwest & Northeast: Though smaller markets, both regions saw modest gains of 10% and 6%, respectively. Combined, they account for 8,700 BTR units in development.

Sun Belt Markets Still Hot

Among individual metros, Sun Belt cities continue to anchor the BTR sector:

- Phoenix remains the undisputed BTR capital, with over 10,000 units set to deliver by April 2028.

- Dallas follows with 5,800 units expected by Q3 2027.

- Other key markets include Atlanta (3,370 units), Fort Worth (3,260), Austin (2,800), and Houston (2,660). Together, these cities will see close to 28,000 new BTR units in under two years.

What’s Next

Despite the recent dip in starts, the BTR sector remains healthy, with another 11,870 units in the planning pipeline. However, economic uncertainty, including the recent federal government shutdown, could impact development timelines in the coming quarters.

As demand for flexible, single-family rentals continues, especially in high-growth markets, BTR is expected to remain a key focus for investors and developers—even as momentum slows.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes