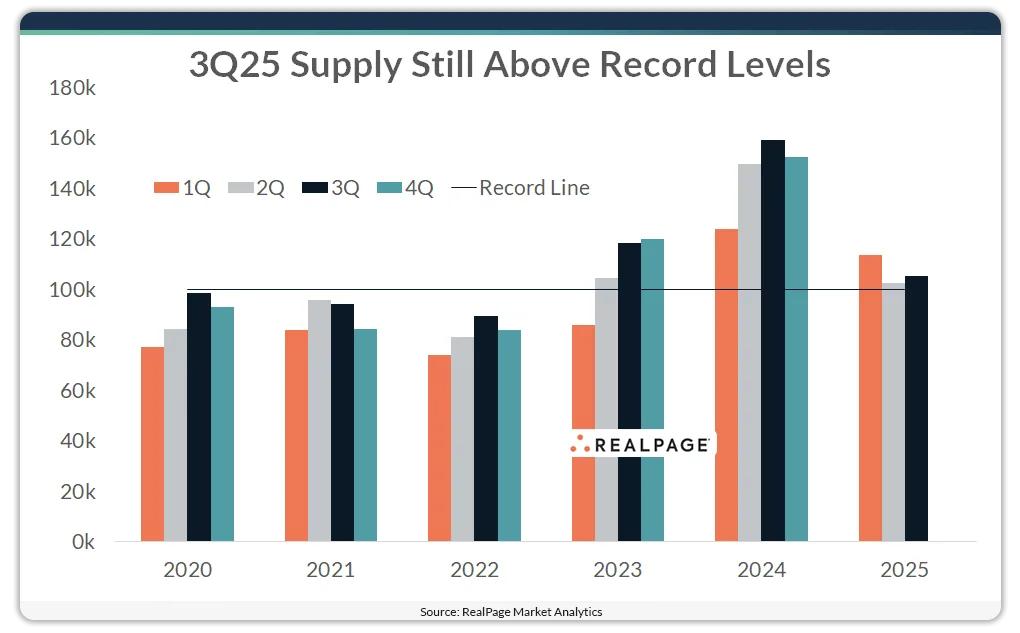

- US apartment construction completions exceeded 100K units in Q3 2025, the 10th consecutive quarter to do so.rn

- While supply volumes are down from their 2024 highs, they remain historically elevated across all regions.rn

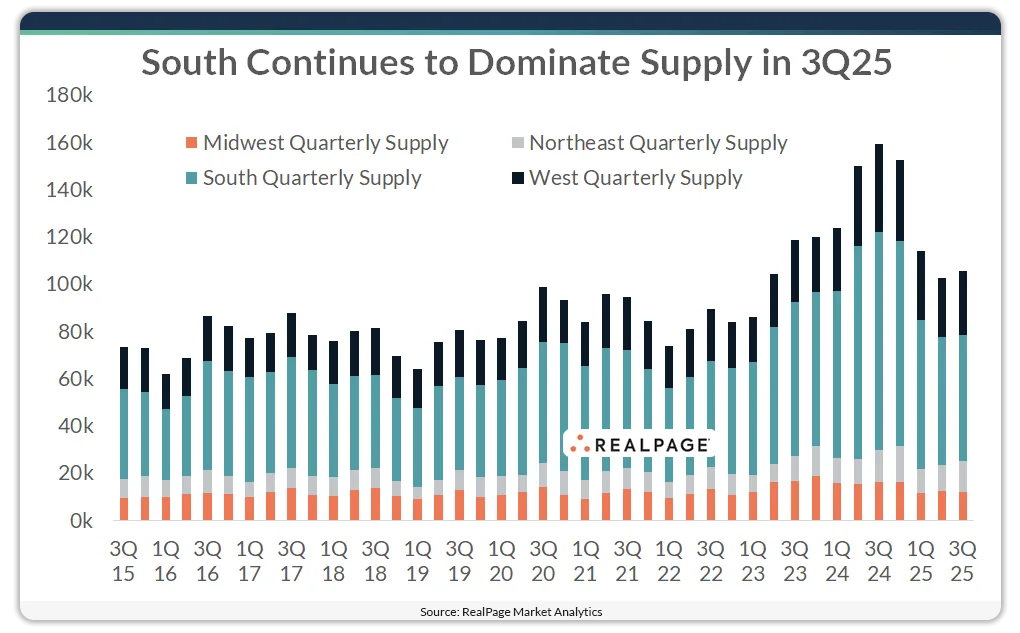

- The South continues to lead in deliveries but has experienced the sharpest quarterly decline since its 2024 peak.rn

Still Strong, But Slowing

The US multifamily market continues to deliver high volumes of new apartments, reports RealPage. In Q3 2025, approximately 105,525 units were completed, according to RealPage Market Analytics. This marks the 10th consecutive quarter with completions exceeding the 100K-unit threshold. The streak began in Q2 2023 and is unprecedented in the firm’s data history, which dates back to the 1990s.

While the pace of deliveries has cooled since peaking in q3 2024, quarterly volumes remain strong by historical standards. That said, 2025 has seen a notably steep pullback, particularly in the South.

Regional Trends: South Leads, Midwest Lags

The South remains the top region for new supply, delivering 53,410 units in Q3, though that’s down sharply from its Q3 2024 peak of over 92,100 units. Despite the slowdown, the region continues to outpace others in total volume.

In the West, Q3 deliveries totaled 26,900 units, up modestly from the previous quarter but still well below the region’s Q3 2024 peak of 37,400 units.

The Northeast and Midwest saw significantly lower supply volumes, at 13,100 and 12,100 units, respectively. The Midwest stood out as the only region where completions fell below the decade average.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Top Markets For Deliveries

Several major markets stood out for high volumes of completions during Q3 2025:

- Phoenix

- New York

- Dallas

Each of these metros delivered more than 6K units between July and September, underscoring continued demand and construction activity in key Sun Belt and gateway cities.

Why It Matters

Despite the recent pullback, the US apartment market remains in a historically high supply cycle. Sustained delivery volumes could continue to pressure rent growth and lease-up timelines, especially in overbuilt submarkets. For developers and investors, understanding regional supply dynamics will be key heading into 2026.