- Metro Atlanta experienced a net loss of US residents for the first time in at least 30 years, according to new census data.rn

- High housing costs, traffic congestion, and stagnant homebuilding are driving people to smaller Southern metros like Chattanooga, Greenville, and Huntsville.rn

- The decline in domestic migration poses risks to Atlanta’s economy, with rising vacancy rates and stalled major developments like Microsoft’s Westside campus.rn

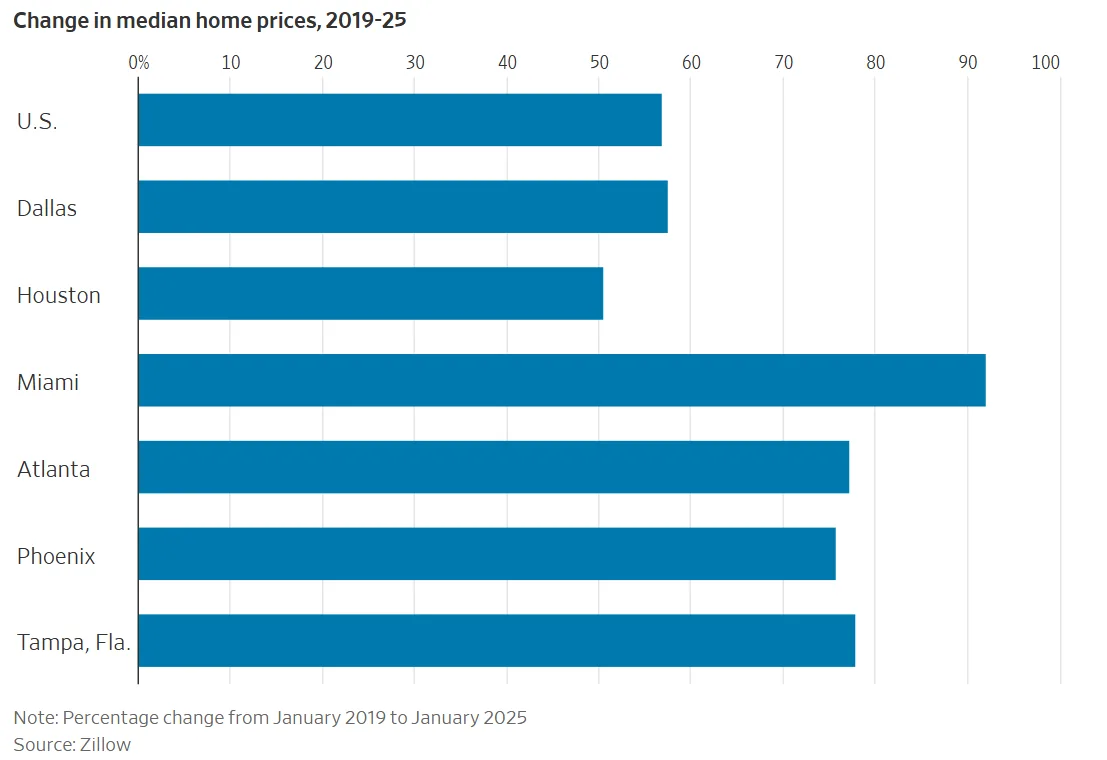

- Atlanta’s slowdown reflects a broader post-pandemic cooling across big Sunbelt cities, including Phoenix and Tampa, with smaller metros picking up the slack.rnrnrn

A Sunbelt Powerhouse Slows Down

For the first time in modern memory, Atlanta is losing more Americans than it’s gaining, per the WSJ. From mid-2023 to mid-2024, the metro saw a net domestic outflow of around 1,330 people—marking an end to decades of steady population growth fueled by affordable living, job prospects, and southern hospitality.

Atlanta’s overall population is still growing—thanks to international migration and a natural birthrate higher than deaths—but the domestic migration drop is a red flag for a city long seen as a rising economic hub.

What’s Driving the Decline?

The reasons are both structural and personal. Surging home prices, limited single-family housing supply, and infamous traffic snarls are making metro Atlanta less appealing. Between 2020 and 2023, housing stock grew by just 0.6% annually—well below previous decades.

That imbalance has driven up costs. Zillow reports home values in the Atlanta area tripled since 2012 to around $390,000, now higher than the national average.

For residents like Adelia Fish and her husband DeJuan McBurnie, the solution was to leave. They bought a new home in Chattanooga, Tennessee, for $320,000—less than they would have paid in rent back in Atlanta.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Broader Sunbelt Slowdown

Atlanta’s reversal is part of a larger cooling trend among Sunbelt metros. Once pandemic-era darlings, cities like Phoenix, Tampa, and Orlando are also seeing slower migration and smaller net gains.

Bank of America data for early 2025 showed seven of the eight largest Sunbelt metros—Atlanta included—lost more residents domestically than they gained.

Meanwhile, smaller metros such as Knoxville, Wilmington, and Greenville are seeing growth surge past pre-Covid trends, attracting young professionals and families priced out of big-city life.

Economic Implications

Atlanta’s waning appeal may make it harder for companies to attract talent, especially as 25% of the region’s office space sits vacant—well above the national average of 20.8%. Microsoft’s indefinite pause on a massive 90-acre Westside campus exemplifies the uncertainty.

In housing, the boom in high-end apartments has backfired, with vacancies rising to 12.2% metro-wide—up from 7.5% a decade ago—while affordable options remain scarce for middle-class families.

What’s Next?

Whether Atlanta rebounds or continues its slide will depend on its ability to tackle affordability, infrastructure, and urban planning challenges. While the city’s regional clout remains strong, the migration momentum has clearly shifted.

For now, smaller Southern metros—with lower costs and growing cultural scenes—are benefiting from Atlanta’s cooling. The Sunbelt may still shine, but its glow is moving toward cities once considered second-tier.

Why It Matters

Atlanta’s shift marks a turning point for post-pandemic migration in the US Developers, employers, and policymakers in major metros may need to rethink their strategies as affordability and quality of life take priority for relocating Americans.