- Over $10.5B in affordable multifamily loans are maturing by 2027, with $21.7B maturing by decade’s end.

- Commercial banks are the largest lenders, responsible for nearly 40% of outstanding loans.

- San Francisco, Los Angeles, and Washington, DC top the list of metros with the highest affordable housing loan volumes.

- Despite low delinquency and high demand, potential policy shifts and cost inflation could destabilize the sector.

A Steady Outlook — For Now

The affordable housing finance market is far smaller than its market-rate counterpart, but it’s showing notable resilience, reports Yardi Matrix. With $116.1B in loans across 3.5M units, most properties enjoy low vacancy and relatively stable cash flows, even amid rising interest rates.

Debt Dynamics

Commercial banks dominate the lending landscape with $46B in loans (39.4%), followed by government sources ($37B, 32.2%) and CMBS/Freddie Mac securitizations ($29B, 25%). Notably, nearly $7.3B in bank loans are set to mature by 2027 — reflecting their outsized role in short-term and construction lending.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

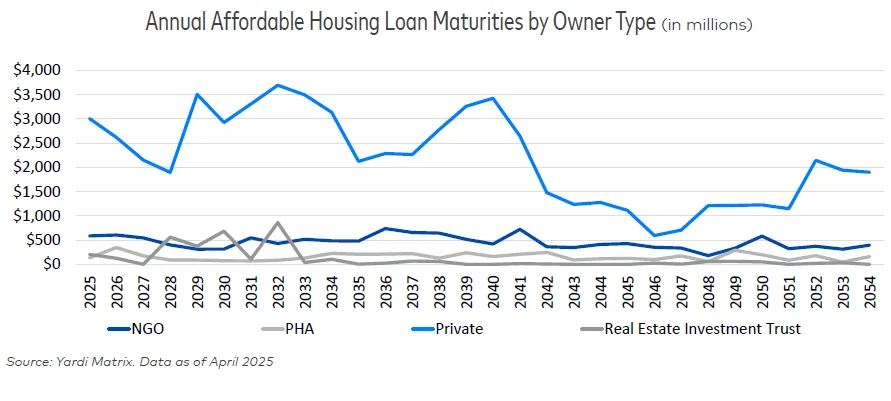

Private Ownership Reigns

Private entities own over 75% of the $116B in outstanding housing loans, with their debt maturities peaking above $3B annually between 2029 and 2034. Meanwhile, NGOs and public housing authorities hold 15.6% and 5.9% of the loan volume, respectively.

Geographic Concentration

Just ten metros hold 40% of all loan volume. San Francisco leads with $6.8B, followed by Los Angeles and Washington, DC, Miami, Atlanta, and Houston also see significant near-term maturities, with Miami alone facing $1B in maturing loans by 2029.

Emerging Risks

Despite its current health, the housing market faces potential headwinds. Policy changes—like a proposed shift to block grants for renter subsidies—and uncertainty around HUD and GSE funding could disrupt the financing environment. Rising development and operational costs are also prompting more complex capital stacks, adding risk to future deals.

Why It Matters

Affordable housing remains essential, but the financing behind it is becoming increasingly complex. While current conditions are stable, long-term sustainability may depend on both policy continuity and innovative financial strategies.