- Nearly $35.1B in apartment transactions closed in Q2 2025. That was 11% above Q1 but 14% lower than last year.

- The average price per unit stayed at $213,629, continuing a streak of more than three years above $200,000 per door.

- Five major single-asset sales topped $175M. Crescent Heights’ $239.6M purchase of Essex Skyline in Southern California led the list.

- Apartment cap rates averaged 5.41%, still the lowest among major property types and a draw for investors.

A Modest Rebound

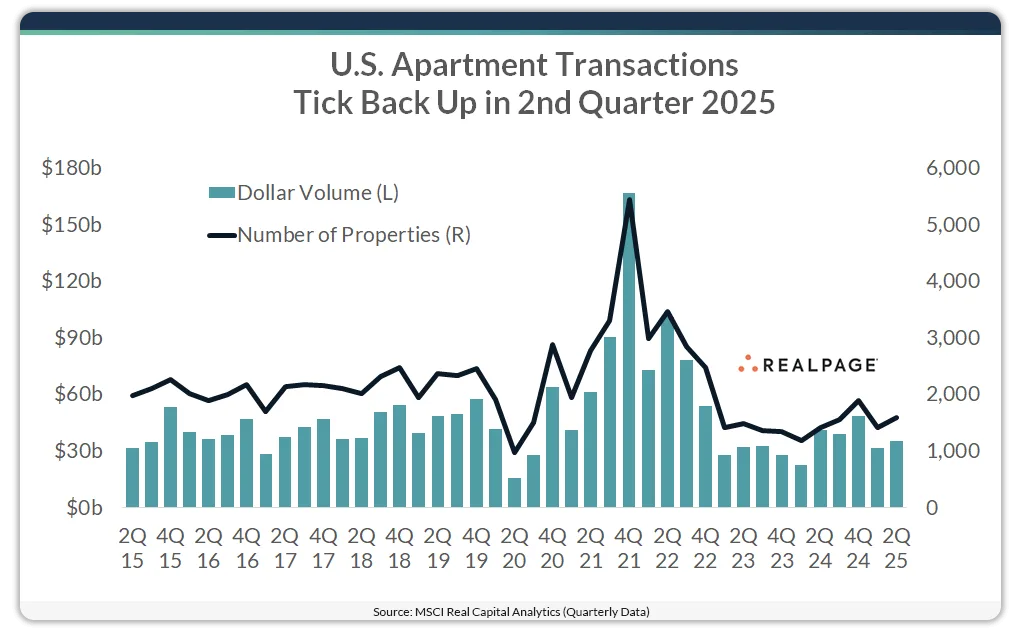

US apartment sales gained momentum in April through June 2025, according to MSCI Real Capital Analytics. Roughly 1,580 properties traded for $35.1B, compared to $31.5B in Q1. Activity, however, according to RealPage, was down year-over-year and far below the five-year average of $54.7B per quarter.

Pricing and Yields

Investors continue to pay high prices for apartments. The average per-unit price was $213,629 in Q2. For context, units averaged about $151,000 between 2015 and 2019.

Cap rates eased to 5.41%, the lowest since late 2023. While higher than the record low of 4.67% in 2022, apartments still offer the tightest yields of any major property type.

Bigger Picture

Over the past 12 months ending in Q2 2025, apartment sales reached $154.1B across 6,445 properties. That was a gain of more than 20% from the prior year. Still, activity remains shy of the 2019 peak of $195.1B and well below the 2021 surge of $359B.

Largest Deals of the Quarter

Five headline trades stood out in Q2 2025:

- Essex Skyline at MacArthur Place (Anaheim, CA) – Crescent Heights paid $239.6M ($686,500/unit) for 349 units. It was the largest national deal and the fourth-biggest in Orange County in 25 years.

- Folia (San Diego, CA) – Holland Partners sold the 342-unit project for $238M ($695,900/unit). It was San Diego’s sixth-largest trade in 25 years.

- Bella Vista at Hilltop (San Pablo, CA) – Kennedy Wilson sold the 1,008-unit community for $225M ($223,000/unit). It was the third-largest national deal of the quarter.

- WestEnd25 (Washington, DC) – JRK Property Holdings bought the 283-unit high-rise for $186M ($657,000/unit). It ranked as Q2’s fourth-largest trade.

- Hill Estates (Boston, MA) – The Hamilton Company acquired the 396-unit property for $175M ($448,000/unit). It was among the top 25 Boston sales in 25 years.

Why It Matters

Apartments remain the preferred property type for many investors. Strong demand, solid pricing, and relatively low yields continue to attract capital. Still, volumes have yet to return to pre-pandemic highs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes