- Apartment searches increased 21% nationally from February to March 2025, reflecting post-Valentine’s relationship changes.

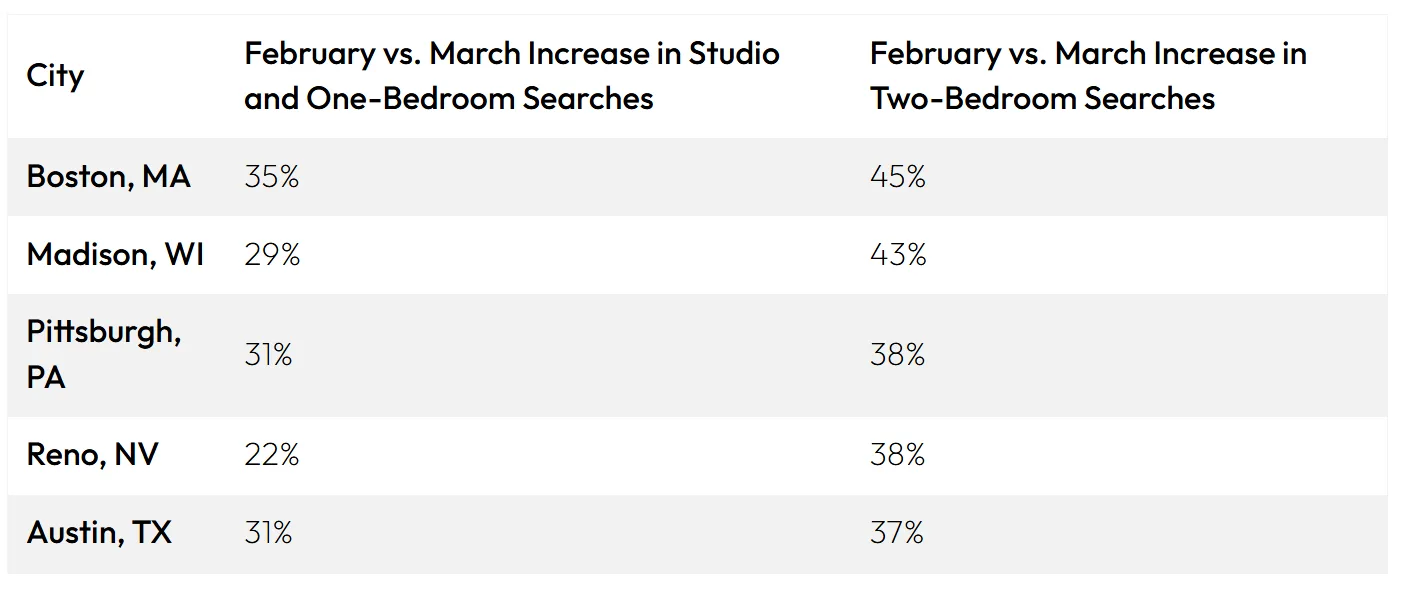

- Boston, Madison, and Austin saw the largest jumps in two-bedroom searches, indicating more couples moving in together.

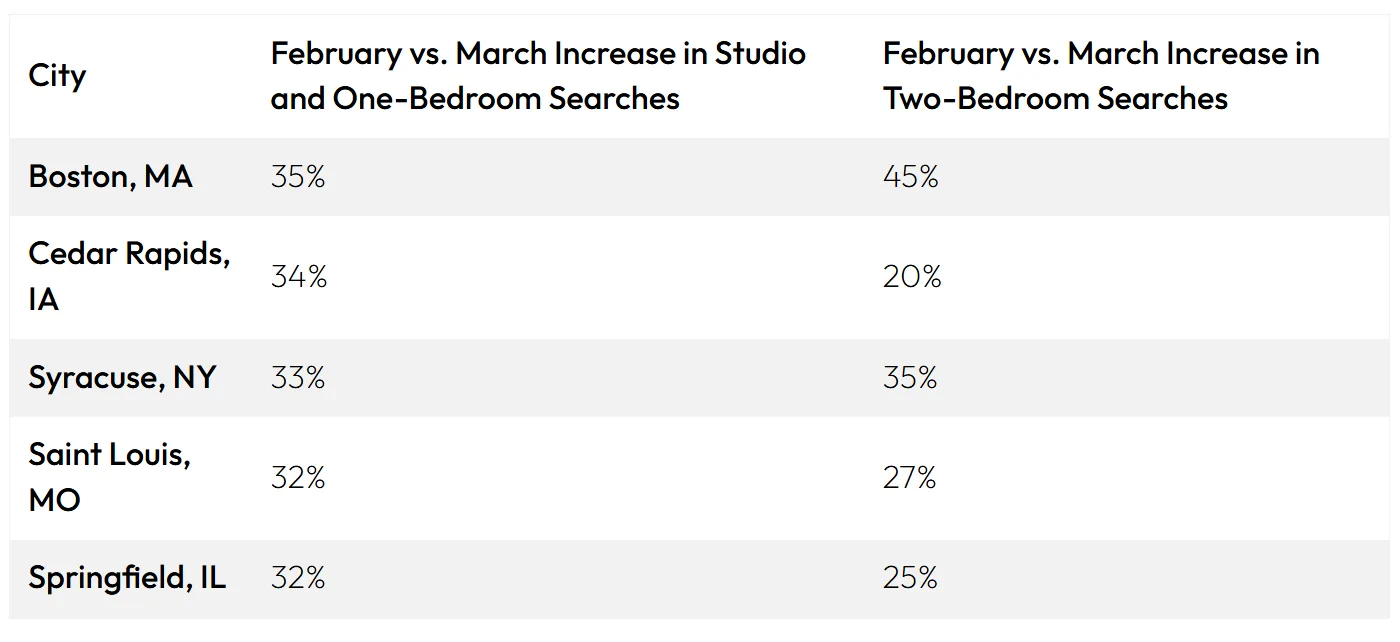

- Cedar Rapids, Syracuse, and Springfield experienced sharp rises in studio and one-bedroom searches, pointing to more breakups.

- Affordability, market flexibility, and culture all shape whether a city sees more move-ins or move-outs after Valentine’s Day.

Post-Valentine’s Apartment Trends

After Valentine’s Day, apartment search data show a clear uptick in housing transitions driven by relationship changes. Apartments.com found that nationally, both studio/one-bedroom and two-bedroom searches climbed by 21% from February to March 2025. The overall trend splits cities into two camps: those where couples are consolidating households, and those where newly single renters are seeking fresh starts.

Move-Ins: Cities Where Couples Cohabitate

In cities like Boston, Madison, Pittsburgh, Reno, and Austin, searches for two-bedroom apartments surged following Valentine’s Day. This signals more couples choosing to live together, motivated by both emotional and financial reasons. Notably, Boston saw a 45% increase in two-bedroom searches, while Madison and Reno posted gains of 43% and 38%, respectively. In these high-rent or active lifestyle cities, moving in together often helps couples save money and access better locations or amenities.

Move-Outs: Cities Where Singles Start Fresh

Other cities—such as Cedar Rapids, Syracuse, Saint Louis, and Springfield—experienced the largest increases in studio and one-bedroom searches after the holiday. For instance, studio and one-bedroom searches in Cedar Rapids jumped 34%, while Springfield and Saint Louis both saw increases above 30%. Lower rents and easier mobility in these markets make it simpler for individuals to move on after a breakup.

Drivers: Affordability and Market Flexibility

Apartment searches are shaped by local rent levels and market competitiveness. In expensive markets, couples may feel greater pressure to move-in together to share costs, while rising rent burdens drive singles to downsize post-breakup. In cities with affordable rents and less competition for units, individuals can more easily secure new apartments after changing relationship status. High turnover markets like Boston also make sublets and lease takeovers practical choices when quick moves are necessary.

Why It Matters

Understanding apartment search trends by city provides insights for landlords, property managers, and investors on seasonal leasing surges and target renter profiles. As relationship-driven moves spike after Valentine’s Day, knowing which cities tend toward breakups or move-ins can help optimize marketing strategies and guide leasing policies. This shift in renter behavior also aligns with broader leasing trends, where flexibility and smaller-scale transactions are increasingly shaping multifamily strategies in 2025. The post-holiday apartment market offers a clear window into how life events directly impact residential demand and occupancy shifts.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes