- Developers are limiting residential buildings to 99 units to avoid wage rules under NYC’s 485-x tax program.

- The new rules require developers of 100+ unit projects to pay workers at least $40 an hour.

- Critics say the policy is slowing affordable housing production and raising project costs.

Developers Keep It Under 100

According to Bloomberg, an increasing number of New York City developers are filing plans for buildings with exactly 99 apartments. In the past year, 28 such permits were filed—more than in the previous 16 years combined. This marks a strategic shift to avoid wage requirements tied to larger buildings.

What Changed

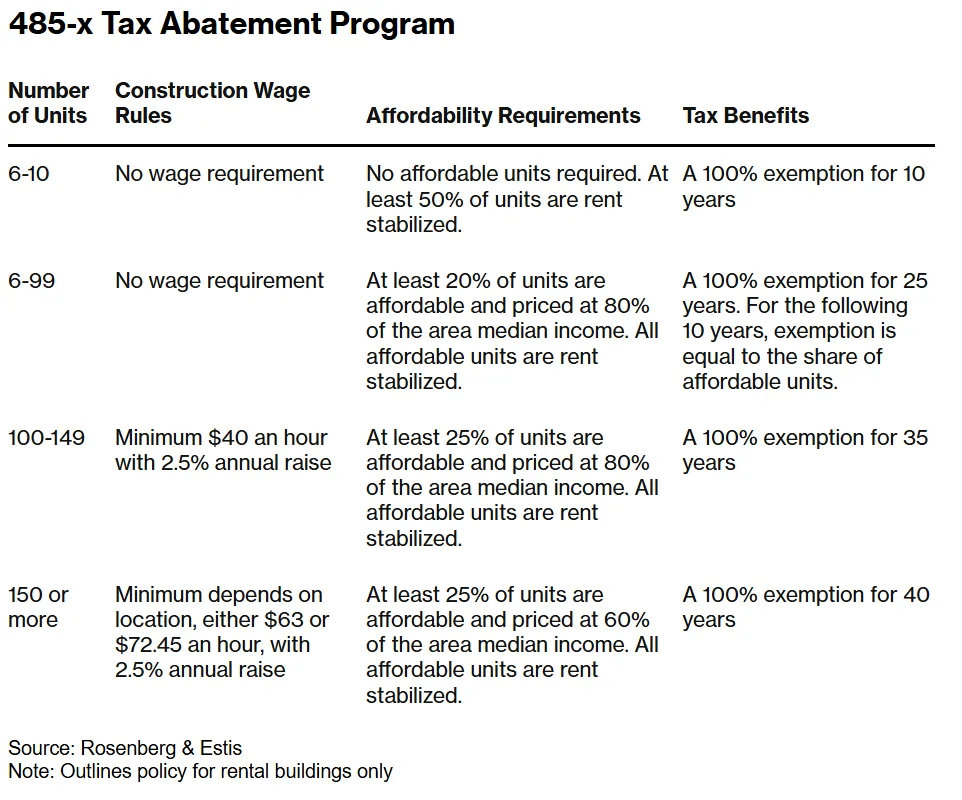

The 485-x tax incentive, which replaced the expired 421-a program, offers tax breaks for projects that include affordable housing. But it comes with strict wage mandates. Buildings with 100 or more units must pay construction workers a minimum of $40 per hour. Wages increase further for buildings with 150+ units. Developers of 99-unit projects only need to meet the city’s $16.50 minimum wage.

Developer Response

MaryAnne Gilmartin, CEO of MAG Partners, had originally planned two 400-unit towers. She’s now considering breaking the project into six smaller buildings. The new approach would produce fewer total apartments, take longer to build, and increase per-unit costs. Still, it’s more financially viable under 485-x.

Cost vs. Scale

Higher wages can increase hard construction costs by up to 20% for projects with 150 units or more. While smaller buildings help control labor costs, they come with trade-offs. Each project still needs elevators, amenities, and separate tax filings, which reduce efficiency.

“You still have to have an elevator and other building requirements, with only 99 units to offset those costs,” said Rick Gropper of Camber Property Group.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Impact on Housing Supply

Critics say the wage rules could undermine the city’s efforts to address the housing shortage. While 485-x revived development after the lapse of 421-a, most current proposals are for small or mid-size projects. This may not be enough to meet Mayor Eric Adams’ goal of adding 500,000 new homes by 2032.

Is the Program Working

In Q2 2025, NYC saw 6,943 proposed units—almost double the number right after 421-a expired. But most are smaller buildings. Rachel Fee of the New York Housing Conference says the city must ensure zoning is used fully on each site. If larger buildings don’t emerge, she believes the program will need changes.

Looking Ahead

The 485-x program is still new, and early results are mixed. Developers say the wage rules limit scale and speed. Advocates want more large projects to help ease rising rents. For now, 99-unit buildings are the clearest sign that policy changes can have unexpected consequences.