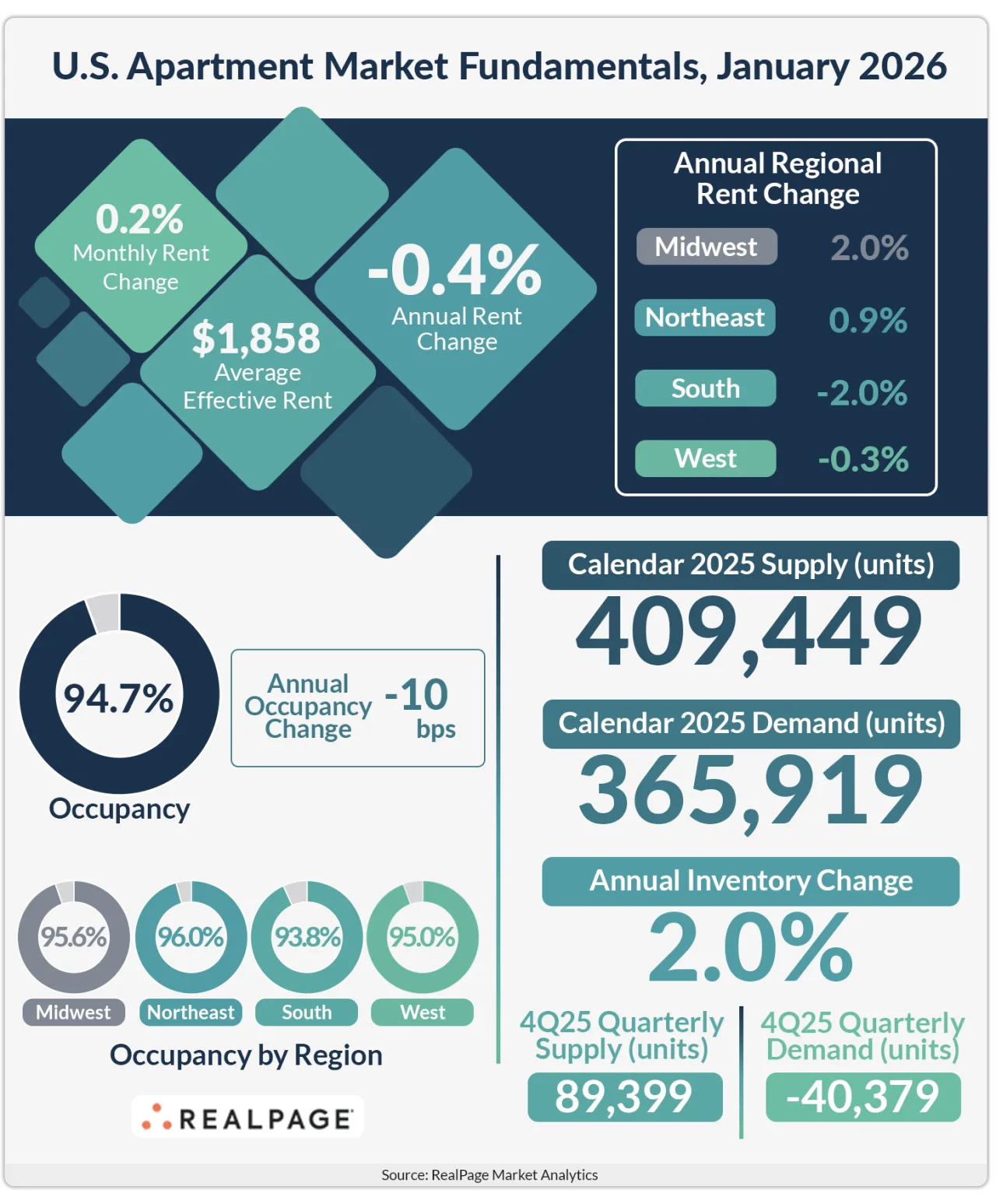

- US apartment occupancy rose 10 bps in January to 94.7% after six months of decline.

- Effective asking rents increased 0.2% over December, ending a seven-month slide.

- Rent cuts in the South and West persisted, but showed signs of easing.

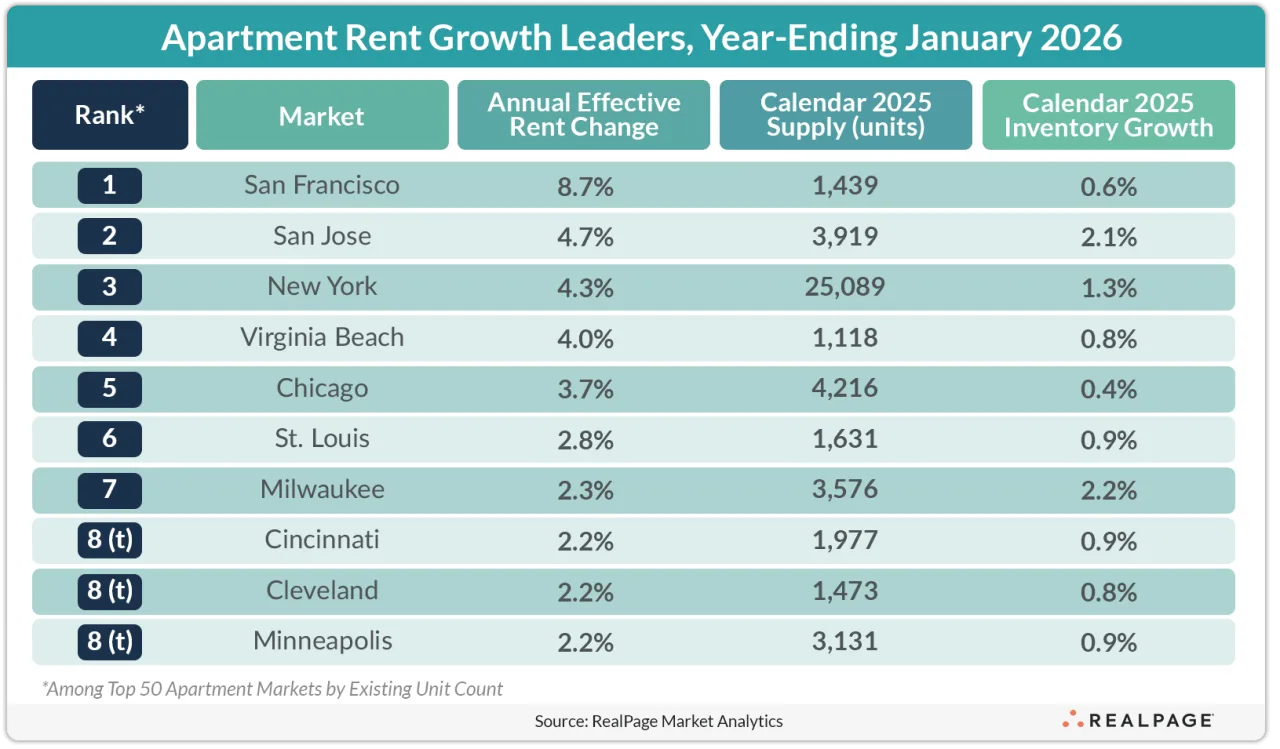

- Tech hubs like San Francisco, San Jose, and New York led annual rent growth.

Occupancy Edges Higher, Rent Declines Slow

Apartment occupancy trends turned slightly positive in January, with US multifamily occupancy rising to 94.7%, RealPage Market Analytics data shows. This uptick followed half a year of mild erosion. However, the rate is still below last year’s figure and remains 100 bps under its April 2025 peak.

Meanwhile, effective asking rents in the US increased 0.2% month-over-month—the first such increase since last summer. Despite this shift, January rents remain 0.4% lower than a year prior, marking a continued annual decrease, though the pace of decline is slowing.

Regional Divergence: South and West Lag, Tech Hubs Advance

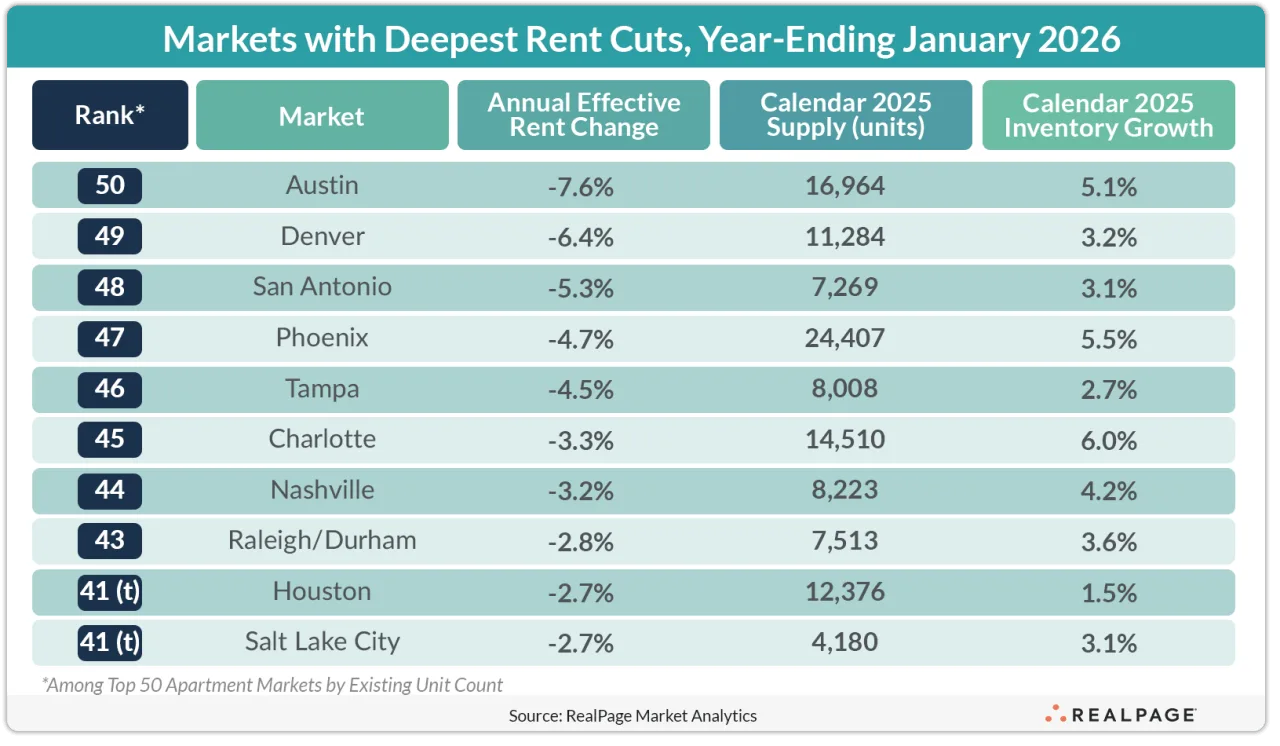

The South and West continued to register the most pronounced rent cuts. These supply-heavy regions, including markets such as Austin, Denver, Phoenix, and Charlotte, saw persistent rent declines as completions outpaced demand. Nonetheless, annual rent reductions in these areas are less severe than they were several months ago, signaling a possible bottoming out.

Meanwhile, stronger hiring momentum in innovation-driven metros has helped stabilize leasing activity elsewhere, reflecting a broader rebound in tech-centered urban markets after a prolonged slowdown.

Tourism-dependent markets like Tampa and Nashville also reported substantial rent cuts, reflecting wider economic challenges as discretionary spending on travel contracts.

Tech Hubs and Midwest Rebound

On the flip side, apartment occupancy trends have strongly favored coastal tech hubs. San Francisco, San Jose, and New York benefited from robust renter demand—partly driven by job growth in artificial intelligence—posting annual rent gains between roughly 4% and 9%. Midwest cities such as Chicago, St. Louis, Milwaukee, Cincinnati, Cleveland, and Minneapolis also saw solid rent growth, showing market resilience outside the traditional growth corridors.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes