- Sales of smaller properties totaled $45.24B in the first half of 2025, a 3.5% year-over-year increase, despite overall market volume still down 27% from the 2022 peak.

- CBRE led the broker rankings, with $5.76B in transaction volume. That marks a 33% annual increase and extends its lead since 2019.

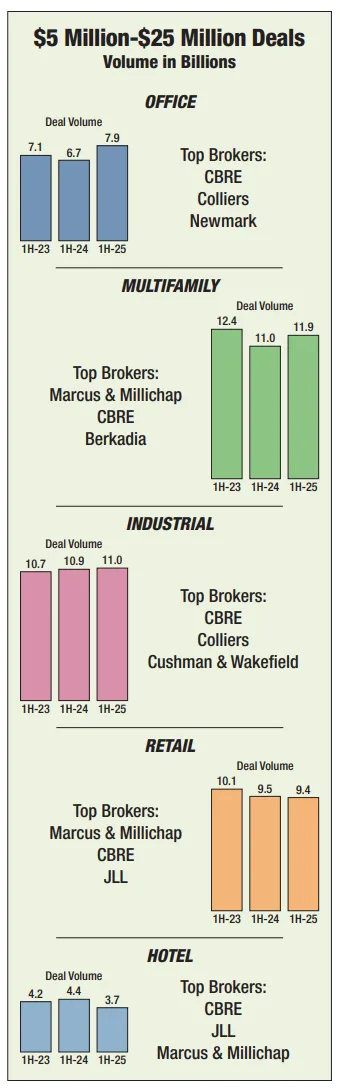

- Multifamily and office sectors drove the growth, with office volume up 18% year-over-year and multifamily maintaining the top spot with $11.94B in sales.

Debt Recovery Sparks Brokered Deal Growth

The sub-$25M commercial real estate market saw modest gains in the first half of 2025. About $45.24B in assets changed hands, up 3.5% from the same period last year, according to Green Street’s Sales Comps Database.

The jump came as brokered deal volume surged 21%, helping to offset a 16% drop in unbrokered transactions. Brokers say improving debt pricing and stronger liquidity are driving more assets to market. Lending from regional banks and CMBS issuers is also making a comeback.

“People are more comfortable bringing assets to market now,” said Brett Siegel, vice chair at Newmark. “Financing is available again, even for deals that struggled last year.”

CBRE Leads, Again

CBRE once again topped Green Street’s broker rankings. The firm posted $5.76B in transaction volume, pushing its market share to 20.8%.

Marcus & Millichap ranked second with $3.85B, followed by JLL ($2.99B), Cushman & Wakefield ($2.89B), Colliers ($2.58B), and Newmark ($2.06B).

CBRE has led the $5M–$25M segment every year since 2019, when the rankings began.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Sector Watch: Office Rebounds, Multifamily Holds Strong

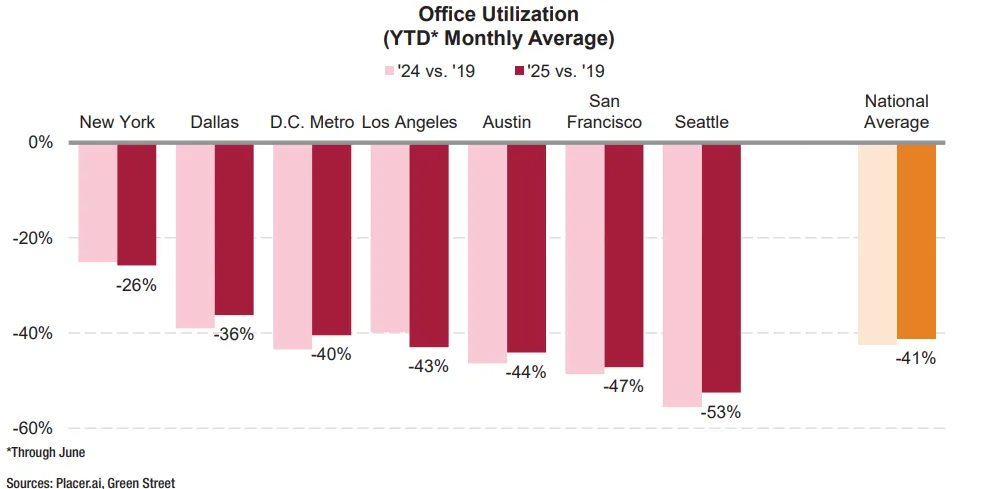

- Office: Sales volume jumped 18% year-over-year to $7.89B. That marks the largest percentage gain across all property types. Market activity was driven by improved financing and a flight to quality in cities like New York, Boston, and D.C.

- Multifamily: Still the largest category, smaller multifamily deals totaled $11.94B, up 9%. Senior living posted the strongest growth, rising 16%, while student housing gained 6%.

- Industrial: Volume was nearly flat at $10.99B. However, brokered deals were up 20%, showing increased reliance on marketed transactions.

- Retail: Volume declined slightly to $9.41B. Strip centers remained strong, but net-lease and mall deals saw weaker demand.

- Hotel: The weakest segment. Volume fell 17% to $3.68B. Still, Q2 brought some relief, with a 23% increase over Q1.

Institutions Move Down-Market

Institutional investors are showing more interest in the smaller-deals space. Traditionally dominated by private buyers, the $5M–$25M range is attracting large firms looking for higher returns and less competition.

“Institutions are starting to cross over,” said David Amsterdam, president of US capital markets at Colliers. “They can move fast and often buy in cash, which helps in a tight debt environment.”

Policy Tailwinds and Rate Uncertainty

The Trump Administration’s tax-and-spending bill, passed in July, brought new momentum to the market. It reinstated 100% bonus depreciation and preserved 1031 exchanges. These changes are expected to improve investor returns, especially for midmarket buyers.

Still, interest rate uncertainty remains a concern. The market is closely watching the Fed’s September meeting. A rate cut could speed up deal volume. But rising Treasury issuance could push rates higher, even if the Fed lowers its benchmark.

“We’ve seen a stop-and-start rhythm all year,” said Marc Schillinger, co-head of JLL’s private-capital group. “When rates dip, deals move. When they rise, everything pauses.”

What’s Next

Brokers believe the smaller-deals segment is entering a new cycle. Liquidity is improving, and deal flow is building. Many expect stronger momentum through year-end.

“There’s more investor appetite now,” said CBRE COO Kevin Aussef. “We’re off to a strong second half.”