- Apartment absorption fell sharply in Q3, with 637,100 units leased over the past year — a notable drop from Q2’s record-setting pace.

- Effective asking rents dipped 0.3% in Q3 — the first such decline for this quarter since 2009.

- Nearly 22% of properties offered rent concessions, averaging 6.2%, as operators work to fill vacancies amid slowing demand.

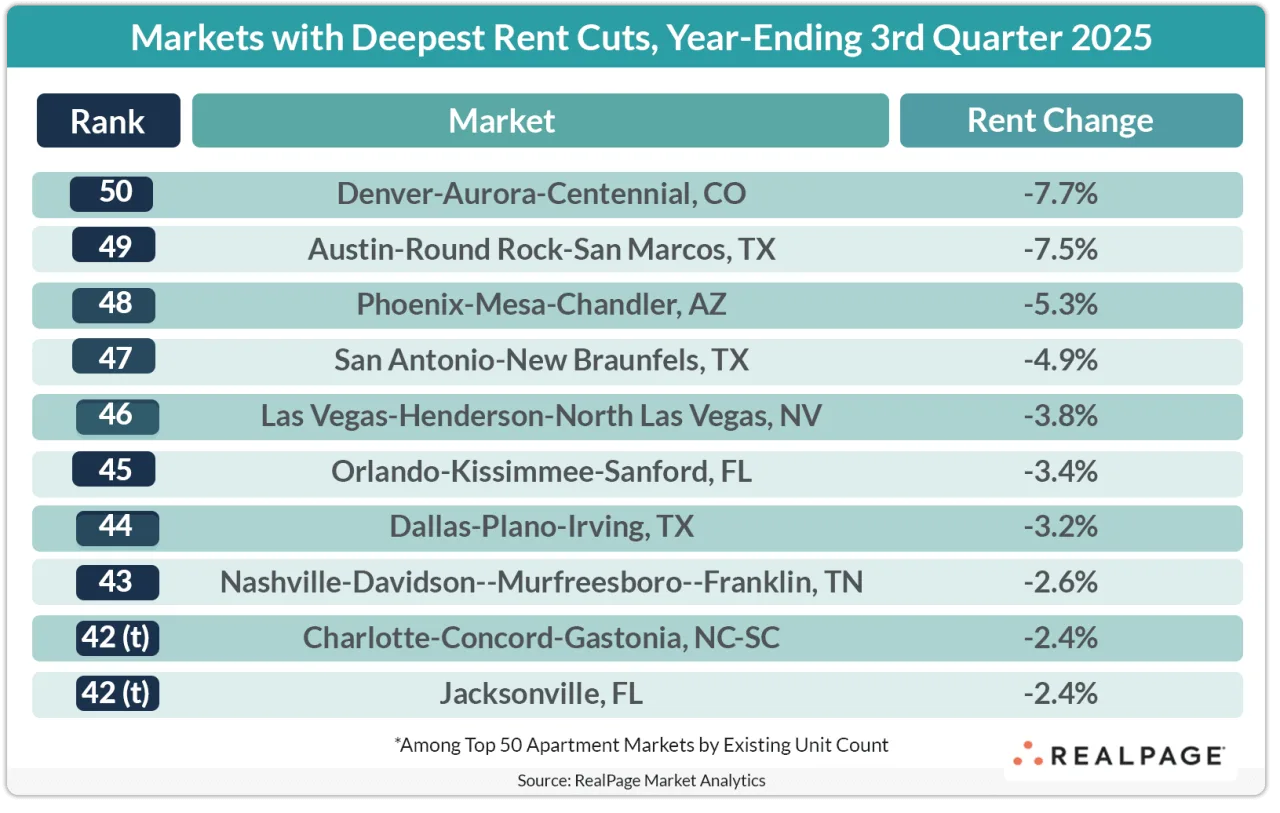

- Rent cuts were steepest in oversupplied markets like Denver, Austin, and Phoenix, while Midwest and tech-heavy coastal markets saw modest gains.

Demand Hits A Speed Bump

The red-hot apartment demand that defined the past two years is cooling, reports RealPage. According to them, the US apartment market absorbed 637,100 units in the year-ending Q3 2025. While that figure remains well above historical norms, it marks a significant decline from the 784,900 units absorbed in the year-ending Q2.

RealPage Chief Economist Carl Whitaker attributes the slowdown to weakening macroeconomic conditions. He also points to a sharp decline in job growth, which is starting to weigh on renter confidence and mobility.

Rent Cuts Make A Comeback

Soft demand and rising vacancies led to a rare 0.3% dip in effective asking rents during Q3 — the first Q3 rent cut since 2009. On a year-over-year basis, rents were down a modest 0.1%.

Operators are increasingly relying on concessions to maintain occupancy. As of Q3, nearly 22% of apartments were offering rent deals, with discounts averaging 6.2%. These incentives may delay meaningful rent growth until excess inventory burns off.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Occupancy And Construction Ease Back

National occupancy fell 30 basis points in Q3 to 95.4%, breaking a five-quarter streak of increases. While occupancy typically dips during this period, the trend shift is notable.

New supply continues to outpace demand, though it is also slowing. About 105,500 new units were delivered in Q3, bringing the annual total to nearly 475K — still above the decade average, but well below the late-2024 peak.

Sun Belt And Tourism Markets Hit Hardest

Rent softness was most pronounced in oversupplied Sun Belt cities. Denver and Austin posted rent drops nearing 8%, while Phoenix and San Antonio saw cuts around 5%.

Tourism-reliant markets like Las Vegas, Orlando, and San Diego also lost momentum, with falling discretionary spending signaling broader economic caution.

Tech Hubs And The Midwest Hold Steady

Not all regions are feeling the squeeze. Tech-centric coastal cities such as San Francisco, New York, and San Jose continued to post rent gains in Q3, helped by slower supply growth and return-to-office mandates.

Midwestern markets with lighter construction pipelines also saw modest rent growth, benefiting from more balanced supply-demand dynamics.

Looking Ahead

With job growth slowing and renters staying put, operators face a more competitive leasing environment heading into 2026. Unless demand rebounds or supply moderates further, elevated concessions are likely to continue. Flat to negative rent growth is also expected in the near term, especially in markets with high levels of new deliveries.