- Affordable housing projects often cost more than $800K per unit, surpassing market-rate construction costs.

- Legal, financing, and consulting fees — or “soft costs” — can exceed 25% of total project budgets.

- Developers earn fees based on total project cost, raising concerns about incentives to reduce expenses.

- Calls for reform of the LIHTC program are growing, with critics and supporters agreeing it’s vital but inefficient.

Why It Costs So Much

Building affordable housing under the LIHTC program is a bureaucratic and financial gauntlet. The core funding mechanism requires developers to stack multiple sources of capital — each with its own requirements, fees, and compliance burdens.

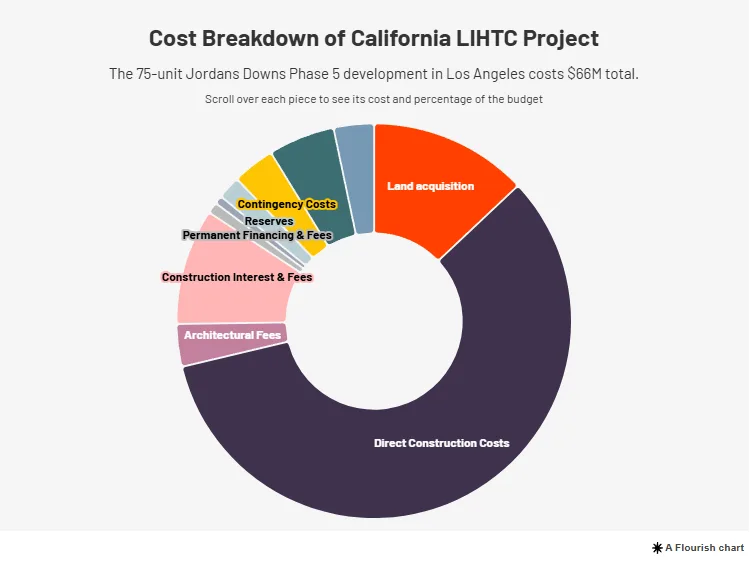

In Los Angeles, a 75-unit LIHTC development at Jordan Downs costs $880K per unit, reports Bisnow. Of its $66M budget, only $38M went toward construction, with the rest consumed by land costs, interest payments, insurance, permits, and legal and consulting fees.

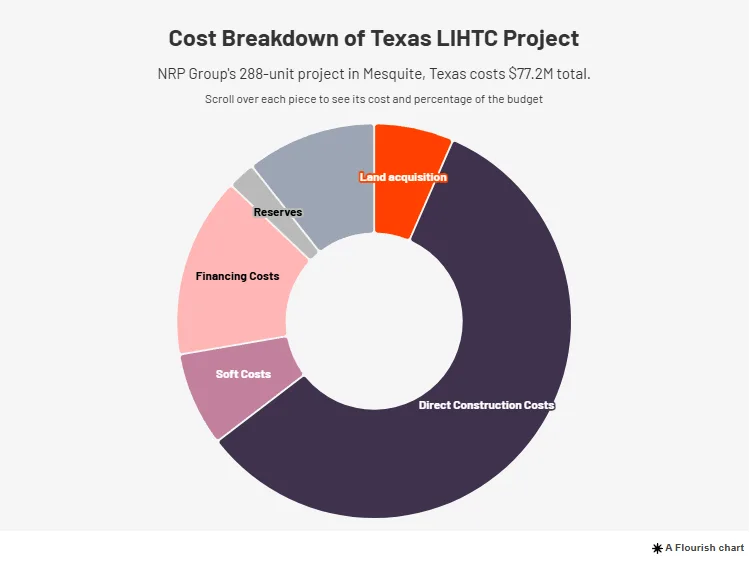

In Dallas, NRP Group’s $77M LIHTC project in Mesquite includes 288 units and cost $267K per unit. While modest compared to other markets, the project still saw nearly $20M spent on soft costs and financing.

The Incentive Problem

Developers make money from LIHTC projects by charging fees — often up to 15% of total costs — which critics argue discourages cost control.

“There is no structural incentive or ways the funding rewards developers for having more cost-effective projects,” said one developer.

Still, many firms defer part of their fee to project operations — a method they argue keeps them accountable to long-term project success.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Bureaucracy Adds Up

States often attach additional requirements to projects receiving LIHTC funds. These can include prevailing wage rules, environmental reviews, and local hiring mandates. Each of these adds to overall project costs. These mandates are part of the scoring system states use to allocate credits, but they also reduce efficiency.

In Boston, affordable housing projects built between 2022 and 2024 cost 43% more per unit than market-rate buildings. In California, RAND found LIHTC soft costs were more than double those for market-rate construction — $187 PSF versus $84.

Pressure For Reform

While LIHTC received its largest expansion in 25 years via the One Big Beautiful Bill Act, its structure is under bipartisan scrutiny. Critics from the right label it wasteful; some on the left argue public housing would be cheaper and more efficient.

Proponents maintain it’s the only tool producing affordable housing at scale, but agree that reform is essential.

Among the proposed reforms:

- Streamlining funding applications across agencies

- Reducing redundant environmental and compliance reviews

- Incentivizing larger developments for better economies of scale

What’s Next

Despite criticisms, LIHTC is expanding. Congress increased its funding in July, and Fannie Mae and Freddie Mac have now doubled their investment caps. The Affordable Housing Tax Credit Coalition estimates this will support 1.2M more affordable units.

Still, the debate continues over whether LIHTC can be reformed to work more efficiently — or whether a new model is needed entirely.

As the affordability crisis deepens nationwide, the pressure is mounting to make affordable housing actually affordable — not just to tenants, but to the governments and developers trying to build it.