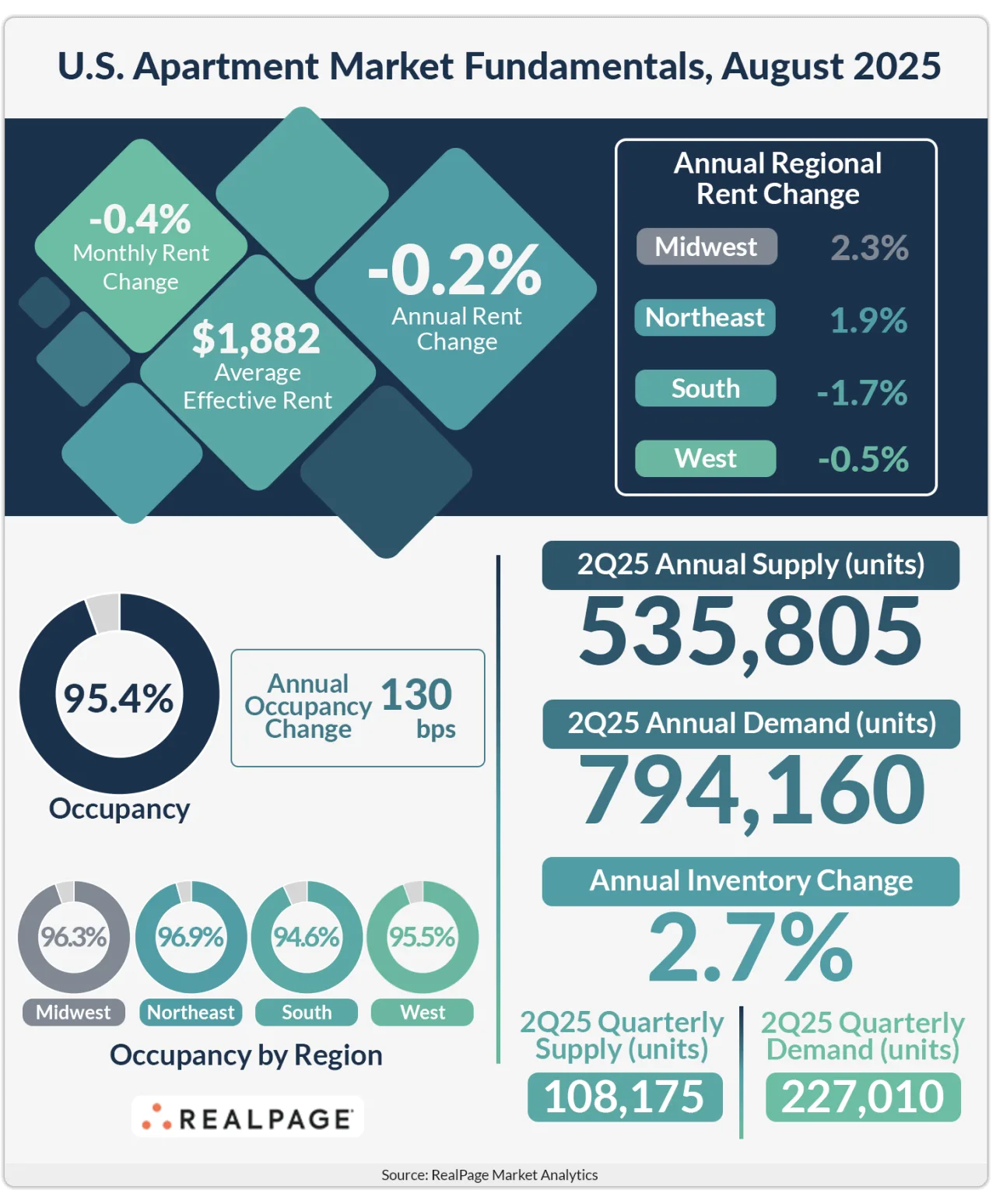

- National apartment occupancy dipped slightly to 95.4% in August, down 10 bps from July but still aligned with the five-year average.

- Effective asking rents fell 0.2% year-over-year, the first nationwide decline since March 2021.

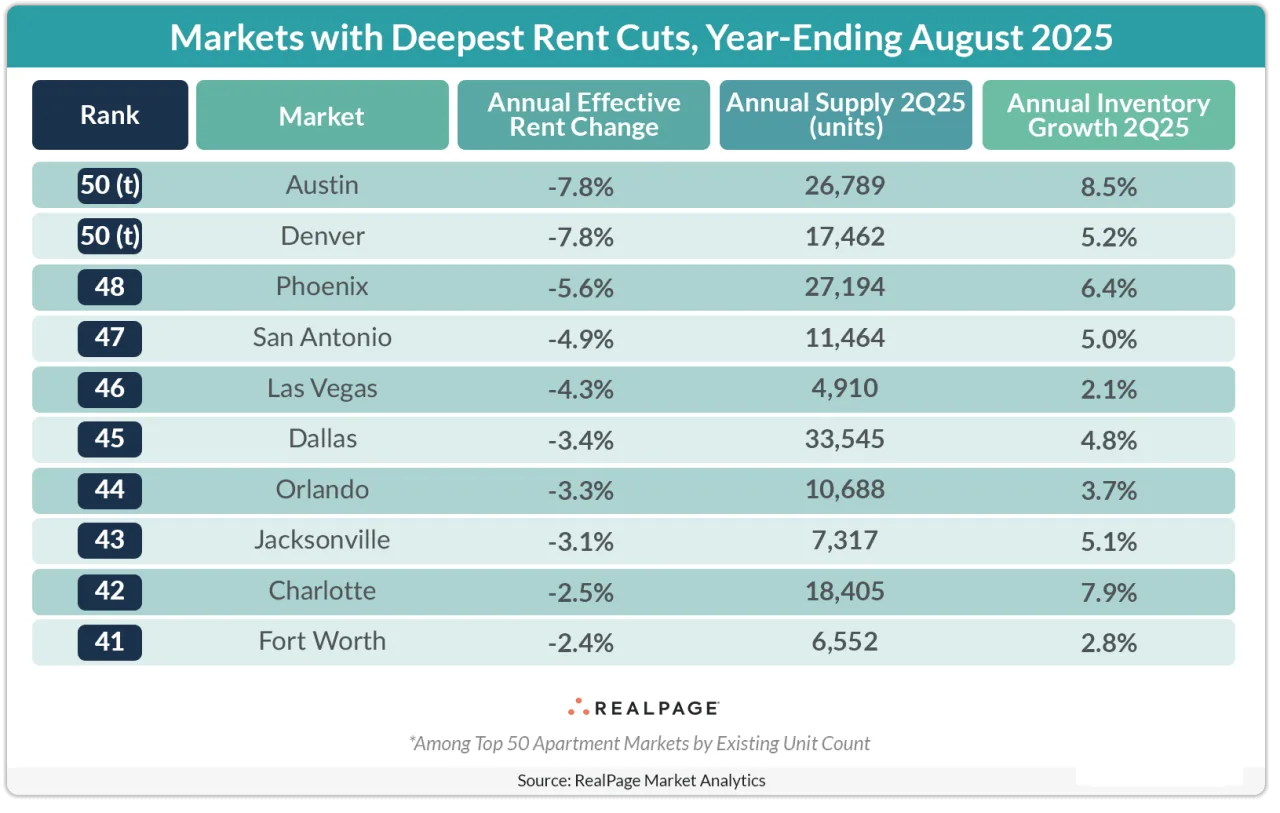

- Weakness was concentrated in the South and West, where heavy supply pipelines and tourism-dependent markets pressured pricing.

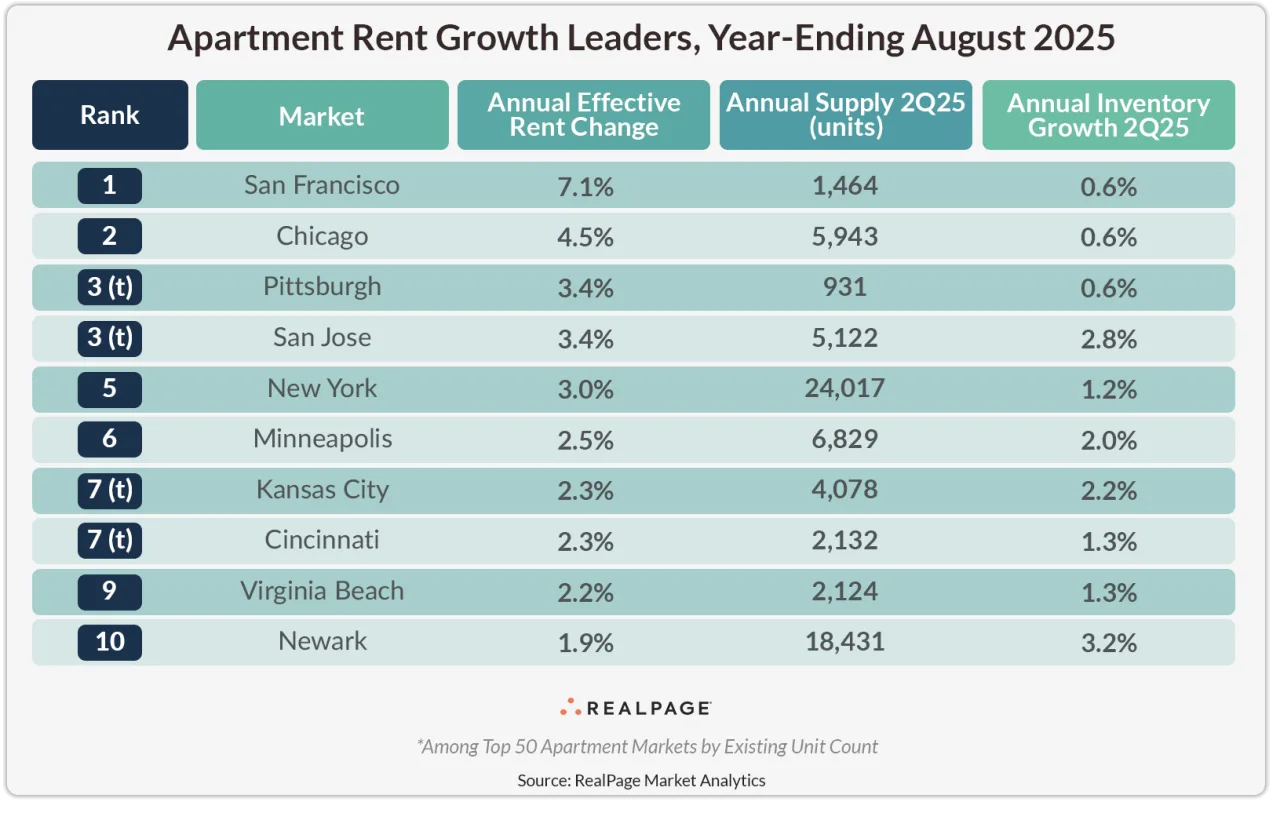

- Coastal and Midwest markets like San Francisco, New York, Chicago, and Minneapolis saw the strongest rent growth, posting 3% to 7% annual gains.

The Big Picture

The US apartment market softened in August as occupancy declined and effective asking rents registered their first annual dip since the pandemic. According to RealPage Market Analytics, occupancy came in at 95.4%, down slightly from July but still consistent with recent norms. While occupancy is up 130 bps year-over-year, weakening demand and new supply are tempering rent growth.

First Annual Cuts Since 2021

Effective asking rents fell 0.2% nationwide in the year ending August, signaling the return of mild annual rent cuts. The last time operators saw annual declines was during the COVID-19 downturn in March 2021. Although monthly rent growth has been limited for over a year, this marks a shift into negative territory.

Regional Dynamics

The South and West accounted for much of the drag on national performance. The South has faced persistent supply challenges, with new deliveries keeping pressure on operators since mid-2023. Meanwhile, the West saw rent cuts deepen further in August, pulling national averages lower.

Tourism-dependent metros such as Orlando and Las Vegas registered rent softness, which analysts warn could be an early indicator of economic stress as households cut back on discretionary travel spending.

Supply-heavy metros—Austin, Denver, Phoenix, Dallas, and Charlotte—also experienced notable rent cuts as new units outpaced demand.

Markets Still Growing

In contrast, tech-centric coastal hubs like San Francisco, San Jose, and New York led the pack in rent growth, with gains ranging from 3% to 7% year-over-year. Several Midwest markets, including Chicago, Pittsburgh, and Minneapolis, also posted strong growth, underscoring demand resiliency outside of the Sun Belt.

Why It Matters

The return of rent cuts highlights the unevenness of the US apartment market as developers continue to deliver a large volume of new units. While occupancy remains near long-term norms, regional disparities are widening, with some markets struggling under supply pressures while others benefit from strong economic and demographic tailwinds.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes