- US banks are set to benefit from declining funding costs and higher-yielding assets, supporting wider net interest margins in 2025.

- However, newly imposed tariffs are expected to weaken business sentiment, suppress investment, and elevate credit costs, creating uncertainty for the sector.

- Maturing CDs are poised to lower deposit costs, but shifts away from non-interest-bearing deposits may dilute funding advantages.

- Consumer savings buffers have run dry, leading to rising delinquencies and potential increases in loan loss reserves.

Strong Start, But Clouds Form

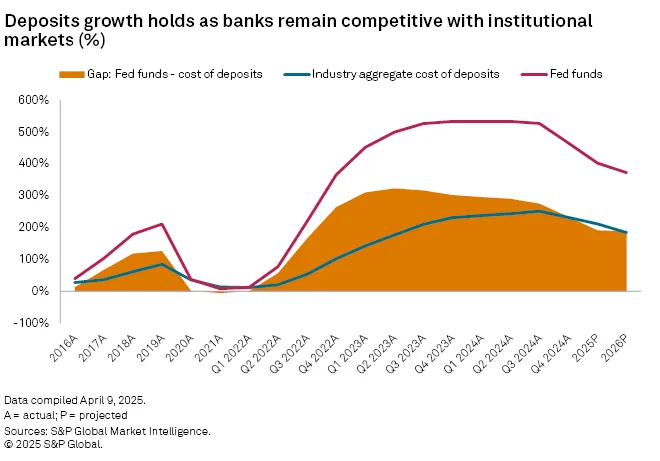

As reported by S&P Global, after a solid earnings rebound in 2024, US banks entered 2025 with favorable fundamentals. Lower funding costs and the replacement of lower-yielding pandemic-era assets with higher-rate loans and securities set the stage for stronger net interest margins. But the Trump administration’s aggressive trade policies, including a broad slate of tariffs, have emerged as a significant drag on the economic outlook.

While margins are still expected to expand this year, businesses are showing signs of caution amid the new trade environment. Reduced investment activity, coupled with softening consumer sentiment, threatens to undercut banks’ earnings momentum.

Deposit Cost Relief on the Horizon

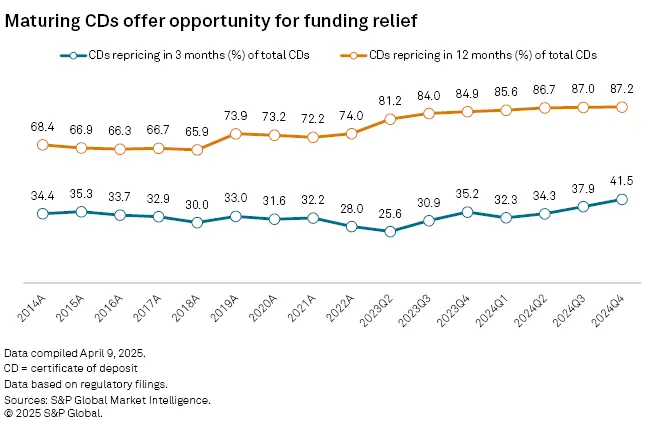

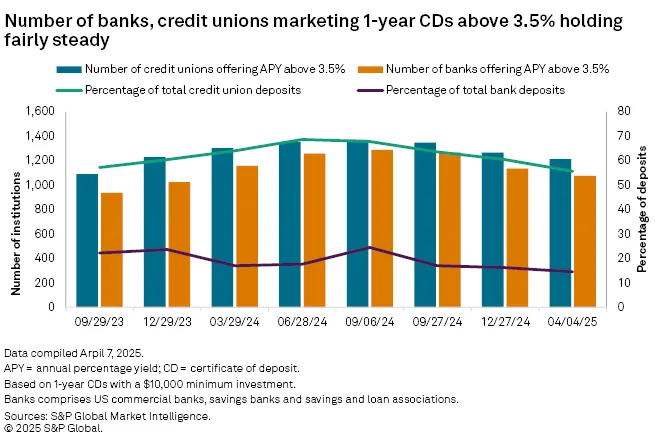

A key bright spot is the expected decline in deposit costs. The bulk of certificates of deposit (CDs) originated during the Fed’s rate-hiking cycle are set to mature in 2025. As of Q4 2024, 87.2% of all CDs were scheduled to mature within 12 months, positioning banks for relief as these higher-cost liabilities roll off the books.

Despite this tailwind, the shift away from non-interest-bearing deposits — the most cost-effective funding source — is a concern. Still, slower loan growth should help banks manage funding needs and support incremental reductions in deposit pricing.

Consumer Credit Risks Resurface

The consumer side of the balance sheet also poses challenges. Pandemic-era savings that once buffered households from rising rates were largely depleted by late summer 2024. As a result, consumer delinquencies have continued to rise, marking a return to pre-pandemic norms.

With the economic outlook clouded by tariffs and potential slowdowns, banks may need to grow their loan loss reserves, placing further pressure on profits.

What’s Next

Despite emerging risks, the banking sector still has several tailwinds. The improved margin environment and recent valuation strength give institutions flexibility to pursue growth through restructuring and M&A. A potentially lighter regulatory stance under the new presidential administration could further fuel deal activity.

Still, the path forward will depend heavily on how tariffs shape business confidence and consumer behavior. While 2025 started on solid footing, the year ahead will test banks’ ability to manage both opportunity and risk.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes