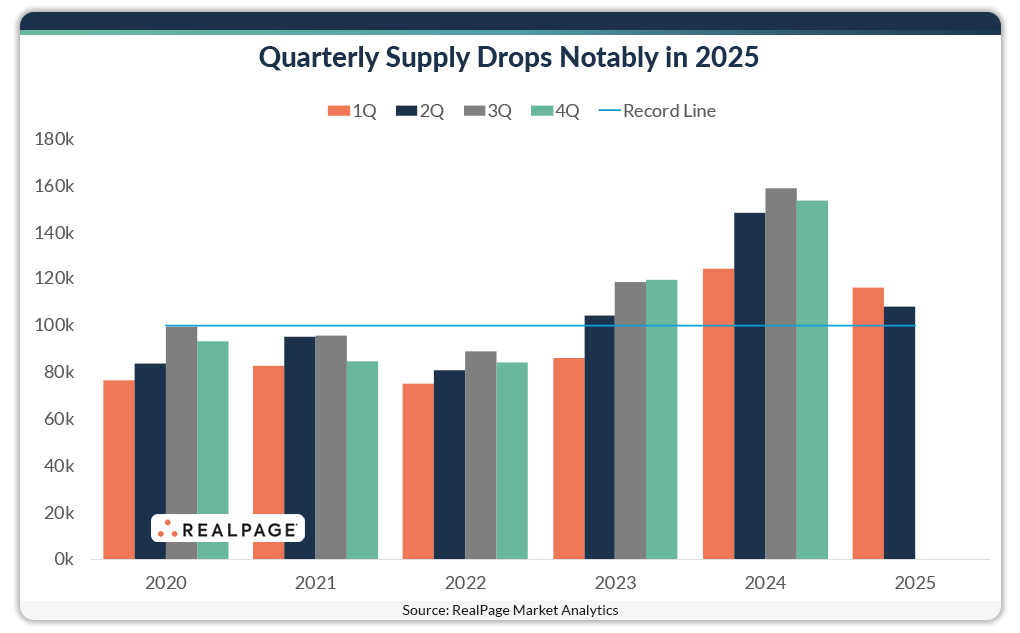

- US apartment completions dropped to 108,200 units in Q2 2025, down from the peak of 159K units in Q3 2024 but still above pre-2023 norms.

- The South remains the most active region for new deliveries, though it also saw the sharpest decline quarter-over-quarter.

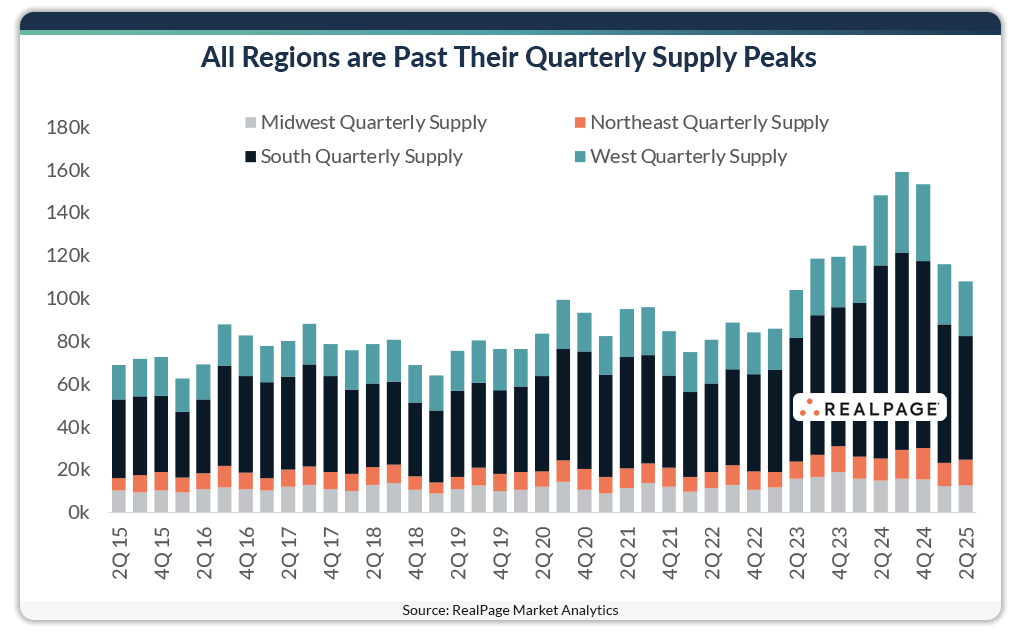

- All four US regions are now past their quarterly delivery peaks, indicating a broader national slowdown in apartment supply.

- Major metro areas like Dallas, New York, Phoenix, and Austin led in completions, each topping 5K new units in Q2 2025.

A Slowdown From The Peak, But Still Historically High

Despite a noticeable pullback from 2024 highs, US apartment supply remains at elevated levels, reports RealPage. In Q2 2025, developers completed roughly 108,200 units, continuing a ninth consecutive quarter of completions exceeding 100K units. The all-time high of 159K units in q3 2024 now marks the peak of a development cycle that began accelerating in mid-2023.

The current decline is more pronounced than in prior quarters. Deliveries dropped from 116,000 units in Q1 2025 and fell further from last year’s highs. This signals the wind-down of a historically active construction period.

South Still Leads, But All Regions Off Highs

The South remained the most active region, delivering nearly 57,800 units in Q2 2025. However, that total was 6,900 units fewer than Q1 and well below its 2024 peak. Other regional trends include:

- West: 25,700 units delivered, down 2,500 units from Q1 2025.

- Midwest: 12,600 units delivered, a slight uptick from Q1, but below its 2023 peak of 18,900 units.

- Northeast: 12,200 units delivered, also slightly higher than Q1 but still trailing the region’s late-2024 peak of nearly 14,600 units.

Every US region is now officially past its peak quarterly supply levels, further reinforcing the cooling trend.

Big Metro Areas Still Driving Volume

While most metros are seeing reduced delivery volumes compared to recent peaks, major cities continue to dominate in raw numbers. Dallas, New York, Phoenix, and Austin each delivered over 5K units in Q2, with annual completions in these markets topping 22K units.

These cities remain key contributors to national supply. However, each has seen a decline from peak delivery levels, reflecting the broader deceleration in multifamily construction activity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Even with quarterly declines, the number of apartments hitting the market remains historically high. This continues to put downward pressure on rents and leasing velocity in some metros. The national slowdown may offer some relief to markets oversaturated with supply in 2023–2024, though elevated completions continue to challenge lease-up performance in many urban cores.

What’s Next

While completions are trending downward, construction pipelines remain full in several metros, suggesting strong—if more measured—delivery volumes through the remainder of 2025. However, with new starts slowing and financing conditions tight, the apartment market could see further moderation heading into 2026.