- Banks maintain healthy earnings through mid-2025, but rising delinquencies and tariff effects could challenge growth in the second half.

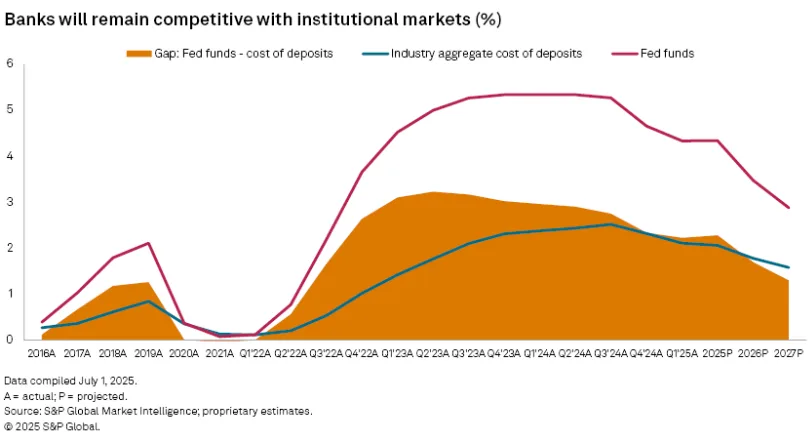

- Lower-cost deposits and strategic balance sheet adjustments help banks stay competitive amid rising market alternatives.

- Credit conditions remain stable, though higher charge-offs in consumer and CRE loans may modestly pressure earnings.

A Solid Start, but Clouds Ahead

According to S&P, banks began 2025 on strong footing. They benefited from margin expansion, steady loan growth, and manageable credit conditions. But economic challenges are building. Tariffs and slowing consumer activity are expected to push delinquencies higher. These modest headwinds could fuel more M&A activity as banks look for new ways to grow and support future bank earnings.

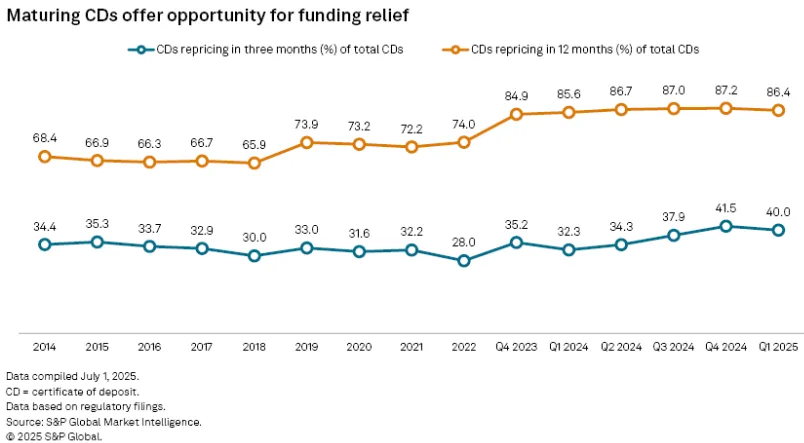

CDs Mature, Costs Fall

Banks are finding relief by shedding higher-cost CDs. By Q1 2025, over 86% of CDs were set to mature within 12 months. Nearly 6% were maturing within three months. This gave banks the chance to reprice liabilities at lower costs. The gap between the average Fed funds rate and deposit costs narrowed to its smallest margin since Q3 2022. That margin may widen slightly later in the year as banks aim to cut costs while staying competitive with Treasury and money market yields.

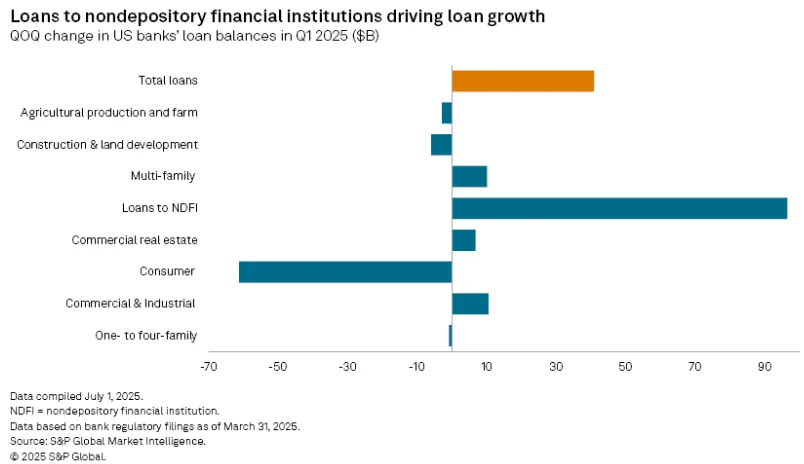

Private Credit Drives Loan Growth

Loan growth in early 2025 was strongest among nondepository financial institutions. These include private credit firms that compete directly with banks. The Fed’s “other loan” category showed the highest growth compared to commercial, consumer, and CRE loans.

Credit Quality Stabilizing—for Now

Banks built up reserves throughout 2023 and 2024 in anticipation of credit normalization. Reserve levels held steady at 1.75% of loans through Q1 2025. Charge-offs are expected to rise in the second half, but losses should remain manageable. Most banks are prepared to absorb them without significant earnings disruption.

What’s Next

Bank fundamentals are sound, but the outlook is mixed. Higher funding competition, a weakening consumer, and rising delinquencies could weigh on earnings. These pressures may lead more institutions to explore mergers or acquisitions as a way to scale and adapt.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes