- Multifamily sector led CRE bid activity in October, driven by persistent housing shortages and a challenging for-sale housing market.

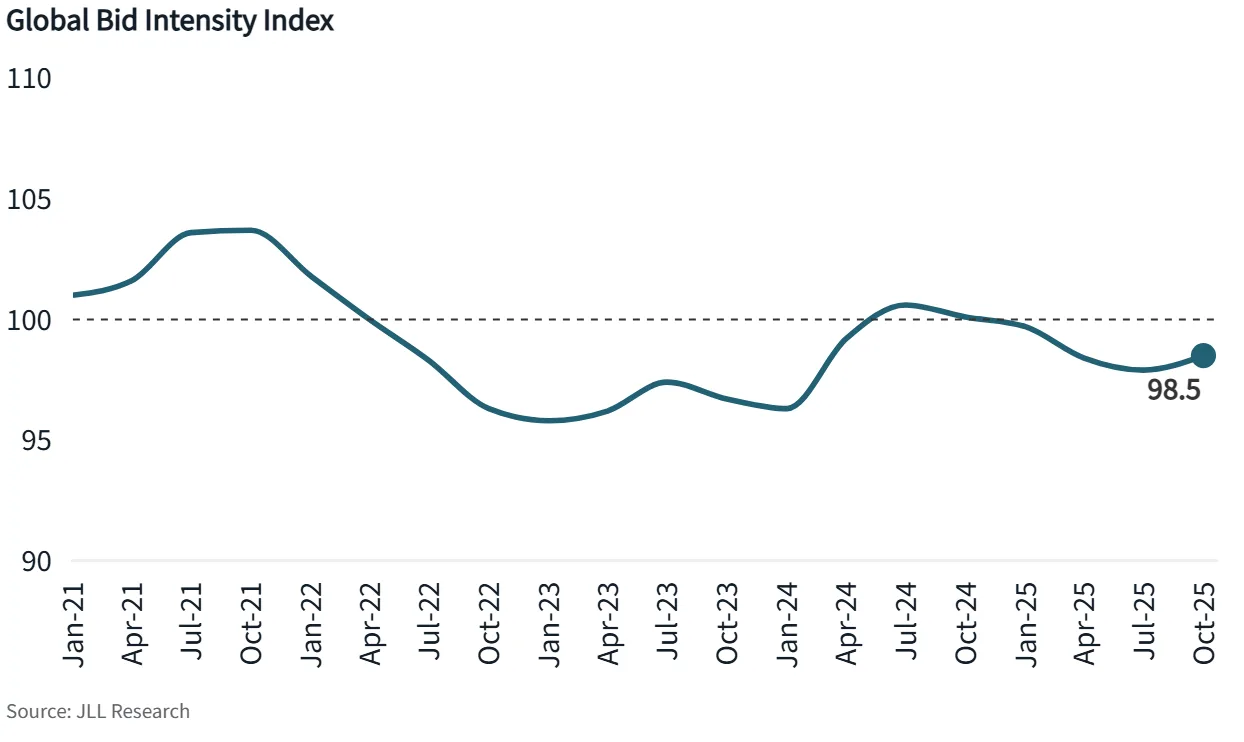

- JLL’s Global Bid Intensity Index recorded the second-highest monthly gain over the past year, signaling rising competitiveness across CRE.

- Industrial and logistics bidding rebounded, while office and retail sectors showed gradual improvements in investor sentiment and transaction dynamics.

- Investor confidence is being bolstered by interest rate cuts, easing trade policy concerns, and strong debt markets, paving the way for further capital deployment into 2026.

Bid Activity Strengthens

CNBC reports that commercial real estate bidding activity saw renewed momentum in October, continuing an upward trend that began in July after more than a year of stagnation. According to JLL’s Global Bid Intensity Index (BII), which tracks bidding competitiveness in real-time, October’s activity marked the second-highest monthly increase in the past 12 months.

The uptick in activity coincides with back-to-back interest rate cuts by the Federal Reserve in September and October, helping ease capital market friction. Investor appetite is also being fueled by stabilizing bond markets and greater clarity on US trade policy.

Multifamily: Still in the Lead

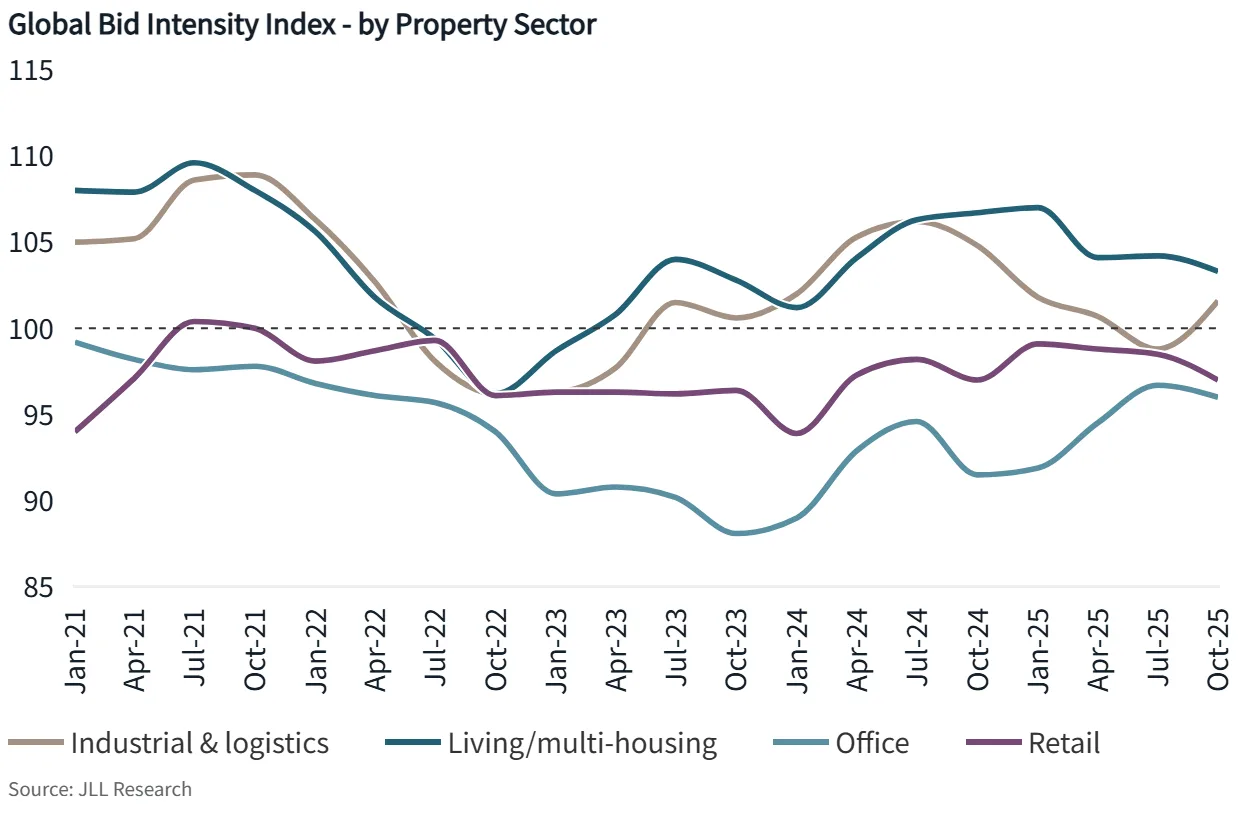

The multifamily housing sector remains the most competitive CRE asset class. Despite high rental vacancy rates, housing affordability challenges and an estimated 3.5M unit housing shortage are keeping renters in place longer—fueling investor confidence.

While rent growth has slowed, the underlying fundamentals continue to support aggressive bidding, especially as new supply works its way into the pipeline.

Industrial & Logistics: Rebounding

After a lull earlier in 2025, bidding activity for industrial and logistics assets showed a meaningful rebound in October. The improvement comes as uncertainty surrounding trade policy eased, making underwriting less risky and bringing sidelined capital back into play.

Retail & Office: Gradual Recovery

Retail saw a mixed performance as more assets came to market, giving buyers more options—a dynamic seen in recent high-profile sales involving institutional players. Liquidity deepened across more retail subtypes, supported by strong consumer spending, but bidding softened slightly due to an increased volume of listings, giving buyers more options.

The office market, once considered the sector with the most distressed outlook, is now showing signs of a slow recovery. BII data shows improved bidder dynamics and an expanding lender pool, especially compared to the all-time lows of late 2023.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Outlook: Risk-On Mode

JLL’s capital markets team noted a broader shift in sentiment as investors adopt a more “risk-on” stance heading into 2026. Richard Bloxam, CEO of Capital Markets at JLL, said institutional capital deployment accelerated in Q3, and expects continued liquidity improvement in the coming quarters.

“Having worked through various junctures of uncertainty over the past year, more investors are showing a higher tolerance for risk,” said Bloxam. “Coupled with exceptionally strong debt markets, we expect this will catalyze continued capital flow growth into 2026.”

JLL’s data suggests the future trajectory of the BII will be closely tied to macroeconomic expectations, policy shifts, and geopolitical developments. But for now, early signals indicate that CRE investors are re-entering the market with renewed conviction.

Why It Matters

October’s resurgence in CRE bid activity is a potential turning point after a prolonged slowdown. With multifamily and industrial leading the charge, and other sectors showing signs of life, investors appear to be recalibrating their strategies for a more active 2026.

What’s Next

Expect continued strength in living sectors, growing investor risk appetite, and deeper liquidity across CRE asset types as debt markets remain favorable and interest rates stabilize.