- Build-to-rent developers are exempt from Trump’s new executive order limiting large institutional purchases of single-family homes.

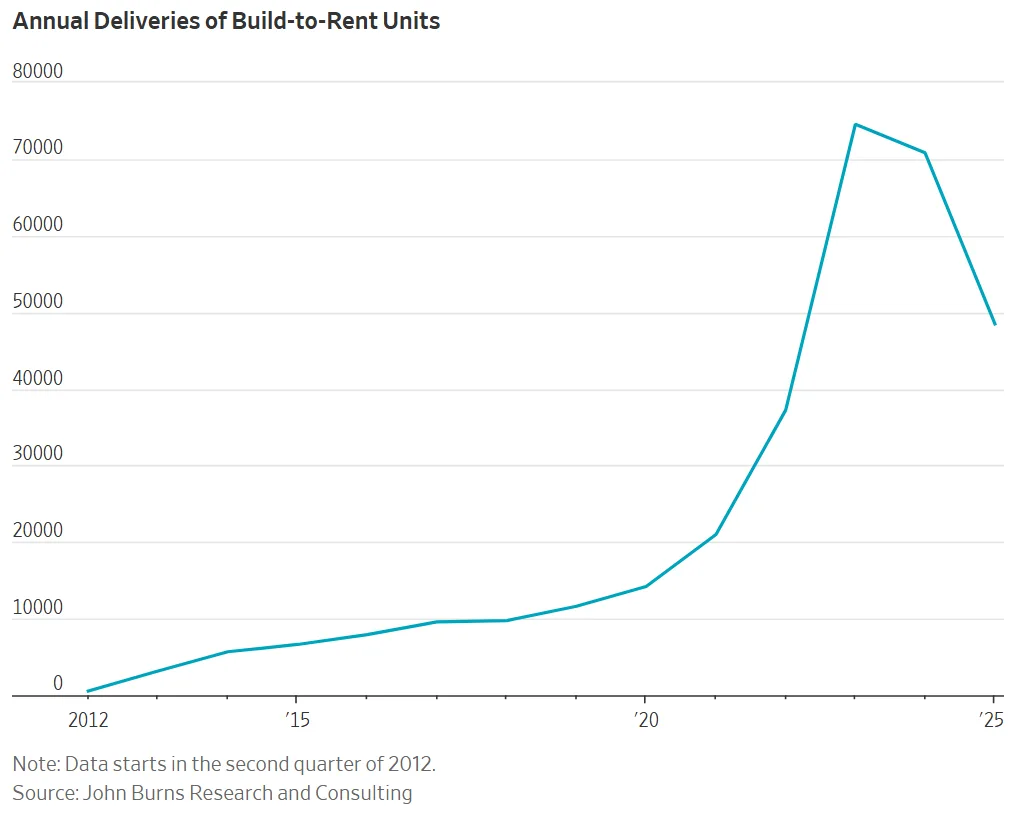

- The build-to-rent sector has accelerated, with over 321,000 homes built since 2012—most in the last five years.

- Institutional investors are shifting focus from buying existing homes to developing purpose-built rental communities.

- Questions remain on the scope of the exemption, but build-to-rent momentum is expected to increase near-term.

Trump Policy Spurs Build-to-Rent Surge

The WSJ reports that President Trump’s executive order targeting institutional investors’ purchases of single-family homes is creating tailwinds for the build-to-rent industry. The order, which restricts large investors from acquiring existing homes, notably exempts build-to-rent developers constructing single-family communities for the rental market.

This carve-out gives build-to-rent developers a clear advantage in a still-tight housing market and positions the sector for rapid expansion.

Why It Matters

Build-to-rent investments offer institutional owners a scalable model to deliver rental housing without competing directly with homebuyers for existing inventory. With demand for rentals in suburban markets rising alongside home prices, BTR neighborhoods provide cost efficiencies for operators and flexibility for renters priced out of ownership.

Wall Street investors have been gradually increasing their exposure to the build-to-rent segment—a trend accelerated by recent regulatory developments.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Shift in Market Dynamics

Since 2012, developers have built over 321,000 build-to-rent homes in the US, says John Burns Research. Nearly 75% of those homes went up in just the last five years. Institutional landlords have shifted from buying scattered single-family homes to building rental communities. These projects often involve major homebuilders like D.R. Horton and Lennar.

Executives at Pretium Partners and Quinn Residences say the model benefits investors and local communities. It helps ease political scrutiny while adding much-needed rental supply.

Open Questions and Next Steps

Trump’s order includes “narrowly tailored exceptions” for build-to-rent projects, but some rules remain unclear. Industry leaders still don’t know how the policy affects land sellers and homebuilders. Congress may act on the issue, so developers are moving forward cautiously. Still, the exemption boosts confidence in the sector’s near-term outlook. At the same time, large-scale rental communities continue to draw attention from policymakers and local governments concerned about market concentration and housing access.

Developers and investors expect further growth as single-family rental demand stays high and regulations become clearer.