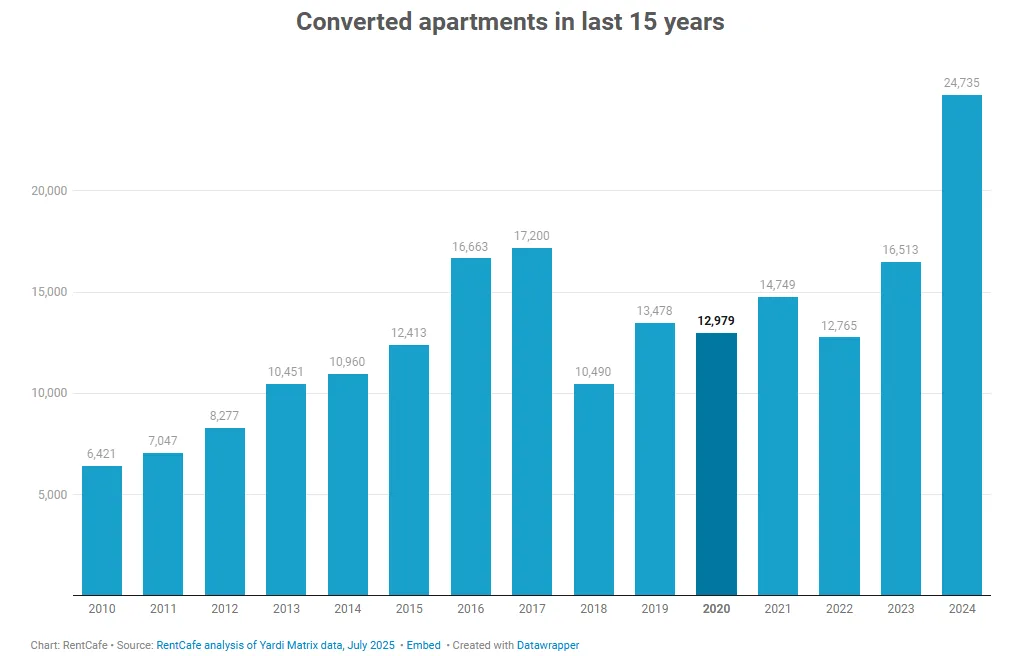

- Adaptive reuse delivered a record 25K apartments in 2024, marking a 50% year-over-year increase and doubling 2022’s total.

- Chicago led all US cities in apartment conversions, surpassing Manhattan with 880 units delivered from repurposed buildings.

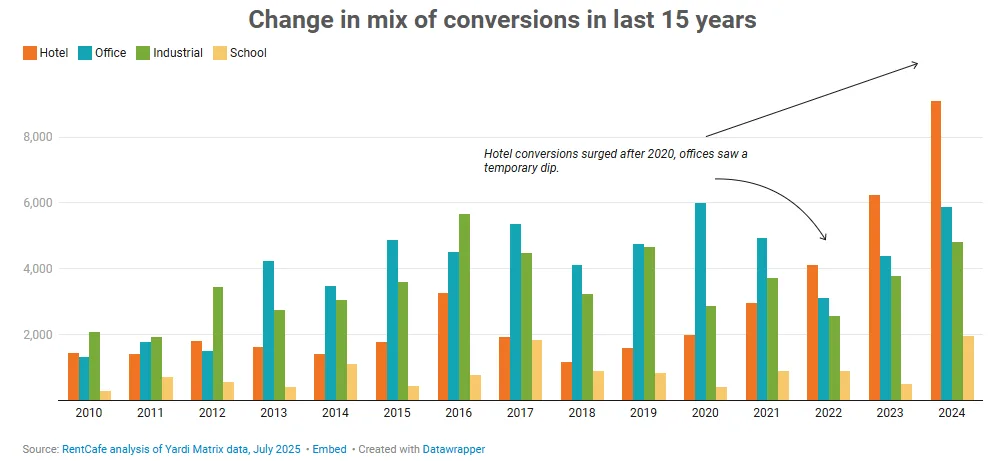

- Hotels and offices were the top sources for reuse projects, with hotels accounting for 37% of completed units and offices making up nearly 24%.

- A record 181K units are in the pipeline, with office-to-residential conversions making up the largest share of future projects.

Conversions Break Records

The adaptive reuse market is not just growing — it’s booming. In 2024, developers across the country converted nearly 25K apartments from existing buildings, marking an all-time high, reports RentCafe. That’s a 50% jump from 2023 and more than double the volume seen just two years earlier.

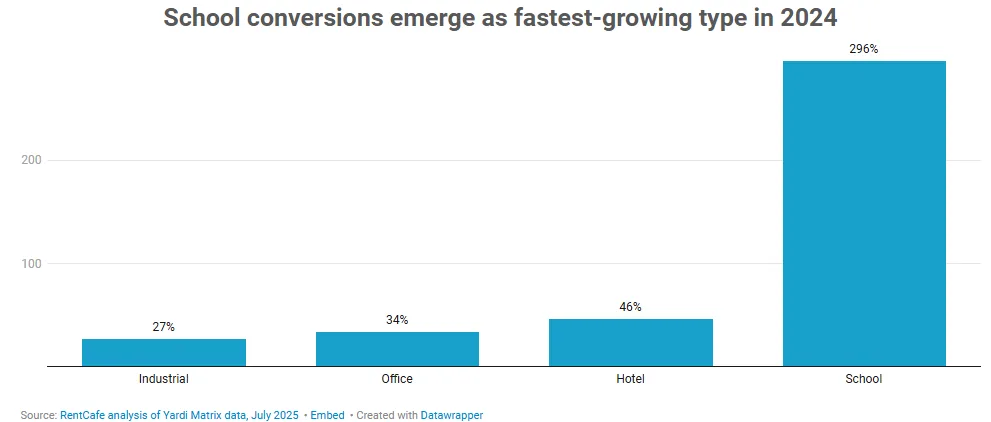

Much of the growth was driven by two building types: hotels and offices. Hotels, under mounting financial pressure, were the most common source of conversions, delivering over 9,100 units — a 46% increase from the previous year. Offices followed with nearly 5,900 units, continuing a steady climb in conversions amid the ongoing shift to hybrid and remote work.

Chicago Leads The Pack

Chicago emerged as the leading city for adaptive reuse completions in 2024, overtaking Manhattan with 880 units delivered across four projects. Notable among them: the redevelopment of a former Sears store in Portage Park into a mixed-use property with 206 apartments.

Denver followed with 789 units — more than twice its 2023 total — including supportive housing created from a former Clarion Inn. Philadelphia rounded out the top three with 761 units, highlighted by the transformation of the historic Philadelphia Electric Company building into luxury lofts and coworking space.

Dallas and Manhattan rounded out the top five. Manhattan — previously the leader — dropped to fifth place despite the 588-unit Pearl House conversion at 160 Water Street, one of the city’s largest office-to-residential projects since the pandemic.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Hotels Dominate, Offices Gain Ground

Hotels were again the dominant building type for conversions, representing 37% of completed adaptive reuse apartments in 2024. Most came from Class B and C hotels, as owners sold underperforming assets due to rising costs and weak demand. Baltimore led hotel conversions, producing 550 units from two shuttered towers downtown.

Office conversions, while fewer in number, still made up nearly a quarter of 2024’s conversions — and accounted for 43% of the future pipeline. Interestingly, most office conversions came from Class A properties, which are better suited for luxury residential redevelopment thanks to their infrastructure and prime locations.

Adaptive reuse of schools also grew rapidly — up 4x year-over-year — with almost 2K apartments created from former educational facilities. This reflects broader demographic and enrollment shifts in urban areas, making old school buildings ideal targets for housing.

181K Units In Development

Looking ahead, adaptive reuse is poised for further expansion. Nearly 181K units are in the pipeline, up 19% from the prior year. Of these, more than 78K are expected to come from office buildings, a clear sign that investors are still betting big on converting commercial space into housing.

Manhattan leads future conversions with 11K planned apartments, spread across both office and hotel projects. Los Angeles and Chicago also remain key players, followed by cities like Washington, DC; Philadelphia; and Denver.

Industrial conversions are rising, led by Buffalo, NY, with 10 projects set to deliver 1,250 units.

Why It Matters

Adaptive reuse has emerged as one of the most effective tools to tackle the nation’s housing shortage while revitalizing underused properties. With demand for office space declining and hospitality assets struggling in many markets, conversions are no longer just a stopgap. They’re a long-term strategy reshaping urban real estate.

This trend will likely accelerate as more cities and states offer incentives and zoning reforms to support reuse projects. As of now, every city in the top 10 delivered more than 500 converted units in 2024, a first for the sector — and a sign of how mainstream adaptive reuse has become.