- US apartment rents are projected to rise 2.3% in 2026 after a 0.7% decline through October 2025, signaling renewed momentum in the multifamily sector.

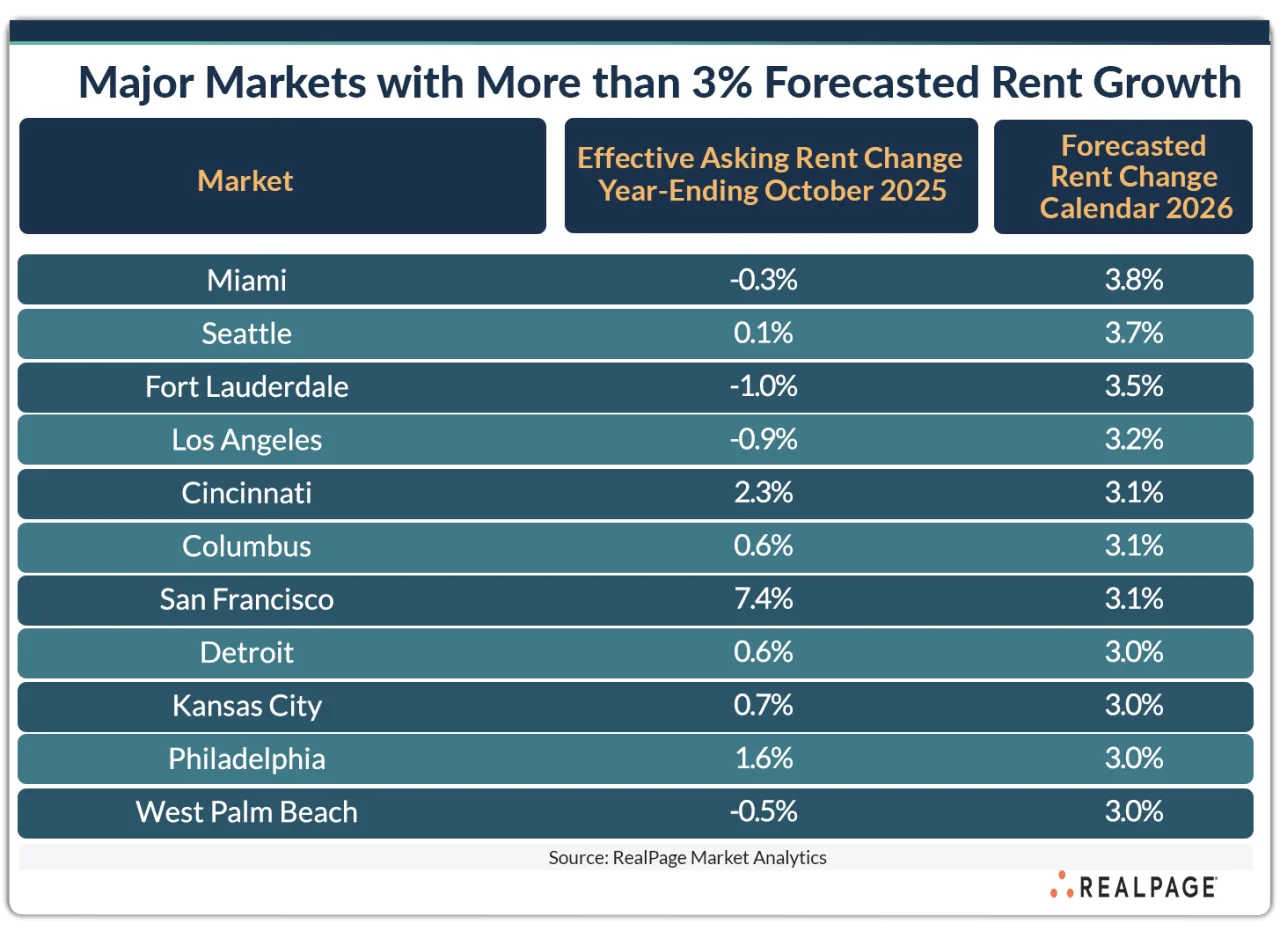

- Miami, Seattle, Fort Lauderdale, and Los Angeles are among the top metros expected to see rent increases of 3% or more next year.

- The Midwest and coastal regions also show strong recovery signs, with cities like Cincinnati, Columbus, and San Francisco forecasted to post healthy gains.

Rents Start To Recover

After a year marked by modest declines and stagnant growth, the apartment market appears to be turning a corner, reports GlobeSt. RealPage Market Analytics forecasts a 2.3% increase in average effective asking rents across the US in 2026—a notable shift from the 0.7% drop through October 2025. The shift reflects easing supply pressures and more stable demand fundamentals heading into the new year.

Leading Metros Bounce Back

Several high-demand cities are positioned for above-average growth. Miami is expected to rise 3.8% after a minor dip this year, while Seattle is projected to post a 3.7% increase following nearly flat performance. Fort Lauderdale and Los Angeles are also forecast to rebound strongly, with rent gains of 3.5% and 3.2%, respectively. These markets are benefiting from population growth, job recovery, and resilient renter demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Steady Gains In The Midwest And Coastal Hubs

Cincinnati and Columbus continue to show stable fundamentals, each forecast to climb 3.1% next year. San Francisco led the nation in 2025 with a 7.4% rent surge but will likely cool to 3.1% in 2026 as growth normalizes. Continued tech-sector stabilization and shifting remote work patterns are helping to revive urban rental demand in these metros.

More Cities Join The Upward Trend

Other metros slated for solid rent gains include Detroit, Kansas City, Philadelphia, and West Palm Beach, each forecast at 3%. These markets reflect both resilient demand and a potential slowdown in new supply, which could help support rent growth. A return to affordability and diversified economic bases may be driving their renewed strength in the rental sector.

Why It Matters

The projected rent rebound suggests that the multifamily market remains fundamentally strong, even amid recent volatility. As new supply starts to taper off and renter demand stabilizes, landlords may regain pricing power—particularly in high-growth and supply-constrained metros. For investors, this signals an opportunity to reenter or expand in markets showing early signs of sustained recovery.

Looking Ahead

If current projections hold, 2026 could mark the beginning of a more balanced rental market. Investors and developers may find renewed confidence in both urban and suburban apartment sectors, especially as rent growth aligns more closely with long-term trends. Moderating inflation and interest rate cuts could further boost leasing activity and investor appetite across asset classes.