- Proximity Premiums: Industrial rents within five miles of major cargo airports like LAX and DFW command up to 24% higher rates.

- Logistics Dominance: 3PL and logistics firms make up over 50% of tenants in airport-adjacent industrial zones.

- Air Cargo Rebound: After declines, air cargo volumes are rising in 2024—though tariff risks cloud the 2025 outlook.

- Rent Growth Leaders: DFW and ORD have seen airport-adjacent rents grow faster than their wider markets since 2019.

Air Cargo Is Back—But for How Long?

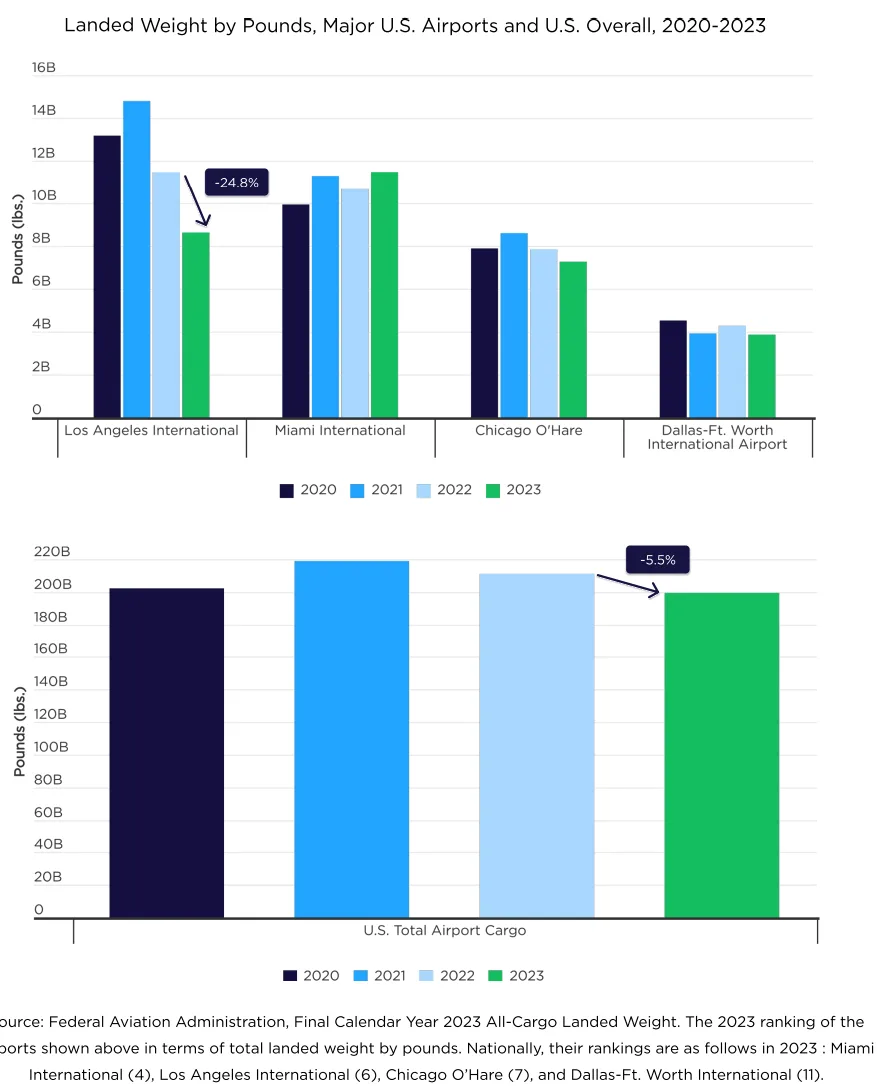

As reported by CompStak, after consecutive annual declines, the US air cargo sector is staging a comeback. Global disruptions—from the Suez Canal to the Red Sea—have pushed more high-value goods back into the sky. While FAA data for 2024 is pending, IATA reports an 11.3% year-over-year global air cargo increase, signaling a strong start to the year.

Miami International stood out in 2023, posting a 7.5% increase in landed cargo weight while LAX, ORD, and DFW saw declines. But as volumes recover, new tariff changes—like the April 2025 executive order removing de minimis exemptions for China—could undercut gains, particularly for fashion and electronics flown into LAX.

Rent Premiums Within 5 Miles of Airports

Industrial real estate near major cargo airports commands a clear premium. According to CompStak:

- LAX: $21.80 PSF—24% above the broader LA market

- MIA: 12% premium over the rest of Miami

- ORD & DFW: Also show double-digit rent gaps for airport-adjacent industrial stock

These premiums reflect the value of proximity for speed, efficiency, and customs clearance—critical for e-commerce and high-turnover goods.

Starting Rents Still Rising Near Airports

From 2019 to 2024, starting rents within five miles of airports outpaced market averages in 3 of 4 studied metros:

- DFW: +107% vs. +64% in rest of market

- ORD: +66% vs. +47%

- MIA: Smaller gap, but airport-adjacent growth still led

Even as rent growth cooled between 2023 and 2024, DFW and LAX airport-adjacent properties outperformed their broader markets.

Who’s Leasing the Space? Mostly Logistics and 3PLs

Airport-adjacent industrial zones are dominated by logistics-heavy tenants:

- Transportation & Warehousing: 52% of occupancy near airports vs. 33% in rest of market

- Materials, Food, and Aerospace: Also play key roles depending on region

LAX, for example, hosts Boeing, SpaceX, and Northrop Grumman near the airport. In Miami, cold storage and floral logistics tenants cluster to serve perishables flown in from Latin America.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Looking Ahead: Growth with Caution in 2025

While 2024 appears strong for air cargo and adjacent industrial markets, the outlook dims slightly moving into 2025. Rising tariffs, shifting supply chains, and cooling consumer demand may blunt momentum.

Notably:

- LAX faces outsized tariff exposure due to reliance on China-origin goods.

- Consumer brands like Shein and Temu, reliant on air freight, may pull back due to policy changes.

- E-commerce strength and infrastructure projects (like Miami’s $400M VICC upgrade) offer tailwinds, but pricing pressure and geopolitical uncertainty loom.

Bottom Line

Proximity to major air cargo hubs remains a lucrative advantage for industrial landlords. But as global trade patterns shift and tariff battles reemerge, these premium zones could see turbulence ahead—even if demand for speed remains sky-high.