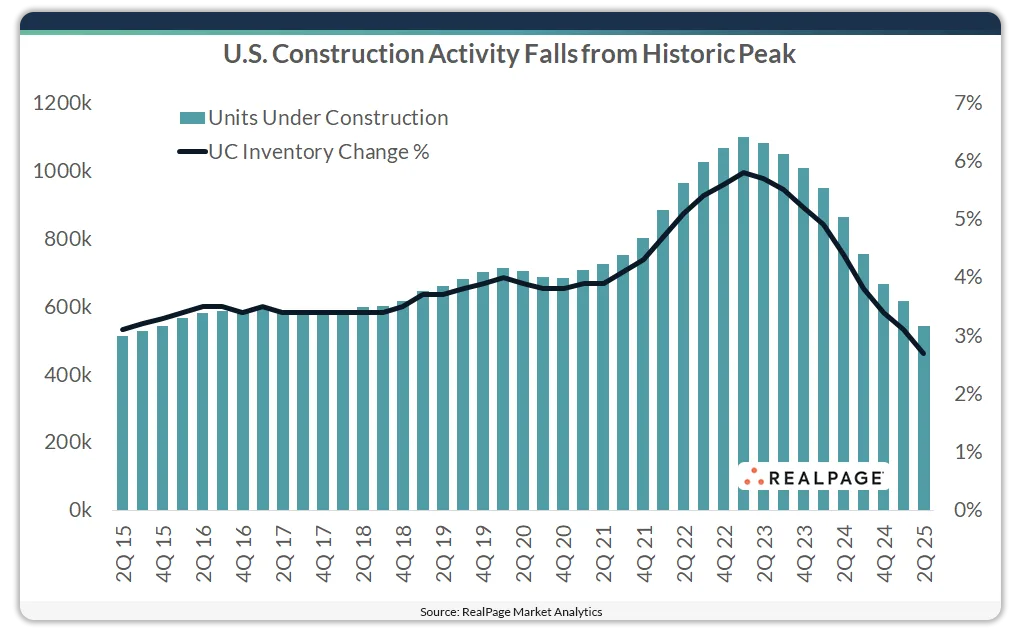

- US apartment construction volumes have fallen to just over 542,800 units. That’s the smallest figure since Q3 2015, down from a record high of 1.1M units in Q1 2023.

- The past year alone saw a 37% year-over-year decline, with nearly 320,000 fewer units underway.

