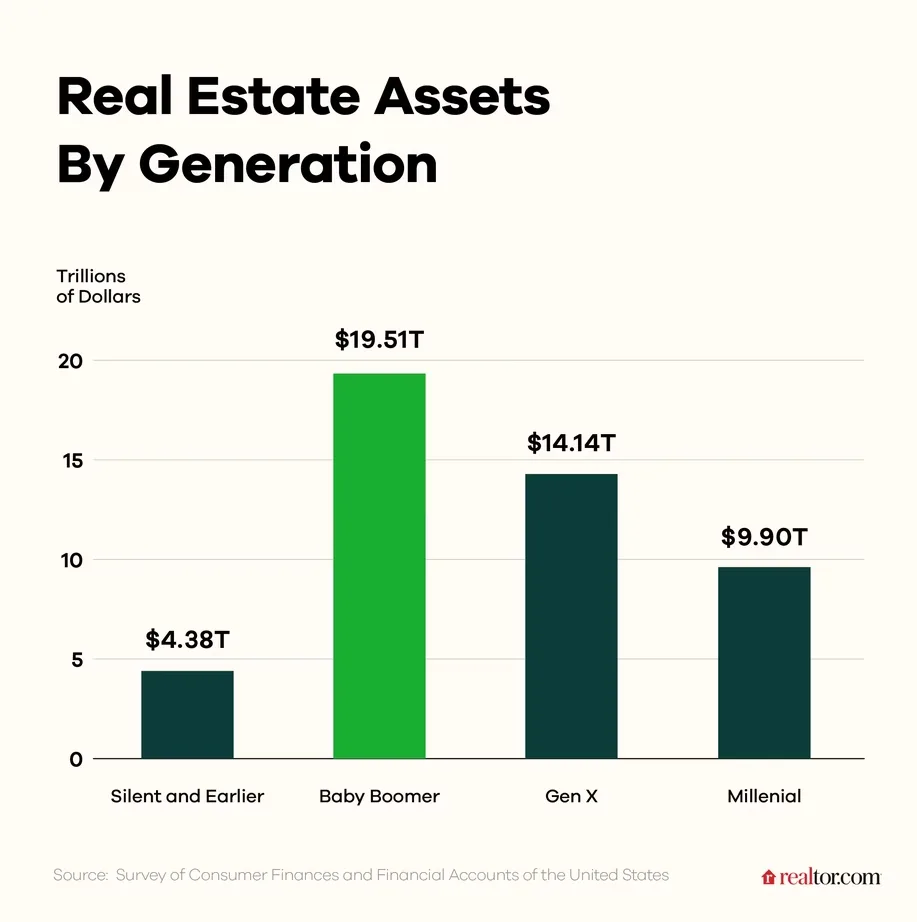

- Baby boomers own an estimated $18–$19 trillion in housing wealth—about half of the US total.

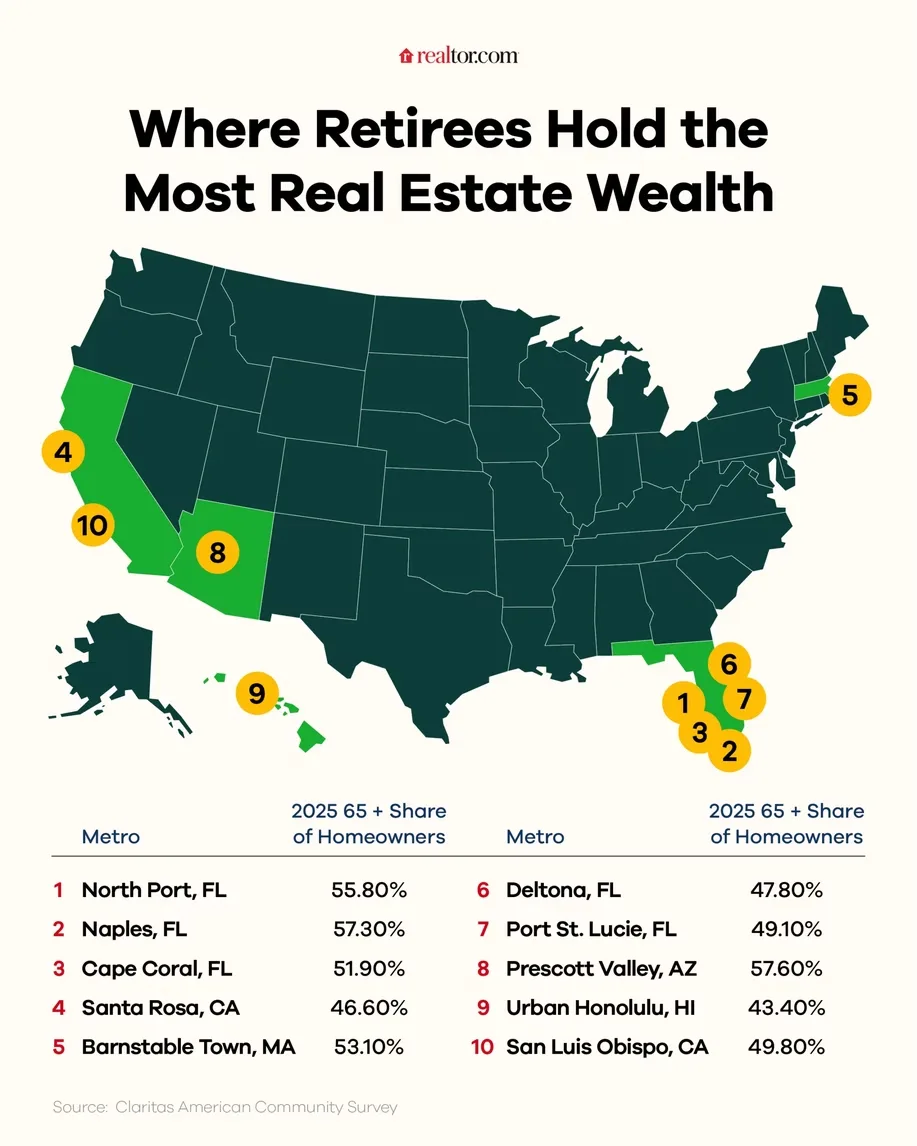

- Florida dominates the list of top retiree housing markets, claiming 5 out of the 10 leading metros.

- North Port-Bradenton and Naples-Marco Island are the top two markets, with boomers owning $97B and $70B in real estate.

- High-value retiree hubs also include Sonoma County, Cape Cod, and parts of Arizona.

Florida Leads in Boomer-Owned Wealth

As reported by Realtor, baby boomers have long favored Florida. Now, their boomer wealth in real estate clearly reflects that trend.

- In North Port-Bradenton, boomers own $97B in real estate. More than half of all homeowners are 65 or older.

- Naples-Marco Island follows with $70B in equity. This upscale coastal area boasts a median home price of $749,000.

- Meanwhile, The Villages—a sprawling retirement community—has the nation’s highest share of 65+ homeowners at 78%. Homes there list for a more modest $369,900.

Clearly, Florida’s warm climate, tax benefits, and retiree-friendly amenities continue to attract aging homeowners.

Other High-Equity Boomer Markets

Beyond Florida, several other metro areas stand out for retiree-owned real estate wealth.

- In Santa Rosa-Petaluma, CA, retirees hold $54B in housing value. The region’s appeal includes wine country, small-town charm, and proximity to San Francisco.

- Barnstable Town, MA (Cape Cod) offers coastal charm and a slower pace of life. Boomers own $34B here, despite a high median price near $900,000.

- Prescott-Prescott Valley, AZ rounds out the list. It attracts retirees with a dry climate, low hurricane risk, and affordable insurance. Homeowners 65+ control $27B in property wealth.

These regions show that retirees are drawn to lifestyle markets, not just affordability.

The Bigger Picture: Generational Wealth Gap

Nationwide, total owner-occupied housing is valued at $47.9 trillion. Boomers hold up to $19 trillion of that wealth.

Home equity alone reached $34.5 trillion in early 2025. This means boomers control the largest share of housing equity by far.

However, they’re not eager to give it up. According to a recent Charles Schwab survey, nearly half say they plan to enjoy their money rather than pass it on.

Furthermore, UBS predicts that most boomer wealth—including homes and cash—will transfer within the next 20 to 25 years. But that transition is moving slowly.

What’s Next

Roughly 12,000 Americans turn 65 every day. This trend will continue through at least 2027.

While that signals the peak of the so-called “silver tsunami,” boomers are in no rush to sell. Many want to age in place or maintain second homes.

As a result, the shift in homeownership and equity to younger generations may take longer than expected.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes