- US healthcare and telecom REITs returned over 16% and 15% this year, leading the market.

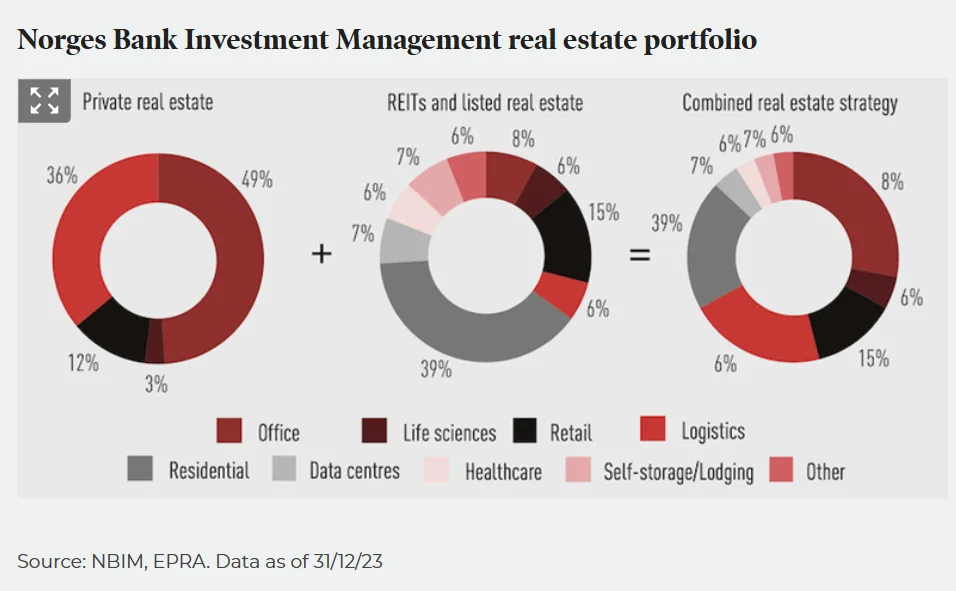

- Major investors like Norges Bank now split portfolios evenly between listed and private real estate.

- REITs offer exposure to high-growth areas like senior housing and data centers, often missing in private portfolios.

- Listed REITs provide daily trading flexibility, especially useful during market stress.

The Public-Private Gap Widens

As healthcare and telecommunications REITs surge in 2025, with returns of 16.1% and 15.9%, many institutional portfolios remain underexposed due to heavy reliance on private real estate, per IPE Real Assets.

This divergence has made the case for a blended investment model more compelling.

Nareit’s John Worth notes that REITs have matured into bona fide real estate vehicles. Once dismissed as stock proxies, they now manage vast, actively operated portfolios in sectors often inaccessible to private funds.

A Strategic Rebalancing

Norges Bank Investment Management, which oversees Norway’s sovereign wealth fund, has restructured its $58B real estate portfolio to split evenly between listed and private assets. Similarly, an Australian super fund shifted from domestic core sectors to international diversification through REITs, gaining exposure to multifamily, healthcare, and digital infrastructure.

Dutch pension managers have long led this approach, treating REITs as integral to real estate strategy, according to Worth.

Unlocking New Sectors and Scale

REITs provide immediate access to fast-growing and non-traditional sectors like data centers and senior housing. CenterSquare’s Uma Moriarity describes REITs as a tactical and scalable tool, especially useful in correcting underexposure to high-performing segments.

Her firm recently helped a $300B client address a residential property gap by creating a “completion portfolio” through listed REITs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Buffer Against Market Cycles

Listed REITs are also praised for liquidity and transparency. Rich Hill of Principal Asset Management argues that a 10–30% REIT allocation helps lower drawdown risk during market downturns, when private fund redemptions become challenging.

REITs, acting as leading indicators, often reprice faster than private assets. This responsiveness has created arbitrage opportunities, especially during periods of rising interest rates.

Outlook: The Integrated Future of Real Estate

With US REITs up 35% this year and European REITs not far behind, global investors are taking note. The consensus among leading strategists is clear: combining public and private real estate enhances portfolio flexibility, risk management, and exposure to future growth sectors.

“Ultimately, we see the integrated approach as the future of real estate portfolio construction,” Worth says. “Combining public and private real estate brings out the best in both.”