- Alexandria Real Estate Equities has signed the largest lease in its history with an unnamed pharmaceutical giant, believed to be Novartis, for a 466,598 SF San Diego facility.

- Biotech leasing volumes are rebounding in markets like San Diego, even as vacancy rates remain high in major hubs including Boston and the Bay Area.

- More than $270B in new drug manufacturing investments have been announced in the US so far this year, with Novartis, AstraZeneca, and other global firms driving the momentum.

- Smaller biotech firms are still cautious, but experts suggest that onshoring trends and potential interest rate cuts could accelerate a broader recovery.

A Major Milestone

After several quarters of market hesitation, Alexandria Real Estate Equities has made a significant announcement, reports CoStar. The nation’s largest biotech REIT revealed a record-setting lease at its Campus Point complex in San Diego. The company described the deal as a “seminal moment” in its history. While the tenant was unnamed, sources indicate it is Swiss pharmaceutical giant Novartis. The lease covers a planned, 466,598 SF build-to-suit research building, with construction expected to start in 2026.

This lease underscores a cautious but meaningful shift in sentiment as the sector begins to navigate out of its pandemic-era malaise.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Manufacturing Leads The Way

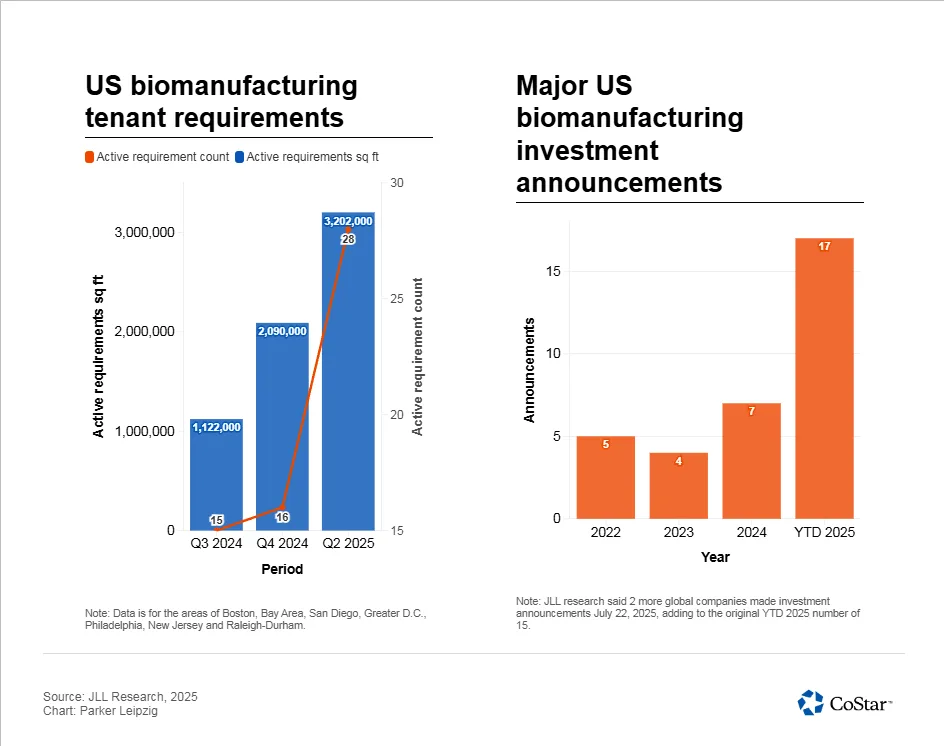

Alexandria’s deal with Novartis isn’t isolated. Drugmakers have collectively announced over $270B in US-based production and R&D facility investments this year through mid-May. Novartis alone plans to spend $23B through 2030 on American projects, including a $1.1B San Diego research hub and expanded manufacturing sites in five other states.

Joining the trend is AstraZeneca, which recently committed $50B in US investments by 2030, adding to the growing wave of onshoring meant to hedge against tariffs and supply chain risks.

Recovery In Sight, But Not Uniform

Despite headline-making leases and massive investment plans, the biotech real estate sector is still grappling with lingering vacancies. JLL reports Q1 2025 direct vacancy rates of 26.4% in Boston, 26.3% in the Bay Area, and 22.3% in San Diego — numbers that climb even higher when subleases are included.

The culprit? Overbuilding during the pandemic and a pullback from smaller, venture-backed biotech firms. Many of these companies continue to offload space, contributing to bloated supply in key regions.

Still, analysts are optimistic. “I personally think the worst of it is behind us,” said Greg Bisconti of JLL. He pointed to FDA reforms, onshoring incentives, and a $600B+ pipeline of announced projects as long-term tailwinds for the sector.

Why It Matters

After a difficult stretch marked by overcapacity and a funding drought, the US biotech real estate market is showing early signs of stabilization — at least among large players. Global pharmaceutical firms are shifting production to the US, positioning developers like Alexandria to benefit from a potential market rebound.

As Novartis and others commit to high-profile campus developments, their choices could influence peers to follow suit, driving occupancy and bringing life back to long-stagnant markets.

What’s Next

Industry watchers expect more major investment announcements in the months ahead, particularly if interest rates drop and trade policies continue to favor domestic production. While smaller biotech firms remain cautious, large-scale commitments from the sector’s giants may finally begin to turn the tide for biotech real estate.