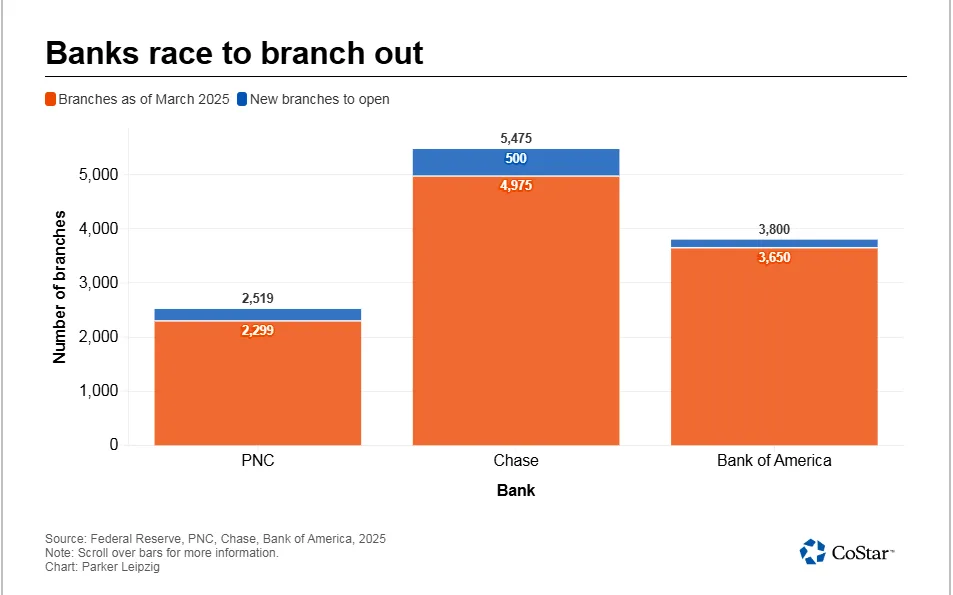

- PNC, Chase, and Bank of America plan to open a combined 870 new branches by 2030, targeting fast-growing US metro areas to compete for consumer deposits.

- Physical branches remain a key tool for attracting federally insured deposits, which are a low-cost source of funds for banks to make loans.

- Banks are optimizing their footprints—opening in growth markets while closing underperforming locations, signaling a strategic real estate shift rather than widespread expansion.

- Despite mobile banking growth, consumers still value face-to-face service, and new branches are being designed with customer convenience and drive-thru access in mind.

Why Banks Are Betting On Brick-And-Mortar

In an increasingly digital world, major US banks are still investing heavily in opening new physical branches, reports CoStar. JPMorgan Chase, Bank of America, and PNC Financial Services collectively plan to launch nearly 900 new branches by the end of the decade. The move is driven by a simple goal: gathering deposits.

Federal deposit insurance makes customer deposits one of the most cost-effective ways for banks to fund lending. And despite the rise of digital tools, physical branches are still one of the best ways to attract and retain depositors, particularly in high-traffic areas.

“They’re really making sure they are where the people and the traffic are,” said Nichole Popovics of TSCG, a retail leasing brokerage.

Where Growth Is Happening

PNC alone plans to spend $1.5B building up to 220 new branches. The bank is focusing on 12 high-growth Sun Belt cities, including Dallas, Miami, Orlando, Charlotte, and Phoenix.

As PNC CEO Bill Demchak noted: “There’s a race on for retail deposits. That’s why we have this big focus on the investment in building branches.”

Fifth Third Bank is following suit, especially in the Southeast. New branches built since 2022 are generating over $25M in deposit balances within the first year—far exceeding initial projections.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Consumers Still Crave In-Person Banking

While banks continue closing branches in stagnant or declining markets, many still find in-person service valuable. PNC’s Jeff Martinez said that customer service and human interaction are differentiators in the digital age: “When I walk into a PNC branch, I get the door opened, I get a handshake, I meet the manager.”

Others, like TSCG’s Popovics, agree that visiting a branch offers a more personal banking experience that even tech-savvy users appreciate.

Real Estate Plays A Role

Landlords and developers also welcome bank tenants.Banks offer strong creditworthiness. This makes them attractive tenants for shopping centers and mixed-use developments, said Mark Reeder of SRS Real Estate Partners.

Branches like First State Bank’s new 11,700 SF facility in Sherman, Texas, feature four drive-thru lanes and freeway access. The location illustrates how site selection is tied to vehicle access, traffic visibility, and community presence.

Not Every Bank Is Expanding

Some institutions are sitting out this expansion trend. Buffalo-based M&T Bank has no plans to add locations, citing a focus on simplicity and profitability without increasing its physical footprint.

The Bottom Line

While not all banks are building, many see branch banking as a competitive advantage—especially in markets with population and economic growth. Even as apps and digital platforms dominate, brick-and-mortar branches remain relevant, serving as both deposit engines and relationship hubs.