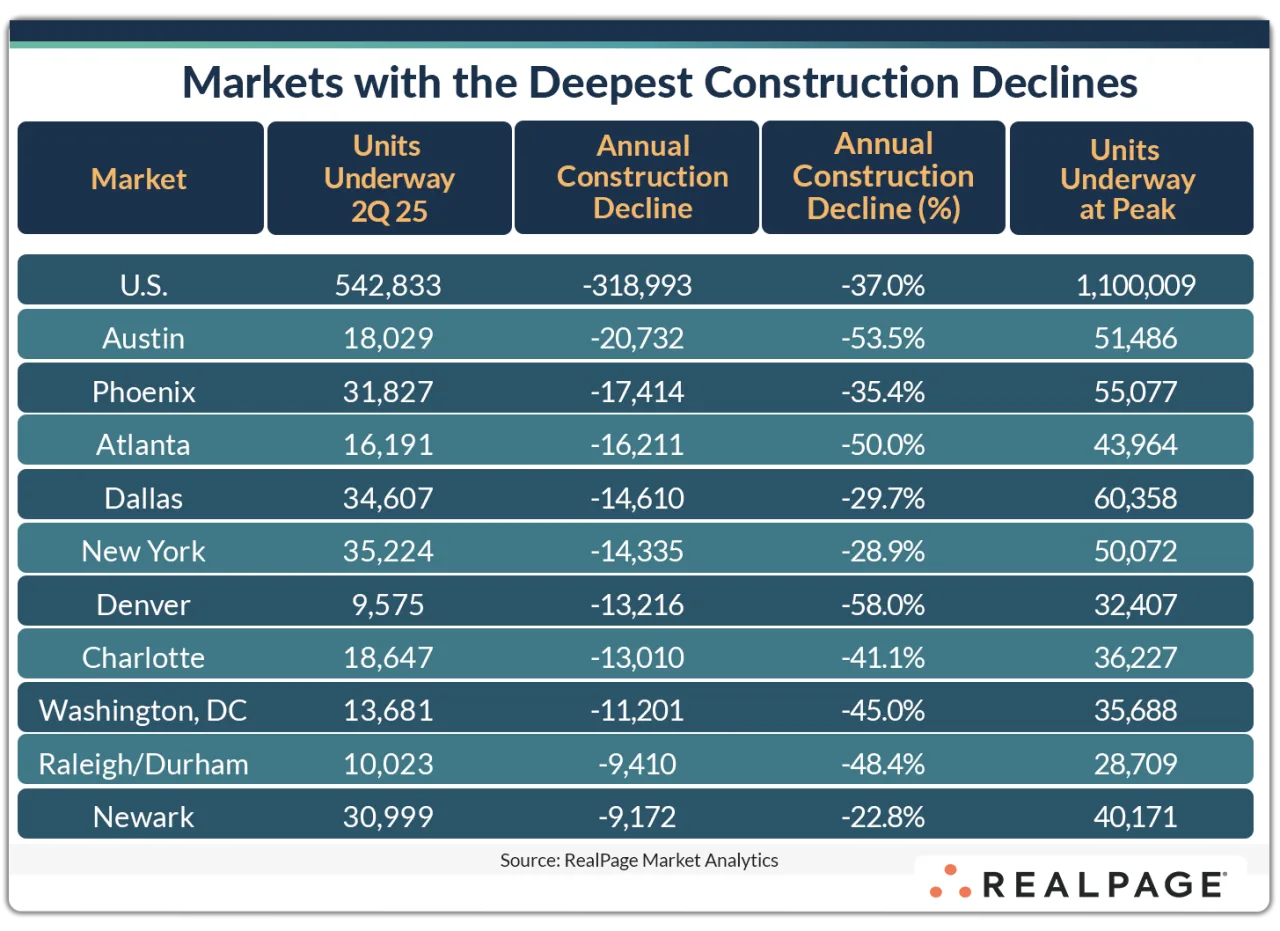

- Markets with the sharpest declines include Austin, Phoenix, Atlanta, Dallas, and New York. A few markets—Cincinnati, Richmond, and West Palm Beach—are seeing growth.

Apartment construction in the US has slowed to its weakest level in almost a decade. At the end of Q2 2025, there were just over 542,800 units under construction, according to RealPage Market Analytics. That is less than half the volume seen at the Q1 2023 peak of more than 1.1M units.

From Boom to Slowdown

After hitting record levels in early 2023, construction has fallen every quarter. Developers finished existing projects, while fewer new permits were issued. Over the past year, the number of units underway dropped by nearly 320,000. Of the remaining projects, about 354,000 units are expected to complete in the next year.

Market Breakdown

Austin saw the sharpest drop. The city had about 18,000 units under construction at the end of Q2—less than half its volume from a year earlier. Phoenix, Atlanta, Dallas, and New York also saw big slowdowns. Each market had between 14,000 and 17,000 fewer units underway compared to last year.

Biggest Percentage Declines

Some cities saw construction plunge by more than 60%. That includes San Jose, Oakland, and Portland on the West Coast, as well as Indianapolis. Denver came close to that mark, with activity down 58% year-over-year.

Largest Markets Still Building

As of Q2 2025, the biggest apartment construction markets were New York, Dallas, Phoenix, Newark, and Los Angeles. All have seen activity decline, but the steepest drop was in Phoenix, where volumes are down 35.4% from last year.

A Few Exceptions

Cincinnati, Richmond, and West Palm Beach went against the national trend. These markets posted small increases in construction activity over the past year.

Why It Matters

The slowdown reflects tighter financing, slower rent growth, and reduced developer confidence. If fewer projects start in the coming months, the supply of new apartments will drop. That could shift market power toward landlords in the years ahead.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes