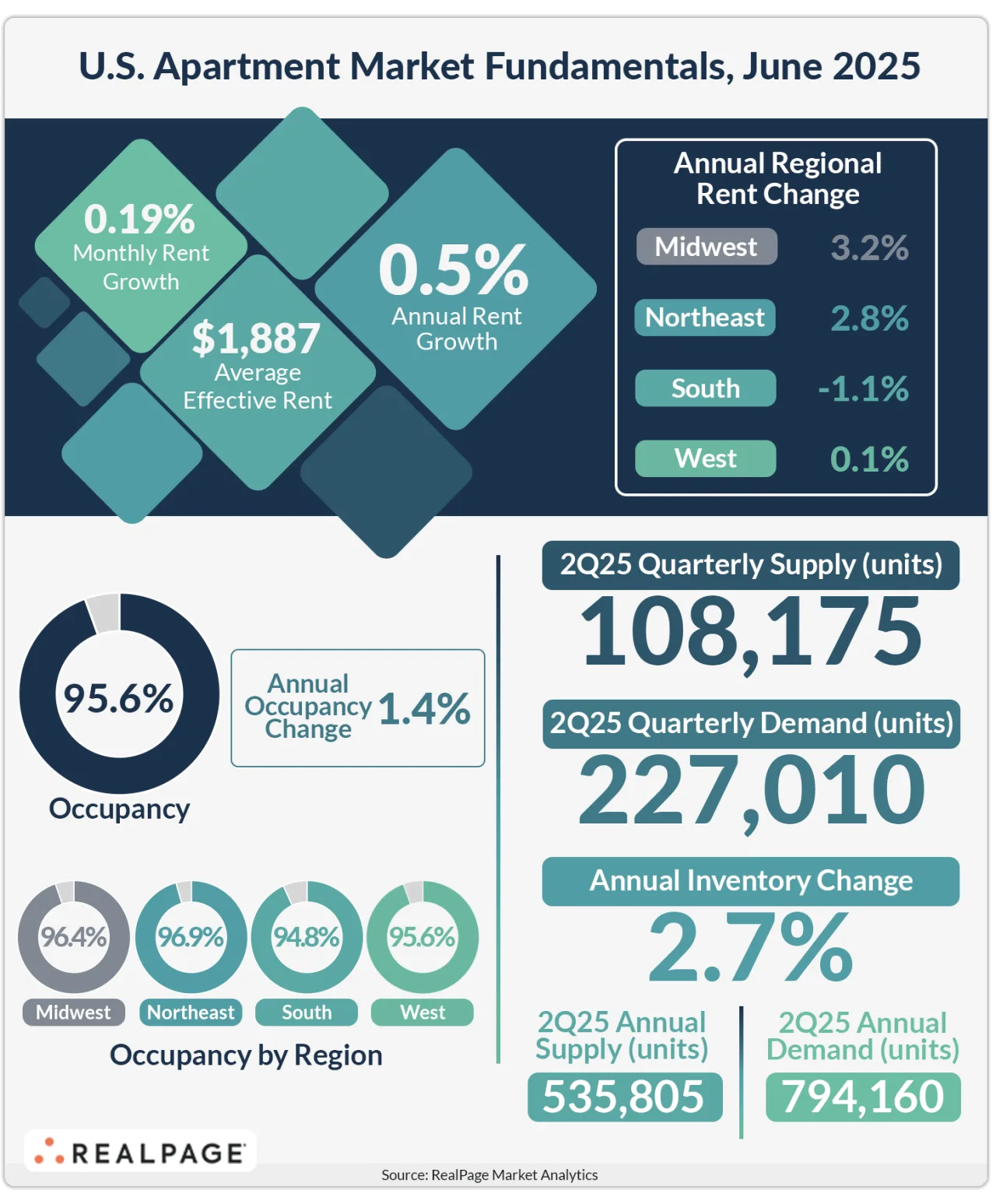

- The US absorbed over 227,000 apartment units in Q2 2025, surpassing previous annual records.

- Rent growth stayed flat, with June showing only a 0.19% increase, as owners prioritized occupancy.

- National occupancy hit 95.6% in June, up 140 basis points year-over-year.

- Tech-heavy cities gained momentum while tourism-dependent markets lost ground.

Demand Holds Firm

RealPage reports that apartment demand surged in Q2 2025. Between April and June, renters absorbed more than 227,000 units. That’s the strongest second-quarter performance since the peak leasing periods of 2021 and early 2022.

RealPage Chief Economist Carl Whitaker called the market “resilient,” noting that job growth, while slowing, still beat expectations. He also pointed to weaker consumer and business sentiment that hasn’t yet translated into lower housing demand.

Supply Starts to Ease

Over the past year, developers delivered more than 535,000 units, including 108,000 in Q2. While that remains above average, it’s lower than the record-setting volumes from late 2024.

Occupancy Climbs, Rents Hold Steady

Operators continued to prioritize leasing over pricing. National occupancy reached 95.6% in June, rising 140 basis points year-over-year. However, rents barely moved. June posted just a 0.19% gain.

In the South, occupancy rose by 160 basis points, but annual rents dropped 1.1%. The trend suggests owners are offering more discounts or concessions to fill units, limiting real rent growth.

More Renewals, Less Turnover

Lease renewal rates rose to 55.1% in the year-ending June, a 2% increase from last year. The uptick reflects renters’ reluctance to move and operators’ efforts to retain tenants rather than chase higher rents with vacant units.

Winners and Losers

Coastal tech hubs—like San Francisco, San Jose, Boston, and New York—saw improved performance in apartment demand. Return-to-office mandates and slowing construction helped support demand.

Some Sun Belt cities, including Dallas, Atlanta, and Jacksonville, also rebounded. These markets posted high demand with fewer new deliveries.

Tourism-driven markets, however, slipped. Las Vegas, Orlando, Nashville, and San Diego showed weaker rent trends in Q2. Softness in these cities could be an early sign of economic pressure, as consumers cut back on travel and leisure.

Markets tied to external industries also cooled. That includes Washington, DC and Baltimore (federal jobs), Houston (oil), and Riverside (international trade).

Supply Keeps Pressure On

Oversupplied metros continued to struggle. Austin, Denver, Phoenix, and San Antonio saw the steepest rent cuts. These cities remain at the top of the list for new deliveries.

What’s Next

The market’s focus remains on keeping units full. Until demand soaks up more supply and concessions fade, rent growth will likely stay subdued. But if economic conditions stabilize and construction slows, fundamentals could shift in favor of landlords later in 2025.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes