- The yield on the 10-year US Treasury rose seven basis points Friday, marking a significant shift that raises borrowing costs for commercial real estate and puts pressure on transaction pricing.

- Despite macroeconomic volatility, US CRE deal volume hit $92.5B in Q1 2025, up 17% YoY, with multifamily, industrial, and hospitality sectors driving growth.

- Experts warn of growing stress tied to refinancing challenges, especially as $1.5T in CRE debt matures in 2025 under a higher-for-longer rate environment.

Fragile Optimism Meets Rising Rates

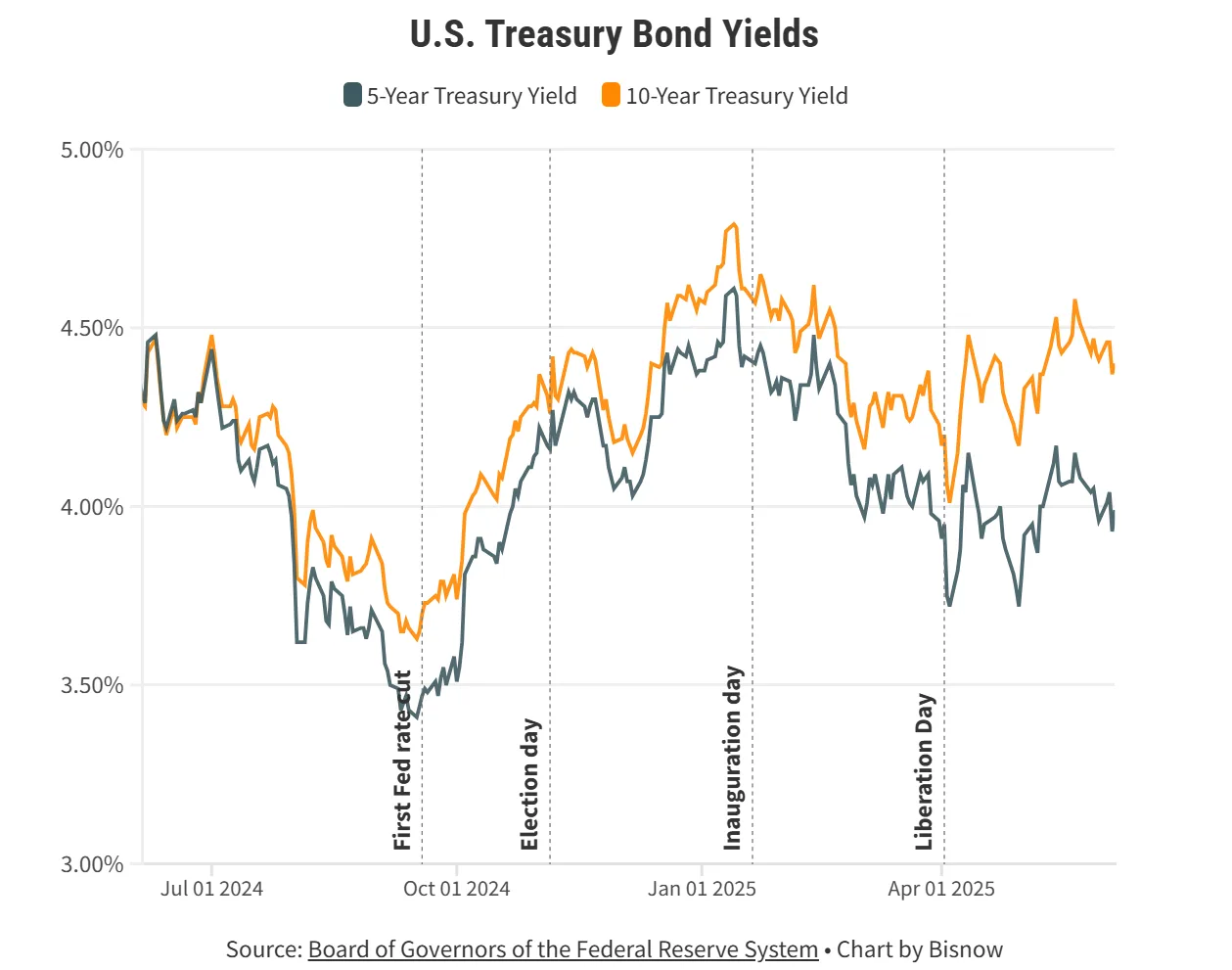

According to Bisnow, the commercial real estate (CRE) industry is feeling renewed strain after a sharp uptick in bond yields, particularly those on US Treasuries. The 10-year benchmark climbed to over 4.7% last Friday — more than a full point above its 12-month low — tightening capital availability just as some signs of market recovery had started to emerge.

The rate movement came on the heels of a softer-than-expected jobs report, but also amid broader uncertainty tied to US fiscal policy and global political tensions, including tariff debates and budget disputes in Washington.

‘Hope Is a Great Panacea’ — But Not a Strategy

Over the past three years, the CRE market has largely operated on delayed decision-making, driven by taglines like “extend and pretend” and “survive until 2025.” But as interest rates remain elevated and refinancing hurdles loom, investors are being forced to confront uncomfortable realities.

“If you’ve gone down that far, you just can’t earn your way out of it,” said Pat Jackson, CEO of Sabal Investment Holdings. “The bond market is basically taking away hope.”

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Transaction Volume Rises, but Unevenly

Despite the macro headwinds, Q1 2025 CRE transaction volume totaled $92.5B, according to Colliers, a 17% increase YoY.

- Multifamily led the charge, up 36% YoY by dollar volume.

- Hospitality and industrial sectors saw 27% and 24% increases, respectively.

- Office remained the laggard, with sales declining amid ongoing demand challenges.

New York stood out, posting a 38% increase in investment sales, per Avison Young.

A Narrow Path Forward

CBRE CFO Emma Giamartino noted on an April earnings call that “as long as rates on the capital market side don’t go above 5%, activity is going to continue.” But with traders bracing for a potential rise above that threshold, the outlook is increasingly cautious.

Investors and analysts agree that bond yields — and broader interest rates — are unlikely to fall meaningfully in the short term, complicating refinancing efforts for the estimated $1.5T in CRE loans maturing this year.

No Distress Flood—Yet

While distress is growing, a broad-based selloff hasn’t emerged. Many property owners are holding onto performing assets, unwilling to transact in an opaque market or absorb deep discounts.

“There’s no value increase from the low cap rate era that owners hoped for,” Jackson added. “That’s influenced guys like us to invest — but we’re being very selective.”

What’s Next

With fiscal uncertainty mounting, including a looming debt ceiling showdown and rising deficits, the bond market remains on edge. Moody’s Director of Economic Research Ermengarde Jabir warned that a deeper shock is likely “in sight,” even if it hasn’t materialized yet.

Capital is flowing selectively, but with caution. Whether that caution turns to retreat may depend on whether bond yields stabilize — or keep climbing.

Bottom Line

Higher interest rates are reshaping CRE investment decisions, forcing owners and investors alike to face the post-pandemic reality. The sector is still moving — but every basis point counts.