- Brookfield’s $885M leveraged loan, led by Wells Fargo, has been put on hold due to ongoing market instability.

- Efforts to sweeten the deal with higher spreads and deeper discounts failed to generate sufficient investor demand.

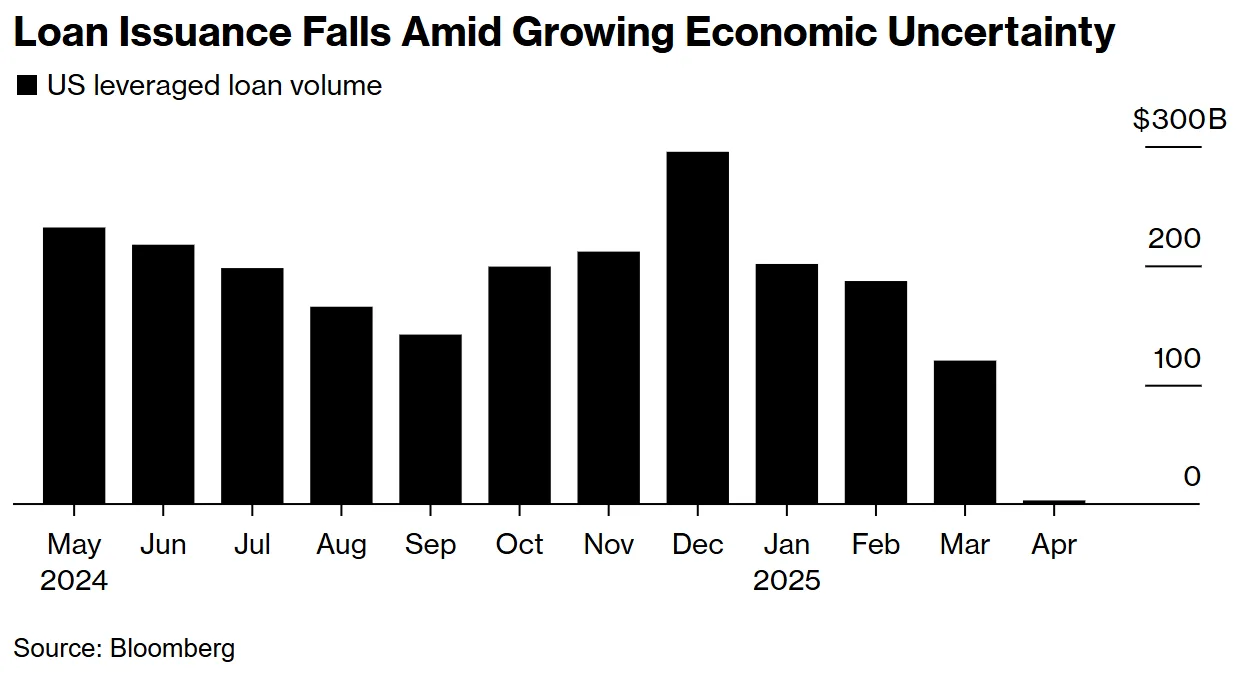

- The delay reflects broader volatility in credit markets, which have seen multiple deals paused following tariff-related market jitters.

A Tumultuous Time for Debt Markets

According to Bloomberg, Brookfield Properties Retail is holding off on a planned $885M leveraged loan, originally intended to refinance its maturing debt. The deal, spearheaded by Wells Fargo, was launched in late March—just days before market turmoil stemming from tariff announcements upended investor appetite for riskier credit instruments.

Despite extending the deadline and increasing investor incentives, demand remained tepid.

A Deal Too Early

The bank had initially offered the loan at 2.75% to 3% over SOFR with a slight discount, but widened terms last week to 3.25%–3.5% and a discount of 98 to 98.5 cents on the dollar. Even with the improved terms, investors were still hesitant, and the revised commitment deadline of April 15 passed without a deal.

The marketing pause makes Brookfield’s loan the eighth deal halted this year, highlighting how fragile investor sentiment remains in the current environment.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Brookfield’s delay isn’t an isolated case. Leveraged loan activity has slowed dramatically across the market, with new launches nearly frozen and several large deals, like ABC Technologies’ $2.2B transaction, stuck on bank balance sheets.

It’s a clear signal that lenders and borrowers alike are in wait-and-see mode, hoping for stabilization before resuming deal activity.

What’s Next

Sources close to the situation expect Wells Fargo to return to market with the Brookfield loan once volatility subsides. With only two other buyout-related deals still active in the US leveraged loan market, Brookfield’s postponement underscores how cautious market participants remain heading deeper into Q2.

For now, the market will be watching for signs of recovery—and recalibrated risk appetite—before significant debt issuance resumes.